Analysts are questioning whether or not November deserves its fame as Bitcoin’s “strongest month” in historical past, after Bitcoin has fallen 10% over the previous seven days and at one level fell beneath $90,000.

“Historic averages counsel energy, however the numbers are biased and the present backdrop is something however regular,” James Harris, CEO of crypto yield supplier Tesseract, informed Cointelegraph.

Harris mentioned that whereas it was notable that it was beneath the long-term common, it was “not the entire image.”

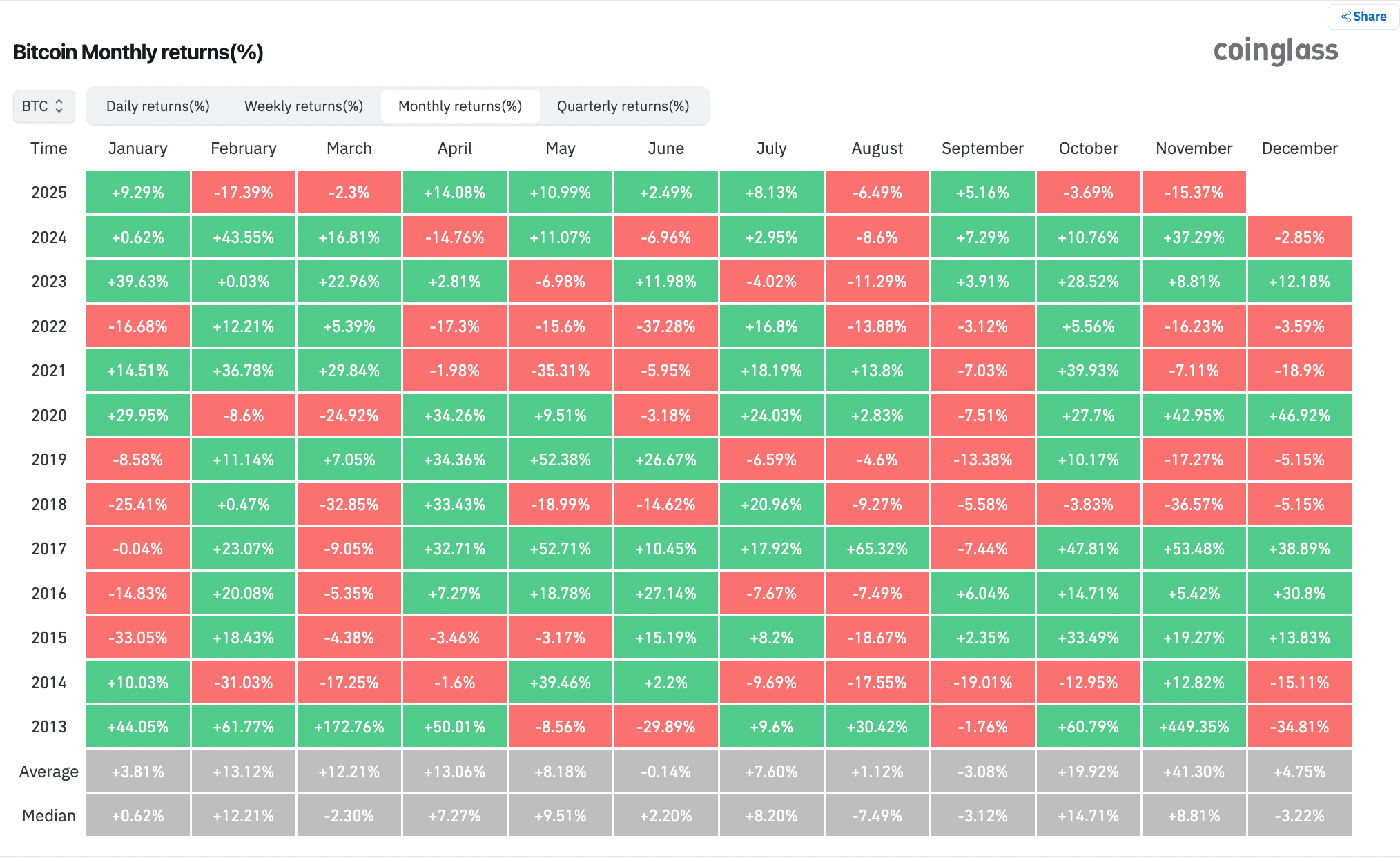

Based on Coinglass, Bitcoin (BTC) has fallen 15.37% because the starting of the month and is on observe to file its worst November since 2019, when it ended the month down 17.27%.

Bitcoin ended October down 3.69%. sauce: coin glass

Bitcoin is up 1% over the previous day, rising from a low of lower than $89,400 to $93,290, in keeping with CoinMarketCap.

Harris mentioned evaluating the present market setting to previous years is “not equivalent,” noting that the U.S. authorities shutdown delayed main financial indicators by six weeks.

“After we reopened, the knowledge backlog precipitated buyers to reprice inflation and assess their expectations nearly in a single day,” he mentioned.

Confidence amongst market individuals that the US Federal Reserve will reduce rates of interest in December additionally plummeted to 41%, in keeping with the CME FedWatch instrument.

It’s potential that Bitcoin will hit a brand new all-time excessive earlier than the tip of the yr, however it’s unlikely.

Harris mentioned there may be nonetheless an opportunity that Bitcoin will regain momentum and hit new all-time highs by the tip of the yr, however he isn’t betting on it.

“It is potential, but it surely’s not one thing we’re predicting,” he mentioned.

Bitcoin final hit an all-time excessive of $125,100 in early October, and merchants are eyeing November, its strongest month in historical past, for a potential continuation of the bull market.

Bitcoin’s common return in November since 2013 was 41.35%, a determine that was additional inflated by 2013’s 449% surge and was about 277% increased than March, the second-highest achieve of the yr.

Bitcoin exhibits ‘early indicators of stabilization’

Bitfinex analysts imagine the worst of Bitcoin’s decline could also be nearing its finish.

On the time of publishing this text, Bitcoin is buying and selling at $93,290. sauce: coin market cap

“It feels just like the time has come for a regional backside to be established comparatively rapidly,” analysts mentioned in feedback shared with Cointelegraph.

“By means of a number of historic cycles, sustainable bottoms have shaped solely after short-term holders have suffered losses, and never earlier than,” they added.

Associated: Cryptocurrencies crash over the weekend, quickly erasing 2025 beneficial properties for Bitcoin

Nevertheless, the November rally that merchants are hoping for may truly spill over into December. The Bitfinex workforce mentioned it was seeing “early indicators of stabilization following one of many sharpest corrections of the cycle” and promoting stress was beginning to ease.

Analysts at crypto funds agency B2BINPAY agreed: “A sustained restoration may type simply as rapidly.”

“The primary significant resistance is within the $97,000 to $100,000 vary,” they mentioned. “Sentiment may be very prone to stay defensive till BTC tries to recuperate it.”

journal: Crypto Bloodbath — Is Bitcoin’s 4-12 months Cycle Over? Commerce Secrets and techniques