In a single day crypto good points evaporated once more by morning in US as Bitcoin BTC$101.727,63 It fell under $102,000 on Wednesday.

It briefly topped $105,000 earlier immediately, however the largest cryptocurrency plummeted 3% in just some hours when conventional markets opened in the USA. It wasn’t simply Bitcoin. ether Ethereum$3.431,64 Though it fell virtually 5% under $3,400 throughout the identical interval, Solana sol$153,62, XRP$2,3488 And different altcoin majors suffered related declines.

U.S. shares associated to cryptocurrencies additionally rose within the early phases. USDC stablecoin issuer Circle (CRCL) fell 9.5% following Q3 outcomes, however crypto miners with information middle ambitions continued to promote, together with Bitfarm (BITF), BitDeer (BTDR), Cipher Mining (CIFR), Hive Digital (HIVE), Hut8 (HUT), and IREN, which fell 5-10%.

Lowering US urge for food for Bitcoin

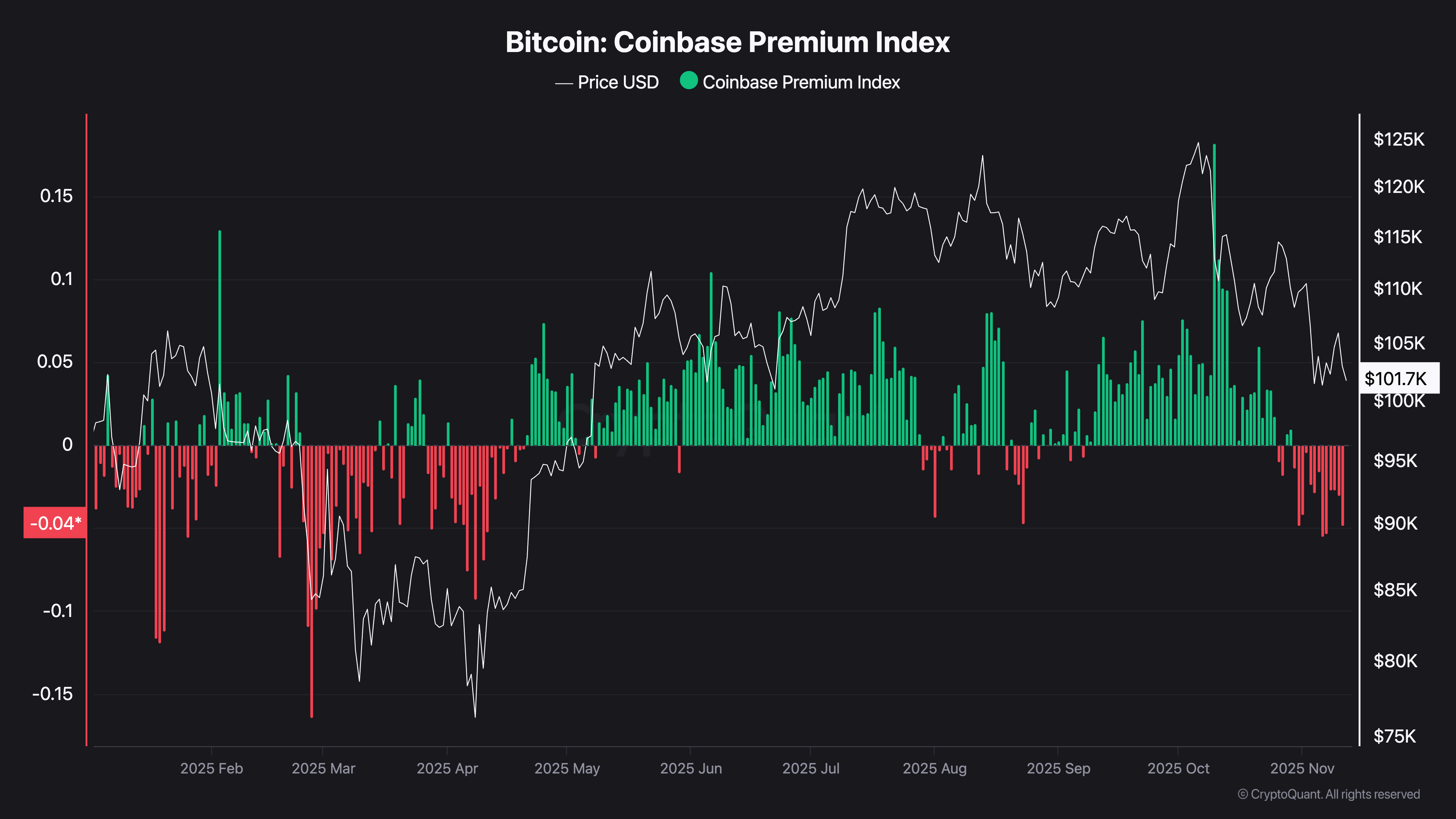

Lackluster worth motion throughout US buying and selling hours has been a fixture of the crypto market in latest weeks. A sign of the weak point in U.S. investor demand is the so-called Coinbase premium, a well-liked measure of U.S. investor demand, which has been unfavorable since late October.

Bitcoin’s Coinbase Premium Index is in its weakest streak for the reason that April correction. (CryptoQuant)

Coinbase Premium measures the worth distinction between the worth of Spot BTC on Coinbase, a cryptocurrency alternate broadly utilized by US clients and plenty of institutional market members, and the worth on Binance, a well-liked alternate amongst offshore retail customers and the highest alternate by buying and selling quantity.

That is the indicator’s longest unfavorable streak since March-April, when a market-wide correction noticed BTC rise above $100,000 earlier than falling to $75,000.

Fed is split on rate of interest cuts

The shift in U.S. sentiment coincides with rising uncertainty over the Fed’s subsequent motion since its October central financial institution assembly. What was broadly anticipated earlier than the assembly to be a straightforward path to a different fee lower in December has now was an inner battle between policymakers.

The Wall Avenue Journal lately reported that central banks are dealing with inner divisions, with policymakers divided over whether or not the higher danger now could be sustained inflation or a softening labor market. The cut up makes the trail to a December fee lower far more unsure than anticipated just a few weeks in the past.

The latest authorities shutdown, which quickly froze the discharge of key jobs and inflation information, has widened the gulf as policymakers have needed to depend on non-public information and anecdotes, the report mentioned.

The report mentioned that the December fee lower is presently a “toss-up” and that even when a call is made to chop charges, the hurdles for additional fee cuts could also be excessive.

Because the Fed’s October assembly, US-listed spot Bitcoin ETFs have seen web outflows of greater than $1.8 billion, indicating that the uncertainty surrounding the Fed’s actions and the dearth of clear optimistic catalysts is conserving BTC on edge.