The restoration in Bitcoin costs has slowed considerably since returning to the $91,000 stage final week. Based on the most recent on-chain information, the flagship cryptocurrency seems to be coming into a important zone, which may result in a good stronger value rebound within the close to future.

On-chain information suggests Bitcoin value might rebound quickly

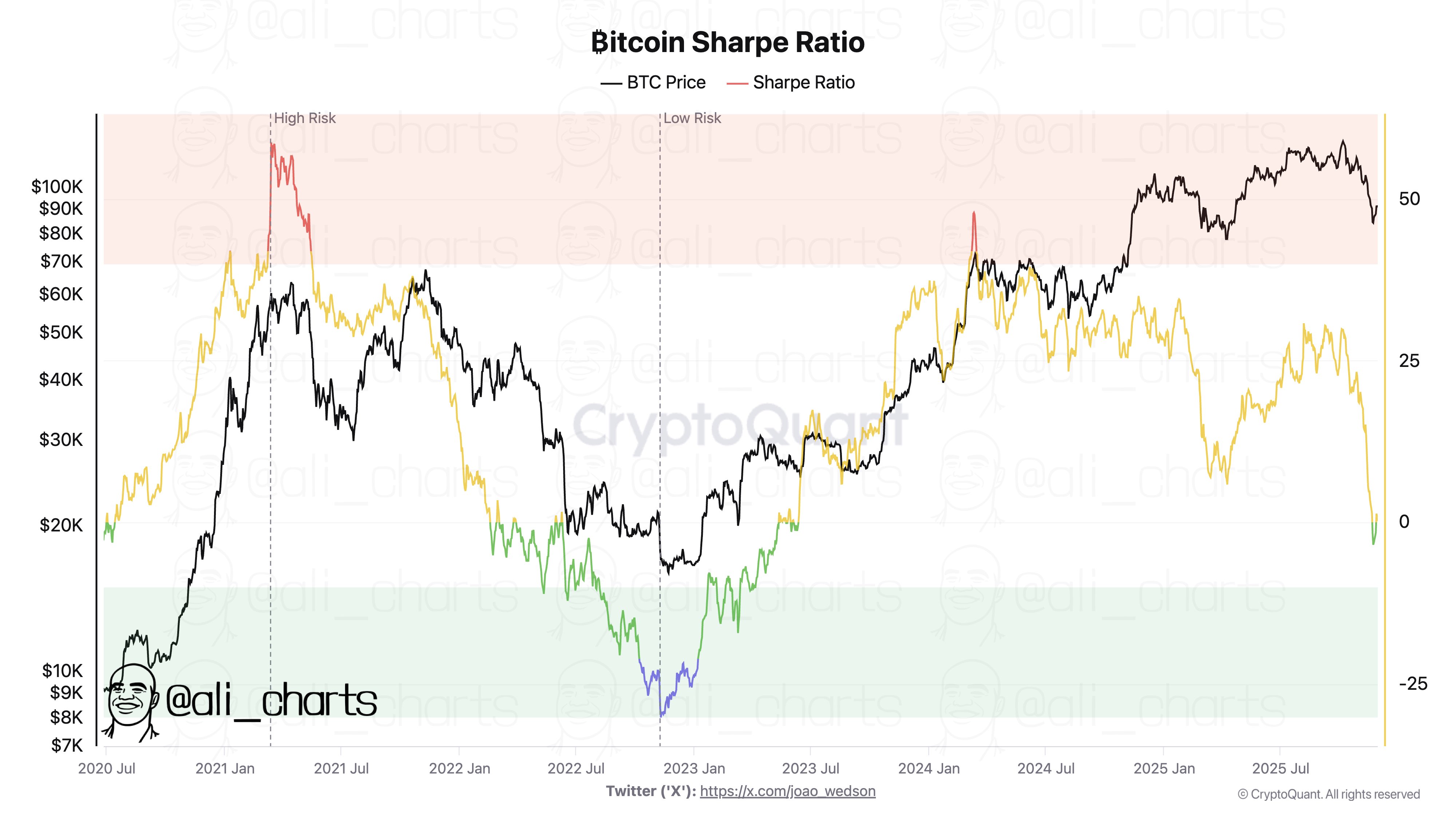

Cryptocurrency analyst Ali Martinez revealed in a November 29 put up on social media platform X that Bitcoin costs could also be coming into a “low danger” zone. Based on market consultants, this low-risk area typically gives traders with strong potential shopping for alternatives.

This analysis revolves across the Sharpe Ratio, an on-chain metric that evaluates the risk-adjusted return of a selected crypto asset (on this case, Bitcoin). This metric principally evaluates the quantity of return supplied by an funding per unit of danger (considering that danger is measured by volatility).

A better Sharpe ratio usually signifies greater risk-adjusted efficiency, that means that the asset generates larger returns in comparison with the dangers assumed. Alternatively, if this indicator is trending downward, it signifies that the coin is within the “low danger zone” and the returns have gotten much less necessary.

Supply: @ali_charts on X

As proven within the chart above, the Bitcoin Sharpe Ratio has fallen sharply and is approaching low danger territory (inexperienced space). Inside this space, market leaders have a tendency to supply decrease returns and are sometimes much less inclined to cost modifications as a consequence of surprising volatility.

Traditionally, the low-risk zone has been a spot the place long-term traders “purchase the sting” in an try and make much less dangerous choices available in the market. Moreover, as noticed within the highlighted chart, Bitcoin value bottomed out when the Sharpe ratio entered the low-risk zone (as seen in late 2022).

Primarily, with the Sharpe ratio hovering round and beneath the zero threshold, Bitcoin value could also be making ready for a market rebound.

Bitcoin Coinbase Premium Hole flashes inexperienced once more

One other on-chain indicator that lends additional credence to the Bitcoin value rebound speculation is the Coinbase Premium Hole. This indicator measures the distinction between the BTC value on the US-based Coinbase change (USD pair) and the worldwide Binance change (USDT pair).

Supply: @JA_Maartunn on X

When Coinbase’s Premium Hole is optimistic, as it’s now, this indicator signifies that US-based traders are actively shopping for Bitcoin. Finally, this demand stress from US traders may present the required float for Bitcoin costs proper now.

As of this writing, the value of BTC is round $90,940, reflecting a rise of simply 0.4% over the previous 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView