Bitcoin markets had an eventful buying and selling week, with a number of failed breakouts from the $115,000 resistance zone regardless of the US Federal Reserve’s announcement of additional rate of interest cuts. As the value pattern is at present secure round $110,000, Bitcoin choices market information gives perception into dealer habits and the prevailing state of affairs. Feelings.

Bitcoin choices merchants guess on a secure market

On Friday, distinguished blockchain analytics agency Glassnode shared a weekly replace on the Bitcoin choices market, analyzing merchants’ beliefs about future value actions. As talked about earlier, the Fed introduced its second charge lower for 2025 on Wednesday. Whereas it is a typically bullish transfer, the hawkish tone suggesting that future charge cuts are unlikely has dampened merchants’ optimism, leading to a brief rally in danger property resembling Bitcoin.

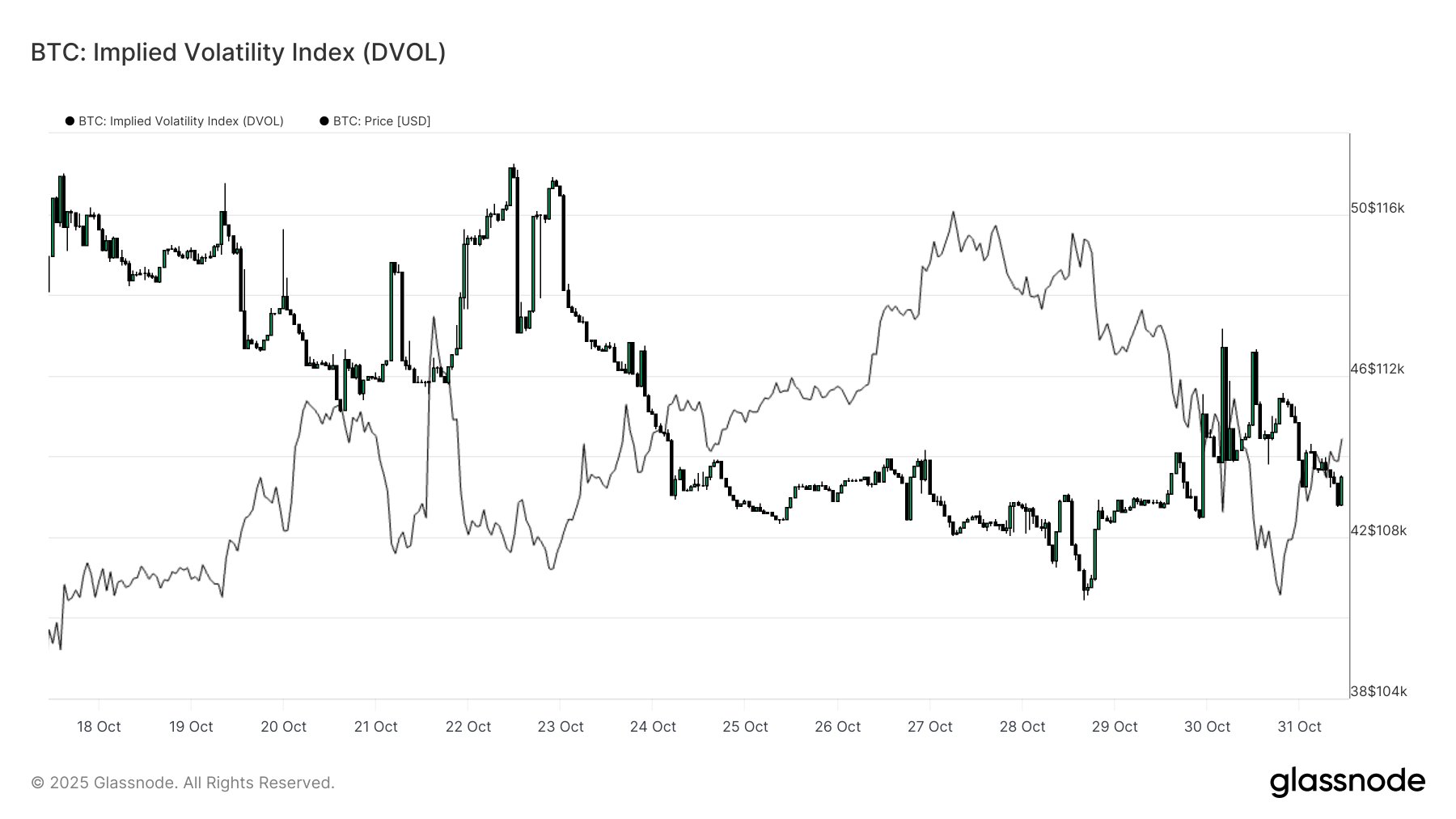

Amid these developments, the BTC Implied Volatility Index, which measures how a lot volatility merchants count on sooner or later, continues to say no. This information means that regardless of the present macro noise, merchants are pricing BTC extra calmly, not anticipating massive value actions. Alternatively, the 1M volatility danger premium additionally turned detrimental as realized volatility moved quicker than implied volatility. Glassnode expects this growth to be mean-reversed. This implies short-term volatility is dear and merchants are prone to promote, thereby confirming the anticipated benign market story.

Moreover, the put/name quantity additionally confirmed one other facet of this story, creating a whole retest to the October lows. Notably, merchants initially displayed bullish habits with the decision wave, however rapidly modified their sentiment consistent with the broader market. Nevertheless, with calls dominating, Glassnode factors to impartial directional confidence, which means the purchase and promote pressures are equal, confirming the market’s insecurity in a right away bullish or bearish transfer.

Do you may have low expectations for value will increase?

The 25 Delta skew chart gives one other story of heightened alarm. Particularly, this indicator measures the implied volatility between calls and places. 25 If the delta skew is impartial, it signifies that the dealer considers the chance of the put to be balanced and the value of the decision to be equal. After a quick stint on this impartial zone, the indicator is now rising once more, indicating that merchants are valuing places extra extremely and actively hedging towards value declines.

Due to this fact, whereas we don’t count on massive value actions within the quick time period, Bitcoin choices merchants look like very cautious of value declines. On the time of writing, Bitcoin’s worth is $109,304, reflecting a slight improve of 1.94% over the previous day. In the meantime, the day by day buying and selling quantity decreased by 11.62% to $65.18 billion.

Featured photos from iStock, charts from Tradingview