The USA and China have taken a significant step towards easing commerce tensions, agreeing to droop a number of tariffs this yr which have roiled world markets.

Nonetheless, regardless of the diplomatic breakthrough, Bitcoin’s worth doesn’t replicate the optimistic outlook anticipated from such transactions.

US and China attain historic settlement

On November 1, the White Home introduced that President Donald Trump and Chinese language President Xi Jinping had reached a commerce and financial settlement. The settlement was finalized throughout a convention held in South Korea.

Beneath the settlement, China will droop new export restrictions on uncommon earth components and grant normal permits for shipments of uncommon earth components. The Chinese language authorities additionally pledged to curb fentanyl exports to the USA and droop all retaliatory tariffs imposed since March 4.

In return, Washington will minimize tariffs on Chinese language items by 10% and lengthen present tariff exemptions till November 2026.

“(This) is a significant victory that protects America’s financial power and nationwide safety whereas placing American staff, farmers, and households first,” the White Home mentioned.

Macroeconomic analysis agency Covisi Letter mentioned the deal was probably the most substantial thaw in U.S.-China commerce relations in years and will ease tensions in world provide chains.

Bitcoin defies diplomatic optimism

Nonetheless, monetary markets have proven little enthusiasm for the information.

Bitcoin, which regularly reacts to geopolitical and macroeconomic alerts, posted a modest achieve of lower than 1% over the previous 24 hours. On the time of writing, it was buying and selling at $110,785.

Certainly, this subdued response is in sharp distinction to the volatility recorded in October. On the time, President Trump’s announcement of recent retaliatory tariffs triggered a $20 billion wave of liquidations throughout the crypto market.

In the meantime, business analysts say this slower worth response displays deeper structural adjustments in Bitcoin possession fairly than a lack of macro sensitivity.

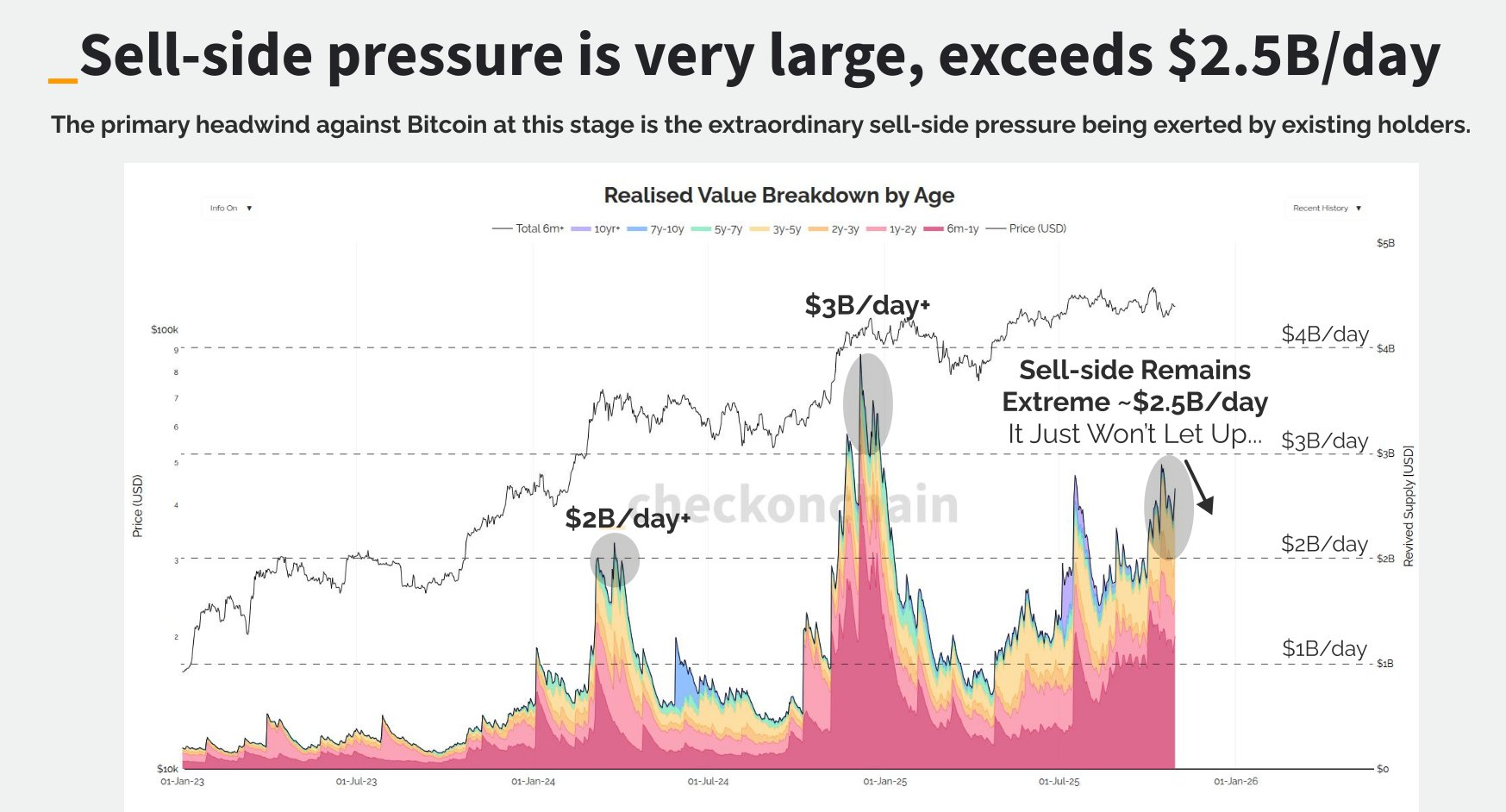

Bitcoin on-chain analyst James Verify noticed that older holders are offloading their cash at an accelerated charge in comparison with earlier cycles.

He famous that strain on Bitcoin sellers stays robust, and the typical age of cash presently on sale is round 100 days. This represents a major enhance from the prior interval’s 30-day common.

Bitcoin promoting strain. Supply: James Verify

He defined that this transformation signifies that long-term holders are shifting their positions to affected person and well-funded new entrants coming into the market.

“We’re watching a altering of the guard from the OGs who rode the early harmful waves to a brand new class of TradFi patrons preferring calmer waters,” Cech defined.

Regardless of the short-term worth decline, specialists keep that Bitcoin’s long-term fundamentals stay intact. They argue that the present rotation represents a pure evolution in asset maturity, as skilled merchants exit and conventional finance begins to take maintain.

The put up Bitcoin stays flat regardless of historic US-China commerce deal announcement appeared first on BeInCrypto.