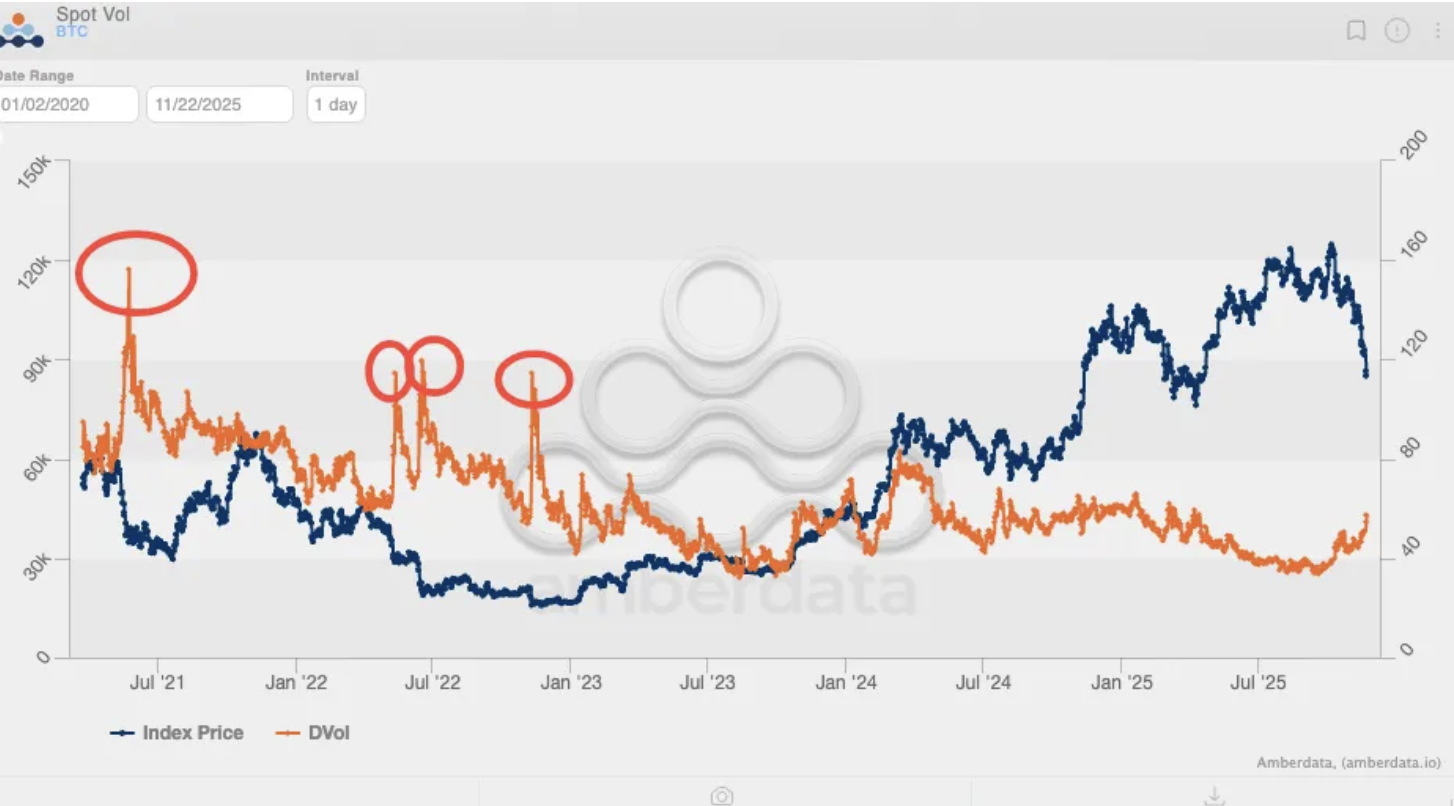

Bitcoin (BTC) worth volatility has skyrocketed over the previous two months, suggesting the market might return to options-driven worth motion that causes massive strikes in each instructions.

Since Bitcoin ETFs have been permitted within the U.S., Bitcoin’s implied volatility has by no means exceeded 80%, mentioned Jeff Park, a market analyst and advisor at funding agency Bitwise.

Nevertheless, the chart shared by Park exhibits that Bitcoin’s volatility has step by step returned to round 60 as of this writing.

Historic BTC volatility ranges present a major spike forward of Bitcoin exchange-traded funds being permitted within the US market in 2024. supply: jeff park

Park cited Bitcoin’s explosive worth motion in January 2021 and the start of the 2021 bull market, which took BTC to a brand new all-time excessive and cycle excessive of $69,000 in November of the identical 12 months, because the final main options-driven meltup. he mentioned:

“Finally, it’s choice positioning, not mere spot flows, that can create the decisive transfer that can propel Bitcoin to new highs. For the primary time in virtually two years, the volatility floor could also be flickering, an early signal that Bitcoin could as soon as once more develop into options-driven.”

This evaluation refutes the idea that the presence of ETFs and institutional buyers completely smoothed out Bitcoin’s worth fluctuations, shifting the market construction to mirror a extra mature asset class, strengthened by passive inflows from funding autos.

Associated: ‘Volatility is your pal’: Eric Trump is not bothered by Bitcoin or crypto carnage

Volatility rises amid market carnage, elevating considerations of extended financial downturn

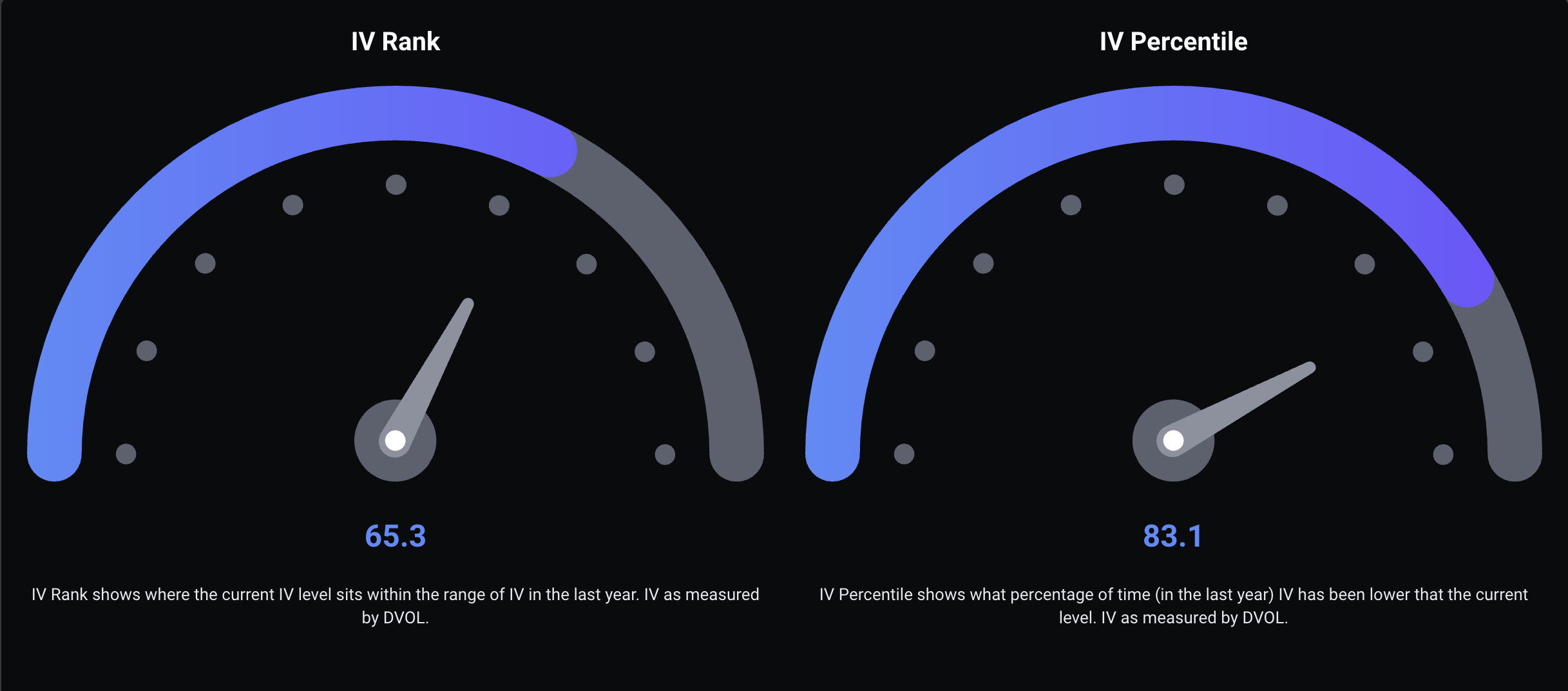

In accordance with Binance CEO Richard Teng, the rise in volatility within the BTC market is in keeping with ranges throughout all asset courses.

Rank and percentile of Bitcoin’s implied volatility in comparison with historic ranges. sauce: It’ll be a joke

Bitcoin crashed beneath $85,000 on Thursday, sparking fears that it might fall additional within the coming weeks and begin one other Bitcoin bear market.

Analysts have supplied a number of theories as to the reason for the financial downturn, together with the liquidation of extremely leveraged positions in derivatives markets, long-term BTC holders cashing out, and macroeconomic pressures.

Analysts at crypto change Bitfinex say Bitcoin’s continued decline is because of short-term components, suggesting a “tactical rebalancing” moderately than a flight of institutional buyers or a scarcity of demand.

Analysts mentioned this doesn’t derail Bitcoin’s long-term fundamentals, worth development, or institutional adoption developments.

journal: Bitcoin “one other massive push” to $150,000, ETH strain will increase: commerce secrets and techniques