The Bitcoin mining sector has come below rising strain as hash costs, a key business profitability indicator, have fallen to ranges that might pressure small operators offline and pressure the broader provide chain.

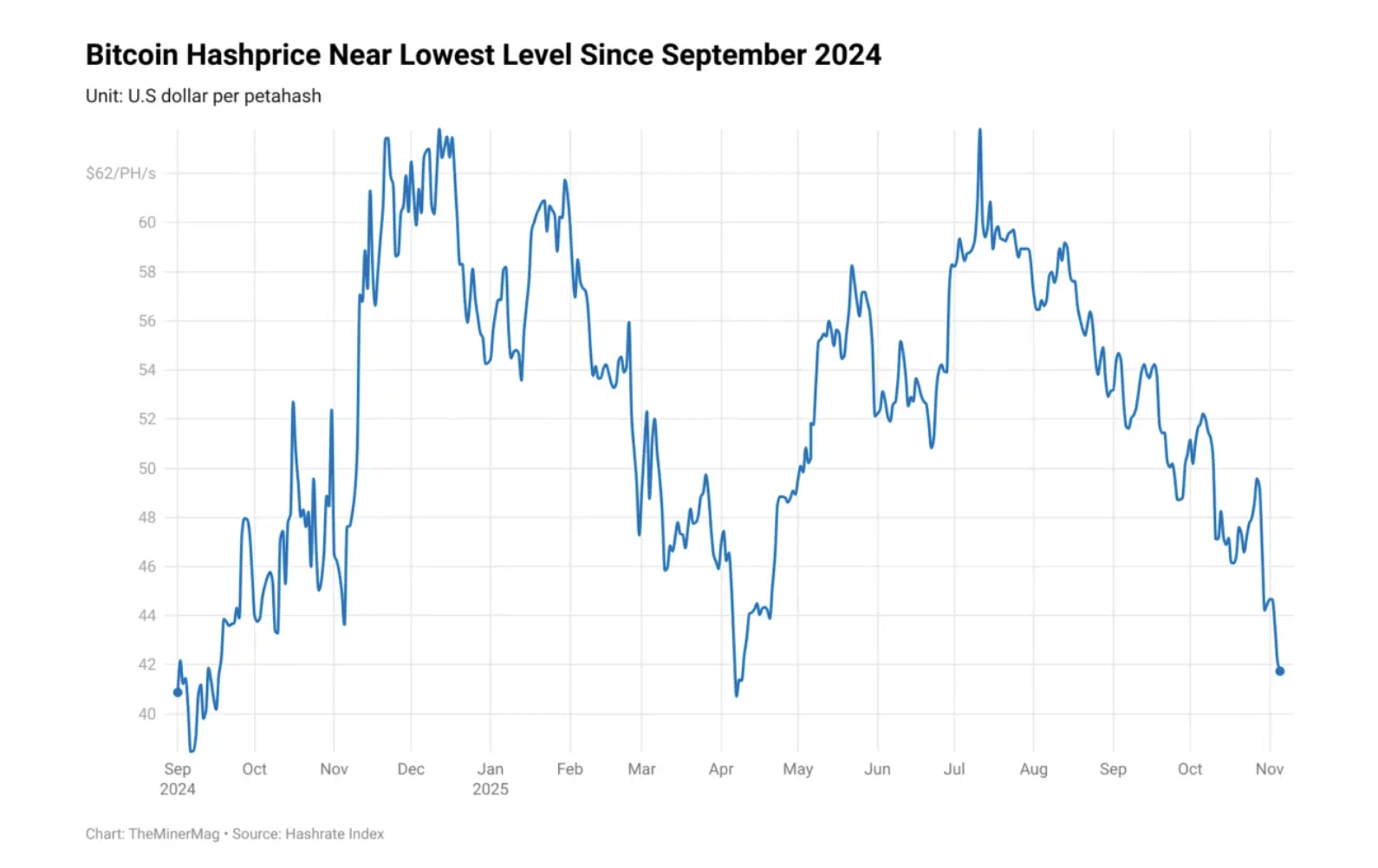

The hash worth, which measures the anticipated every day return per unit of computing energy, is at the moment round $42 per petahash per second (PH/s). The metric has been steadily declining since surpassing $62 per PH/s in July.

In accordance with TheMinerMag, the rise to the $40 stage is inflicting Bitcoin mining operations, which have already got razor-thin revenue margins, to think about shutting down their rigs.

The decline in hash costs has additionally affected the mining provide chain. In accordance with the report, the {hardware} supplier has seen fewer orders from struggling miners, and its BTC-denominated gross sales have additionally been hit by falling costs after the October market crash.

Hash costs have plummeted and are approaching disaster ranges. sauce: the minor mug

Mining {hardware} producers reminiscent of Bitdeer are turning to self-mining to make up for the shortage of demand for mining machines.

As Bitcoin mining turns into extra aggressive, with razor-thin revenue margins, excessive capital expenditures for {hardware} upgrades, and rising power prices, many Bitcoin miners are pivoting to AI and high-performance computing knowledge facilities to generate income.

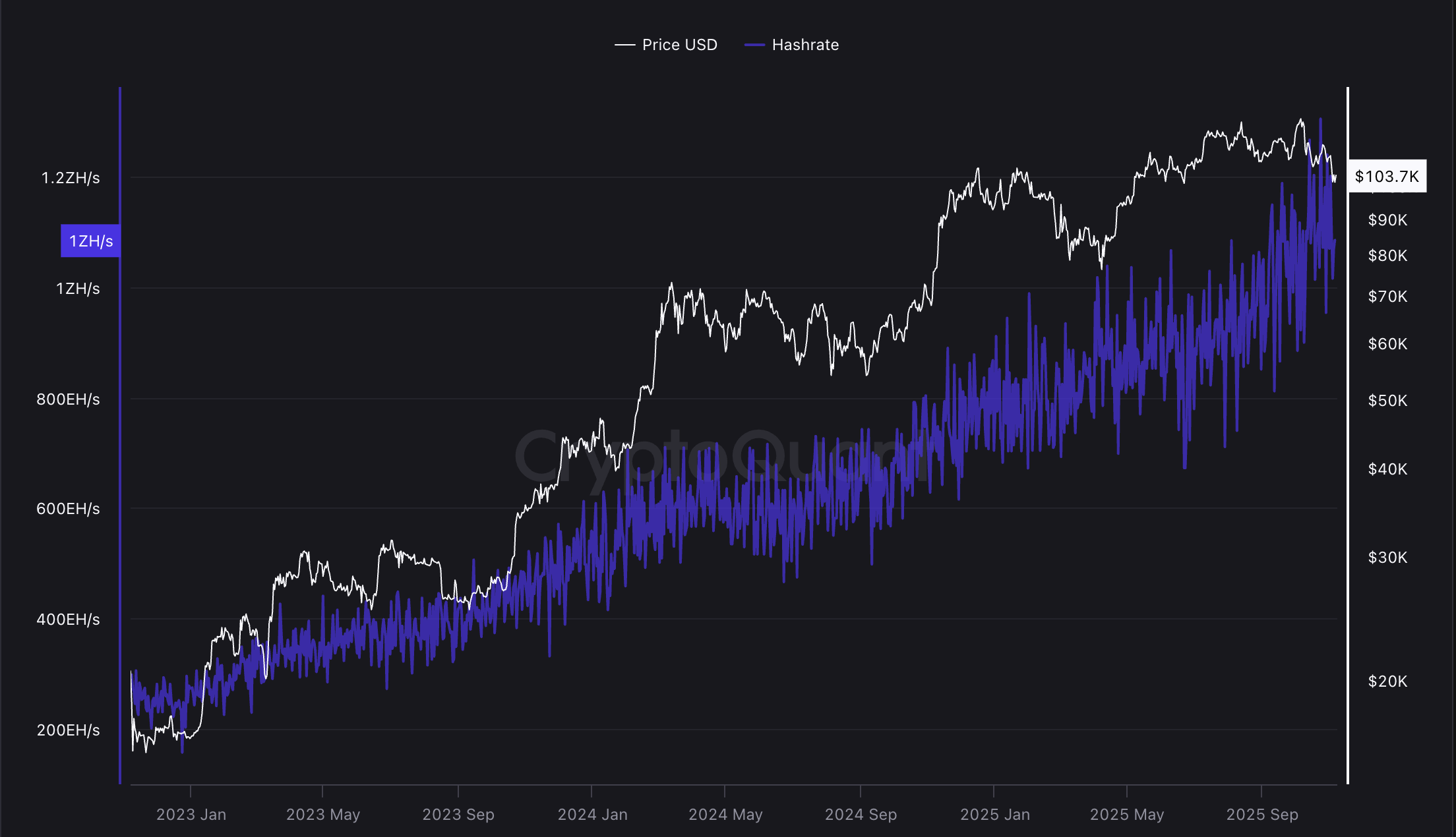

Miners pivot to AI as hashrate continues to extend

Bitcoin miners are assured a 50% discount in rewards each 4 years throughout Bitcoin halving, because the computing energy and energy required to mine blocks continues to extend.

The hash fee of the Bitcoin community continues to rise, exceeding 1 zetahash per second (ZH/s). sauce: cryptoquant

In 2009, the primary block reward for efficiently mining a block was 50 BTC, and Node Runners used private pc CPUs to mine BTC.

After the April 2024 halving, the BTC block reward decreased to three.125 BTC, and mining BTC at the moment requires specialised mining {hardware} often known as an application-specific built-in circuit (ASIC).

These troublesome financial situations have compelled many miners to diversify into adjoining AI datacenter and computing companies, producing billions of {dollars} in income for those who have made the transition.

In October, Cipher Mining signed a $5.5 billion cope with tech large Amazon to supply computing energy to Amazon Internet Providers for 15 years.

Bitcoin mining firm IREN signed the same cope with Microsoft in November to supply GPU computing providers price $9.7 billion.