On Friday, the market capitalization of Bitcoin mining shares rose 9.43%, with the entire prime 10 publicly traded miners by market capitalization closing within the inexperienced, together with three shares with double-digit positive aspects. With one week left on the 2025 calendar, practically the complete mining group, aside from two laggards, seems poised to finish the yr on a constructive word.

Sturdy buying and selling on Friday places listed Bitcoin miners in for a loud run into 2026

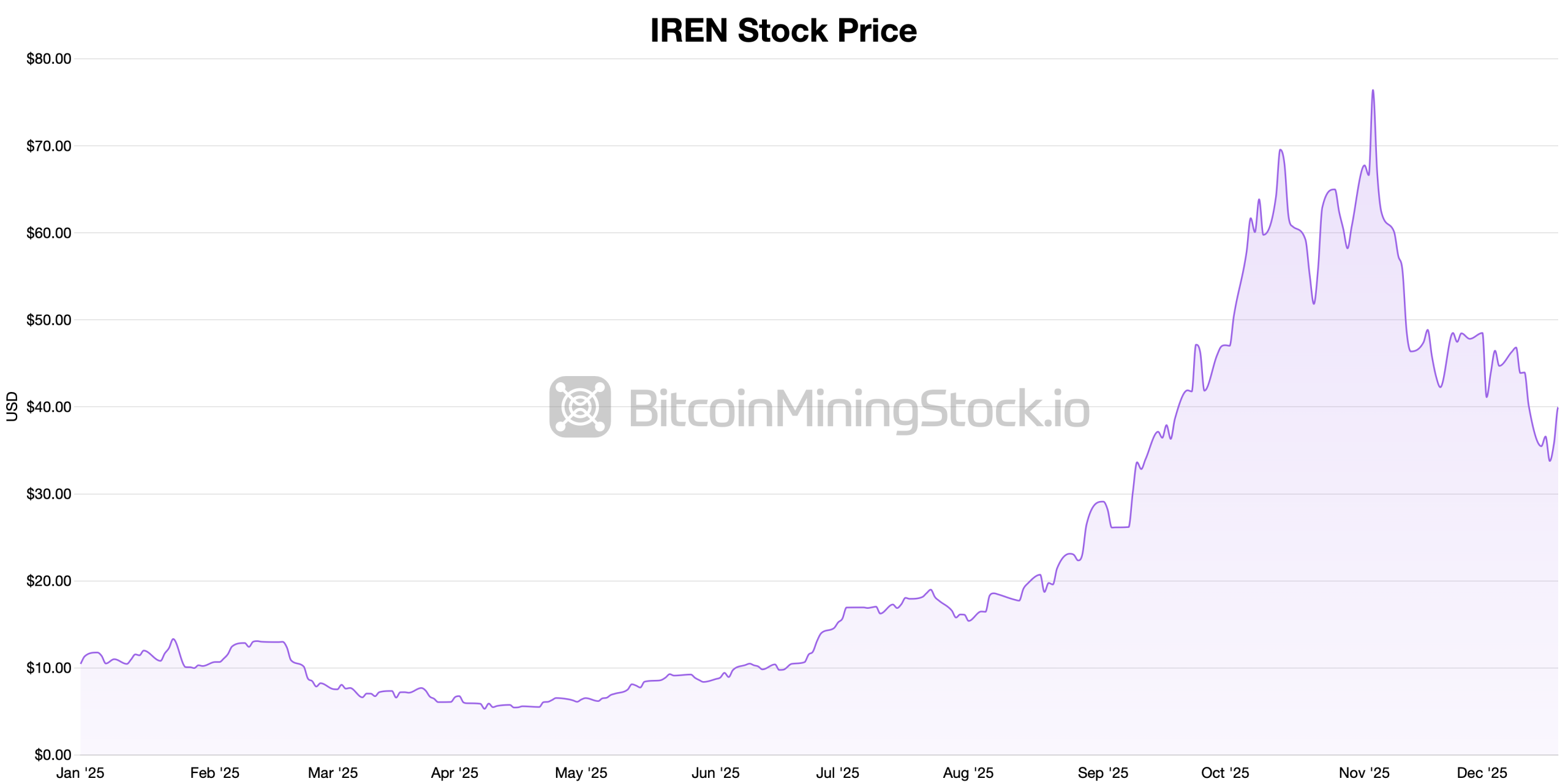

Bitcoin miners traded on U.S. exchanges have been strong on Friday, maintaining tempo with main U.S. inventory indexes. IREN Restricted, the most important publicly traded Bitcoin miner with a market capitalization of $11.31 billion, rose 11.50% on the day to shut at $39.92. Though the inventory worth has fallen by 0.52% up to now 5 enterprise days, the general image remains to be attracting consideration, with the inventory worth growing 306.51% year-to-date (year-to-date).

Utilized Digital rose 16.52% on Friday to shut at $27.85. Nonetheless, the inventory worth remained largely unchanged over the five-day interval, down simply 0.03%. Zooming out, APLD remains to be having an important yr, up 264.52% year-to-date, giving it a market cap of round $7.8 billion. Just under APLD, Cipher Mining closed at $16.21 on Friday, marking a 6.99% acquire on the day.

IREN YTD statistics as of December 20, 2025.

This enhance hasn’t utterly erased the latest impression, with the inventory nonetheless down 4.92% over the previous 5 periods. Nonetheless, CIFR has loads to be happy with over the long run, with its inventory worth up 249.35% year-to-date and its market cap hovering round $6.4 billion. Riot Platforms closed Friday’s buying and selling up 8.37% at $14.50. Nonetheless, in 5 days, the inventory worth fell by 5.22%. On a year-to-date foundation, RIOT nonetheless leads by 42.01%, with a valuation hovering round $5.39 Billion.

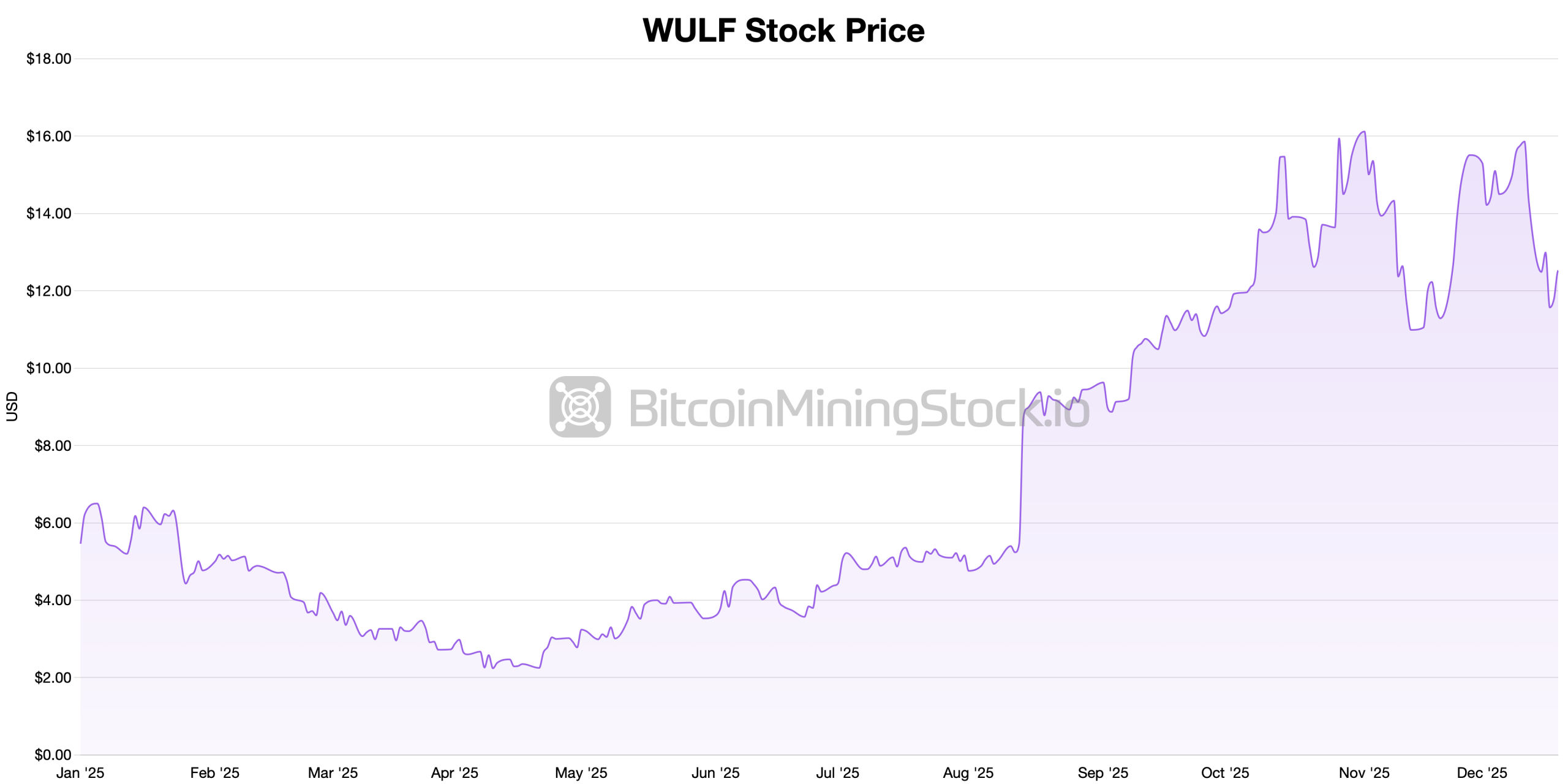

WULF YTD statistics as of December 20, 2025.

TerraWolf Inc. closed the week at $12.52, up 6.19% on Friday. Brief-term buying and selling has been powerful, with the inventory worth down 12.63% over the previous 5 days. Even after this decline, WULF remains to be up 121.20% year-to-date, with a market capitalization of roughly $4.89 billion as we strategy the final week of December.

Additionally learn: Bitcoin futures and choices positioning indicators a cautious reset forward

Rounding out the highest 10, Core Scientific ended the week at $15.60, up 7.14% on the day, growing its year-to-date acquire to 11.03% and giving it a market cap of roughly $4.84 billion. Hut 8 Corp. surged 14.33% to shut at $44.12, giving it a year-to-date return of 115.32% and valuing the miner at roughly $4.77 billion.

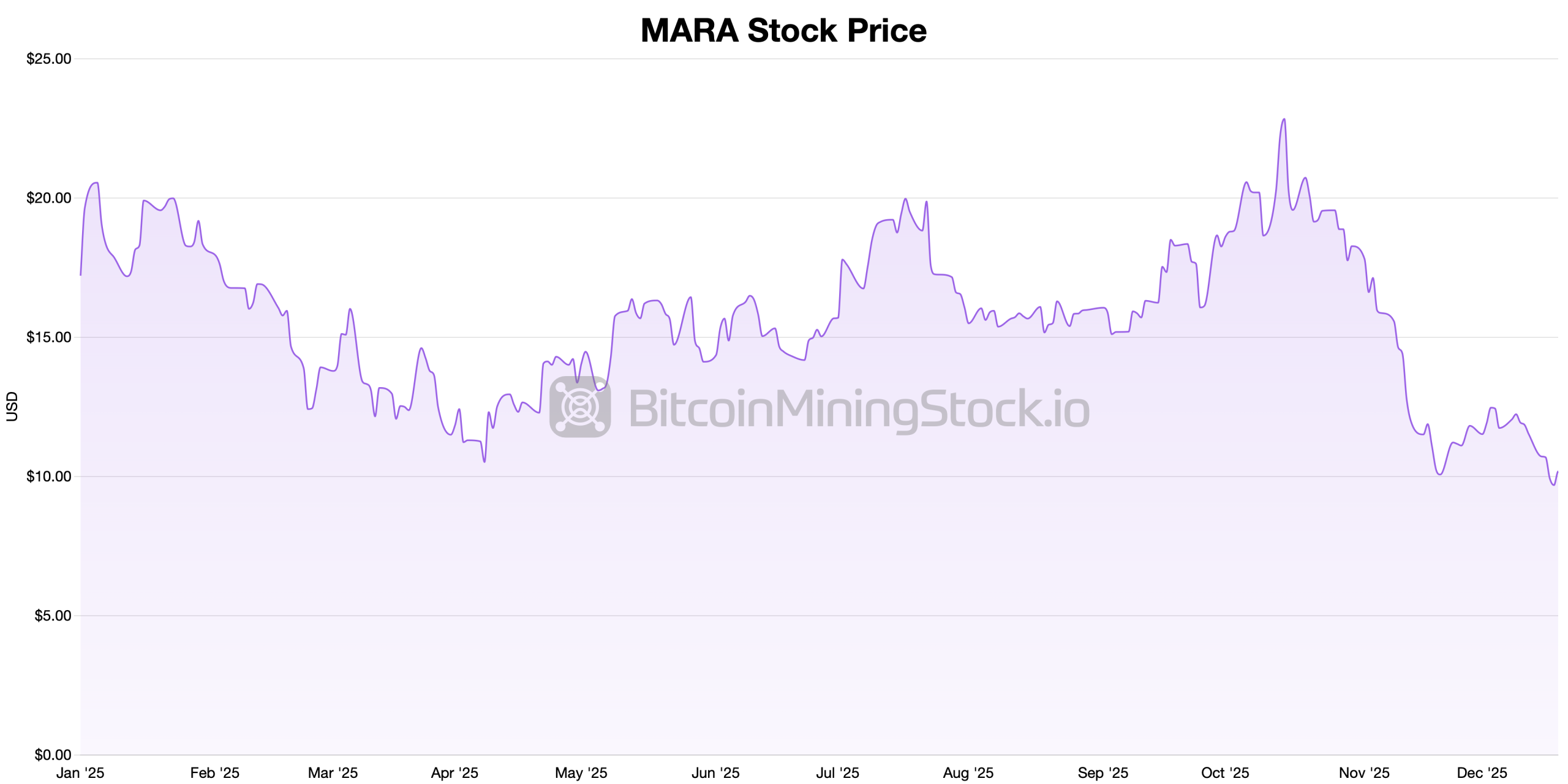

MARA year-to-date statistics as of December 20, 2025.

MARA Holdings rose 5.05% on the day to shut at $10.18, however was nonetheless down 39.29% since January 1st, giving it a market cap of practically $3.85 billion. Cleanspark Inc. rose 7.41% to finish the yr at $12.03, up 30.61% year-to-date. In the meantime, Bitdeer Applied sciences Group closed at $11.01, up 9.99% for the day however down 49.19% for the yr, giving it a market valuation of roughly $2.3 billion.

Friday’s across-the-board rally ended the yr neatly for publicly traded Bitcoin miners, and regardless of some short-term stumbles, most corporations enter the ultimate days of 2025 on strong footing. The distinction between unstable weekly buying and selling and attention-grabbing year-to-date outcomes exhibits that traders proceed to concentrate on scale, execution, and stability sheet self-discipline because the calendar turns, even when not all miners make it to the end line unscathed.

The ultimate week of December is anticipated to stay constructive, however unstable, as traders maintain their books on monitor and safe income, whereas skinny vacation buying and selling can be exaggerated. As 2026 begins, consideration will flip to stability sheets, growth plans, and Bitcoin worth developments, which ought to set the tone for which miners preserve momentum and which face a reset.

Incessantly requested questions ⛏️

- Why did Bitcoin mining shares rise on Friday?Most miners rose together with U.S. inventory indexes as traders bid up shares forward of year-end positioning.

- Which Bitcoin Mining Shares Led the Rise?Massive miners akin to IREN Restricted, Utilized Digital, and Hut 8 posted the strongest single-day positive aspects.

- What ought to traders be anticipating within the closing week of December?If vacation liquidity is skinny and settlement exercise will increase, general worth fluctuations in mining shares could enhance.

- What are crucial components for Bitcoin miners heading into 2026?Steadiness sheets, growth plans, and Bitcoin worth developments are more likely to decide efficiency early within the new yr.