Deep Out of the Cash (OTM) Bitcoin BTC$89,954.33 Put possibility expirations are getting longer as merchants reap the benefits of low cost lottery tickets for moonshot income within the occasion of a wild swing in BTC.

On main crypto choices trade Deribit, the $20,000 train put is the second hottest possibility expiring in June 2026, with over $191 million in nominal open curiosity.

Notional open curiosity is the greenback worth of the variety of lively contracts. A put possibility with a strike worth beneath the market charge of BTC is claimed to be OTM. These OTM places are usually cheaper than places close to or above BTC’s spot worth.

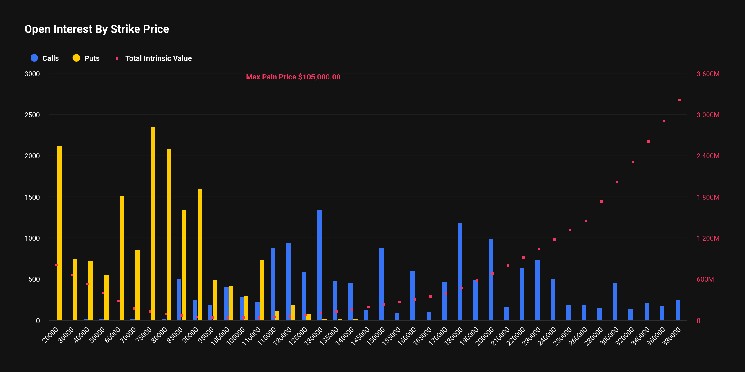

Different OTM places are additionally seeing large strikes at June expirations with strikes at $30,000, $40,000, $60,000, and $75,000.

Deep OTM put exercise is often interpreted as merchants getting ready for a worth crash. Nonetheless, this isn’t essentially the case because the trade can be seeing increased train name exercise above $200,000.

Sidra Farik, international head of retail at Deribit, mentioned these flows symbolize a bullish view on long-term volatility at low price, quite than bets on the course of costs. Consider this as an affordable lottery ticket for the potential explosion of volatility over the subsequent six months.

“There may be roughly 2,117 open curiosity on a $20,000 Bitcoin enter expiring in June. We additionally noticed giant trades with a $30,000 put and a $230,000 name strike. These out-of-the-money possibility mixtures don’t counsel directional trades, however quite deep wing trades, which professionals use to commerce long-term volatility cheaply and alter for tail danger on their books,” Farik advised CoinDesk.

She defined {that a} $20,000 put or $230,000 name is basically volatility positioning quite than worth positioning as a result of it’s too removed from the spot worth to be a purely protecting hedge. On the time of writing, BTC was buying and selling close to $90,500, in accordance with CoinDesk knowledge.

Those that maintain each OTM calls and places could derive uneven advantages from excessive volatility or wild worth actions in both course. Nonetheless, if the market is flat, these choices shortly lose worth.

An possibility is a by-product contract that offers the customer the precise to purchase or promote the underlying asset at a specified worth at a later date. A put possibility supplies the precise to promote and represents a bearish wager in the marketplace. When you make the decision, you can be given the precise to buy.

The crypto choices market, together with these related to BlackRock’s IBIT ETF, has developed into a complicated discipline the place establishments and whales play a recreation of three-dimensional chess to handle danger and revenue from modifications in worth course, time decay, and volatility.

Broadly talking, the temper within the choices market seems to be bearish, as BTC places proceed to commerce at a premium to calls throughout all durations, in accordance with Amber Knowledge’s Possibility Threat Reversal. That is at the least partially on account of persistent name overwriting, a method aimed toward rising yields on prime of spot market holdings.