Bitcoin (BTC) remained flat for a lot of October, barely gaining 1.5% for the month. Nevertheless, over the previous week, Bitcoin costs have risen almost 5%, placing the main target again on the opportunity of a bullish reversal.

Earlier this week, Bitcoin briefly rose above $113,200, however was rejected close to $115,000. This zone now defines the road between hesitation and new power. Though the rejection appeared sudden, the information reveals it was anticipated. And if one important degree collapses, restoration may be troublesome.

Why breakout failed

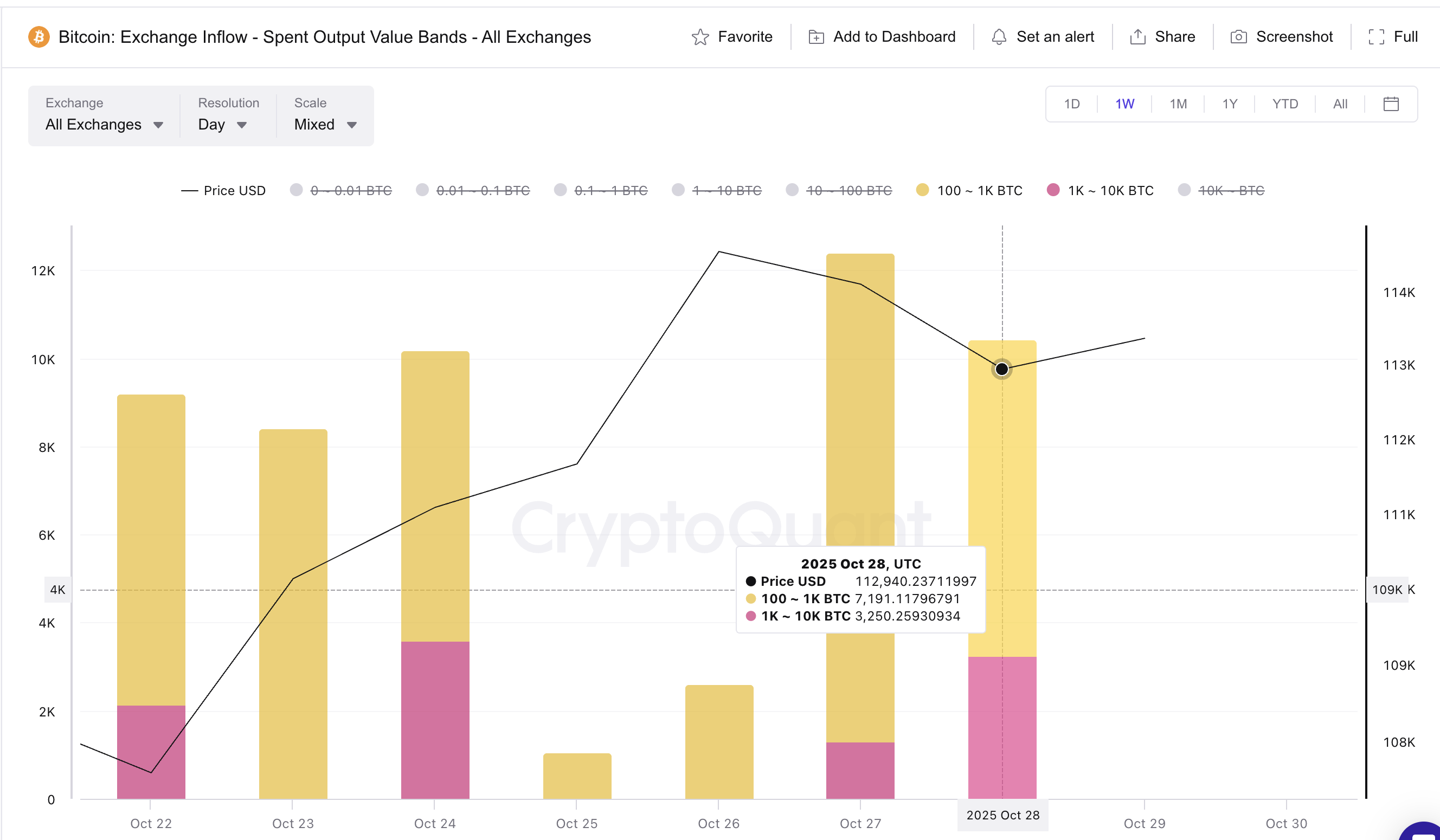

The primary indicators got here from on-chain conduct fairly than charts. CryptoQuant’s Spent Output Worth Bands, which observe how a lot Bitcoin every group of holders moved onto exchanges, confirmed a pointy improve in promoting strain from October twenty fifth to twenty eighth.

The 100-1,000 BTC group (sharks) elevated trade transfers from 1,046 BTC to 7,191 BTC, whereas the 1,000-10,000 BTC group (whales) added roughly 3,250 BTC throughout the identical interval.

Bitcoin whale launch: CryptoQuant

Need extra token insights like this? Join editor Harsh Notariya’s day by day crypto e-newsletter right here.

Such inflows typically symbolize revenue taking or short-term hedging. These strikes flooded exchanges with provide rights as Bitcoin examined $115,000, capping Bitcoin’s value actions and halting what may have been a clear continuation.

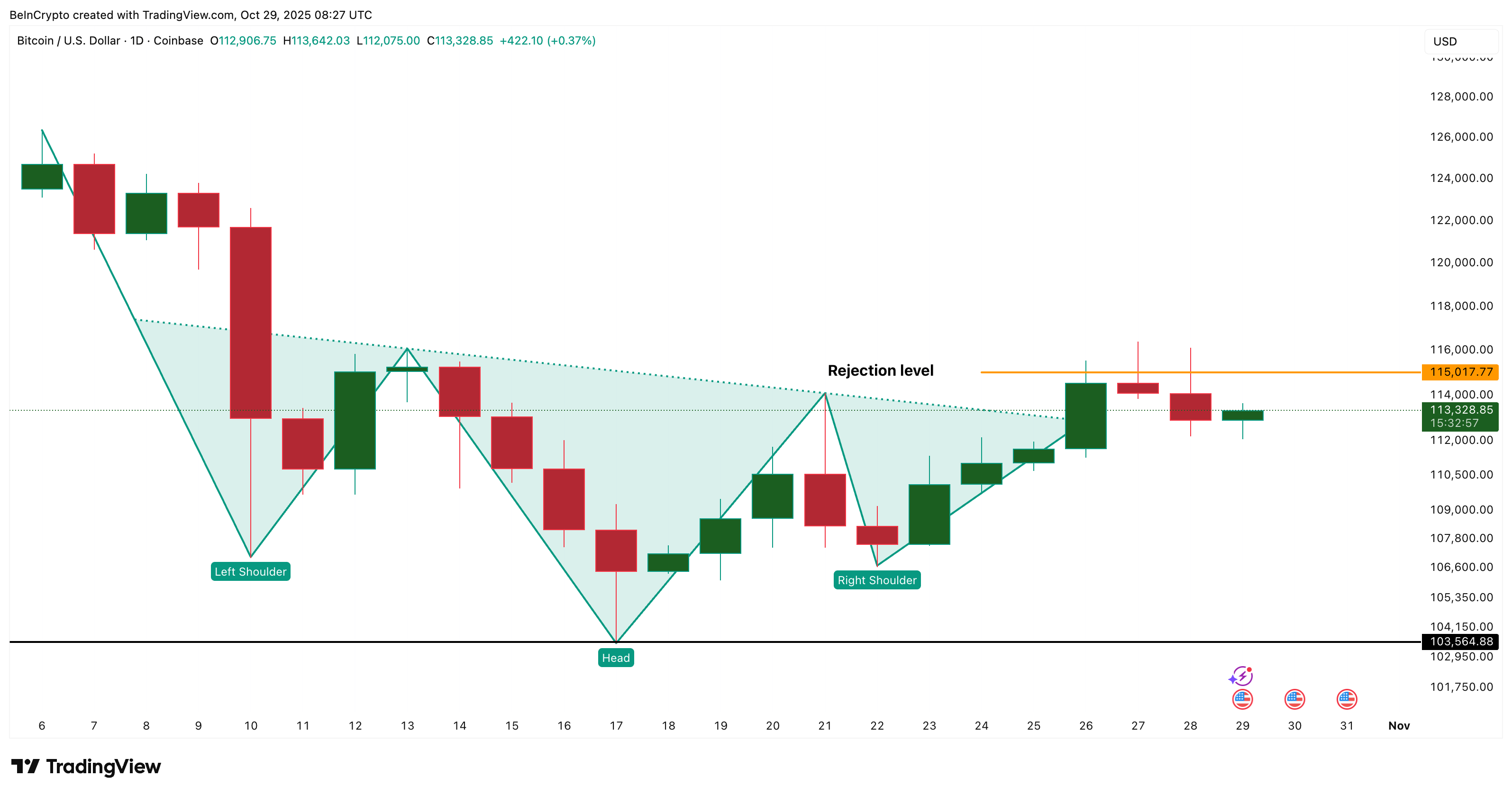

Bitcoin value chart: TradingView

This wave of enormous shareholder exercise explains why breakout makes an attempt stalled regardless of sturdy retail optimism.

Why is the setup nonetheless legitimate?

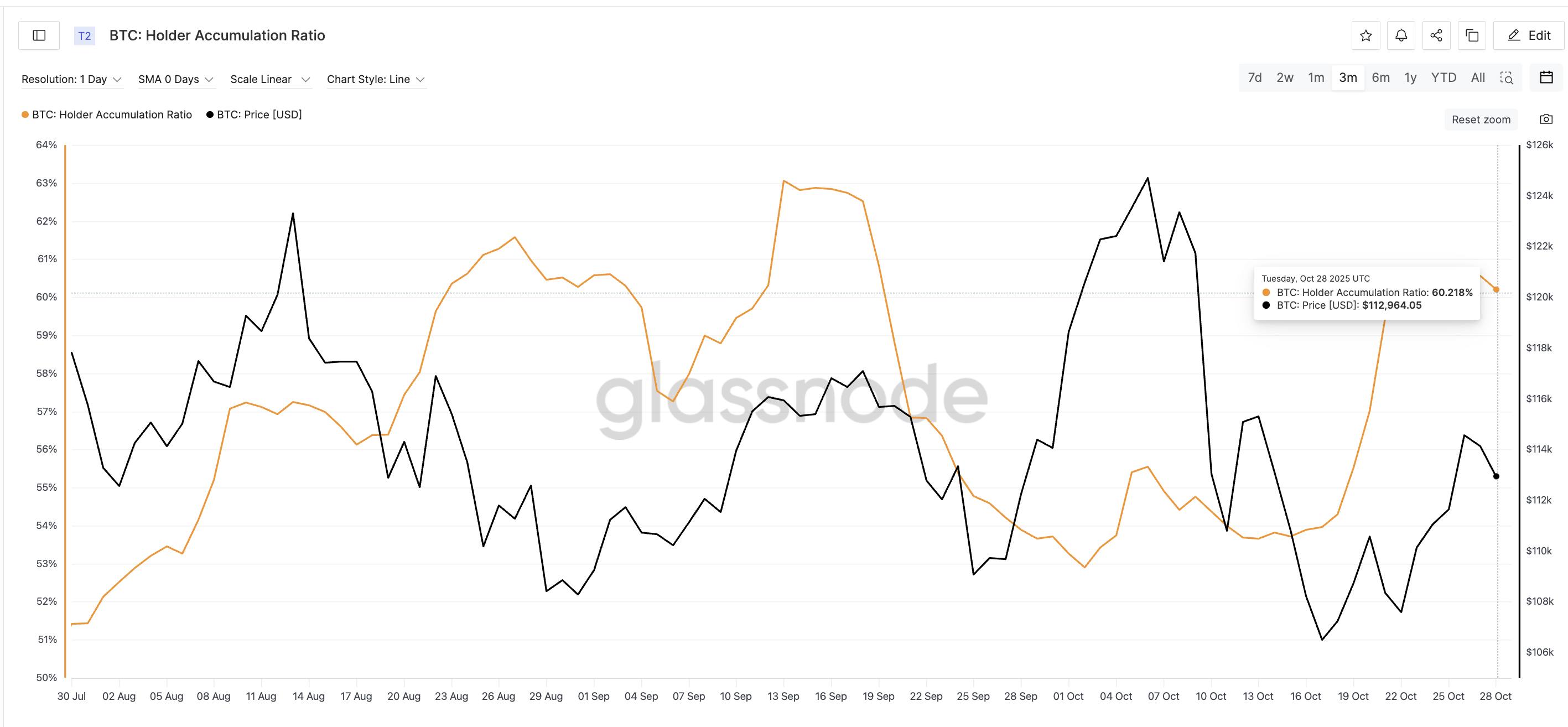

Even after that promoting strain, Bitcoin’s fundamentals look like steady. Glassnode’s Holder Accumulation Price (HAR), which tracks what number of wallets have added to their BTC stability, is holding regular at 60.2%.

A quantity above 50% means the market is in a state of web accumulation, indicating that long-term holders are nonetheless quietly shopping for. Though the index is barely under its latest three-month excessive of almost 63%, the information confirms that broad buying traits stay intact.

Bitcoin accumulation underway: Glassnode

This motion is vital as a result of it offsets short-term promoting in whales.

Lengthy-term holders take in cash shifting to exchanges, thus stopping deeper declines and retaining the construction steady. That is what leaves the door open for a brand new push if momentum returns.

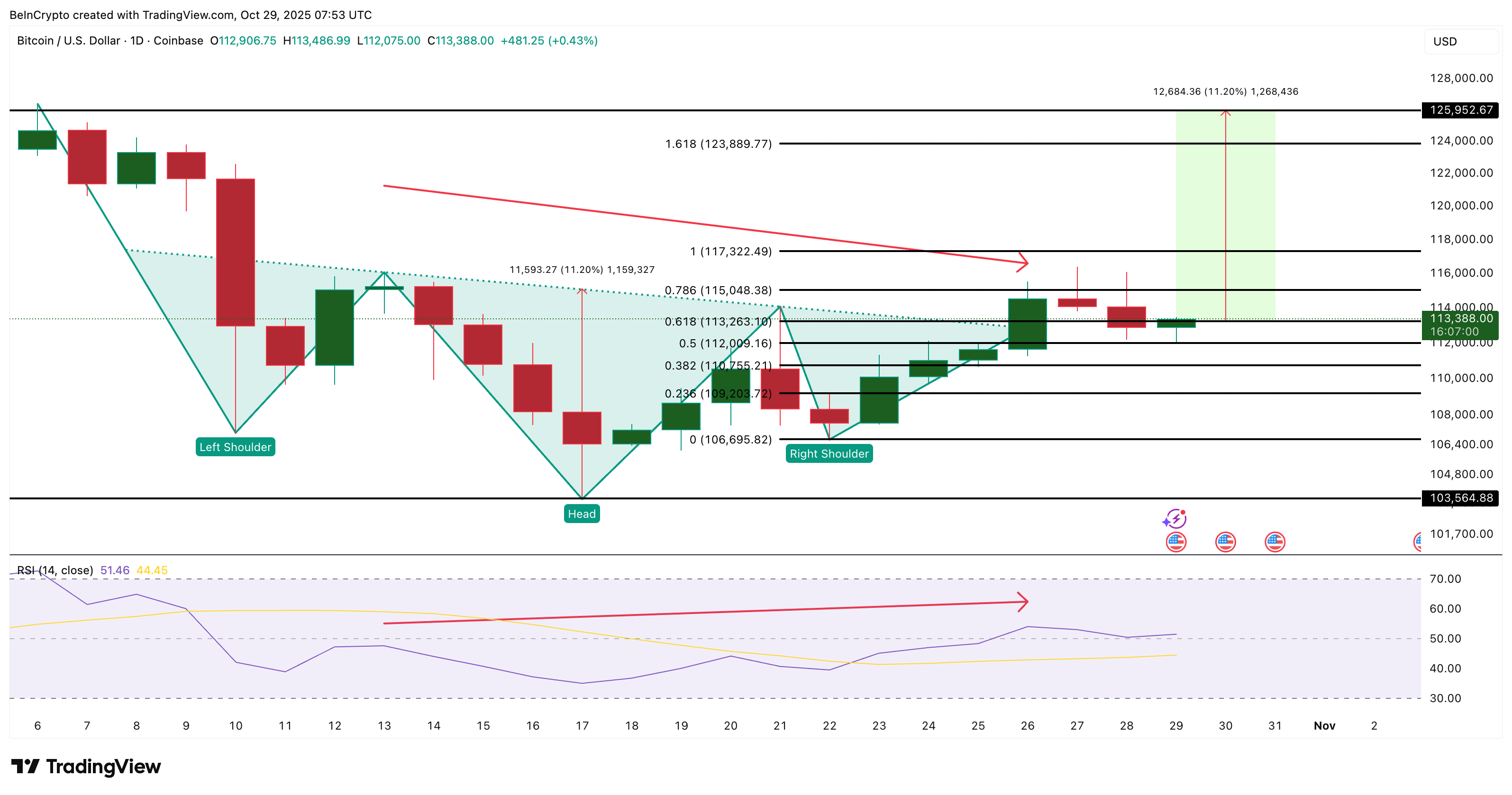

Bitcoin value construction and why restoration is anticipated

Bitcoin’s present setup nonetheless follows a transparent technical construction, an inverted head-and-shoulders sample, which regularly signifies a change in momentum from promote to purchase. This formation stays legitimate so long as BTC stays above the sample’s base of $106,600.

The Relative Power Index (RSI), an indicator that measures the power of shopping for and promoting momentum, first confirmed a hidden bearish divergence between October 13 and 26, simply as a breakout try was forming.

Throughout this era, Bitcoin value traded decrease highs, however the RSI elevated greater highs, indicating that momentum is weakening regardless of merchants pushing the worth greater.

Bitcoin Value Evaluation: TradingView

This imbalance was the explanation why many have been anticipating a attainable breakout failure round $115,000. And that is precisely what adopted – rejection and short-term fixes.

The divergence has now flattened, which means that the RSI and Bitcoin value are as soon as once more shifting in sync. This stabilization signifies that sellers are dropping momentum and are poised for a restoration. Nevertheless, $115,000 continues to be the important thing check. That is the extent that capped the earlier breakout and can decide whether or not this sample continues to evolve greater.

If Bitcoin closes decisively above that, a neckline breakout may pave the way in which to $117,300 and $125,900 (close to BTC’s peak). That is an 11% improve from the present zone. If BTC value fails and falls under $106,600, the bullish setup will likely be invalidated. It’s also possible to switch BTC in direction of $103,500.

Bitcoin’s Failed Breakout Was Anticipated — and So May Be Its Restoration If $115,000 Breaks appeared first on BeInCrypto.