Regardless of a really sturdy begin to the month, the traditionally bullish “Uptober” interval didn’t go as anticipated for Bitcoin costs. After the market-wide decline on October tenth, this main cryptocurrency has not been in a position to clearly recuperate to its earlier highs.

Certainly, Bitcoin worth efficiency continues to wrestle beneath sustained bearish stress, dropping to a brand new low close to $103,000 on Friday, October 18th. With uncertainty sweeping the market, traders are questioning if the bull market is over or if the downturn is only a small change.

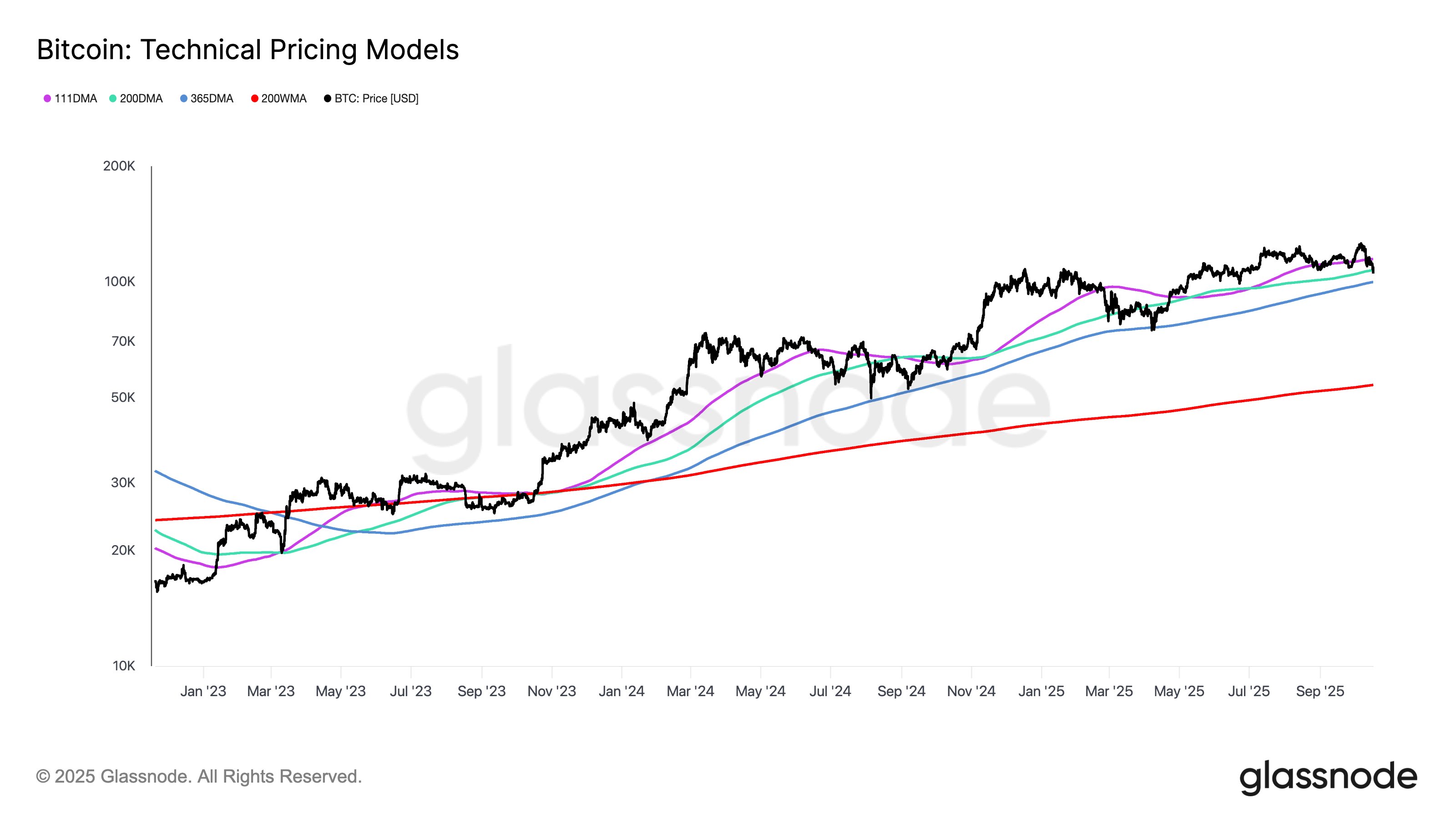

In accordance with latest outlooks, the present technical place of BTC worth could present perception into the following steps.

BTC prone to additional correction if loses $99,900 assist

In an October seventeenth put up on social media platform X, Glassnode proposed an fascinating evaluation of the present Bitcoin pricing. A distinguished crypto evaluation agency has revealed that the flagship cryptocurrency is presently positioned between two main assist zones.

This evaluation is predicated on the Glassnode technical worth mannequin, which is a chart that features a variety of technical indicators, together with the Pi Cycle indicator, the Mayer A number of, the annual transferring common (MA), and the 200-week transferring common.

In accordance with Glassnode, Bitcoin worth is presently wedged between the Mayer a number of ($107,400) and the annual MA ($99,900).

Supply: @glassnode on X

The Mayer A number of (200-day easy transferring common) is a well-liked technical indicator usually related to transition factors between bull and bear markets. The 365-day SMA, then again, offers a long-standing baseline that signifies excessive timeframe market momentum.

Following the newest decline, Bitcoin worth fell under its 200-day transferring common, suggesting a doable transition from bullish to bearish market circumstances. BTC continues to be above its 365-day transferring common, however the most effective cryptocurrency wants to maneuver above this stage for the present pattern to stabilize.

In the end, traders could wish to regulate BTC worth, as a break under the $99,900 stage might spell even larger bother for the world’s largest cryptocurrency. It’s price noting that though there’s worth resistance close to the 111-day transferring common (presently $114,700), a return to ranges above the Mayer a number of might be vital for Bitcoin’s growth.

Bitcoin worth overview

On the time of this writing, Bitcoin is price roughly $106,427, reflecting a worth decline of virtually 2% over the previous 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView