Bitcoin costs began the brand new month on a tough word, persevering with the wild swings that began in October. On Friday afternoon, November seventh, the premier cryptocurrency briefly fell under the psychological $100,000 degree for the second time up to now week.

Bitcoin’s value struggles in latest weeks are believed to be resulting from adjustments within the conduct of buyers, significantly these referred to as long-term holders (LTHs). A distinguished crypto knowledgeable on X supplied additional perception into the impression of LTH operations on BTC value.

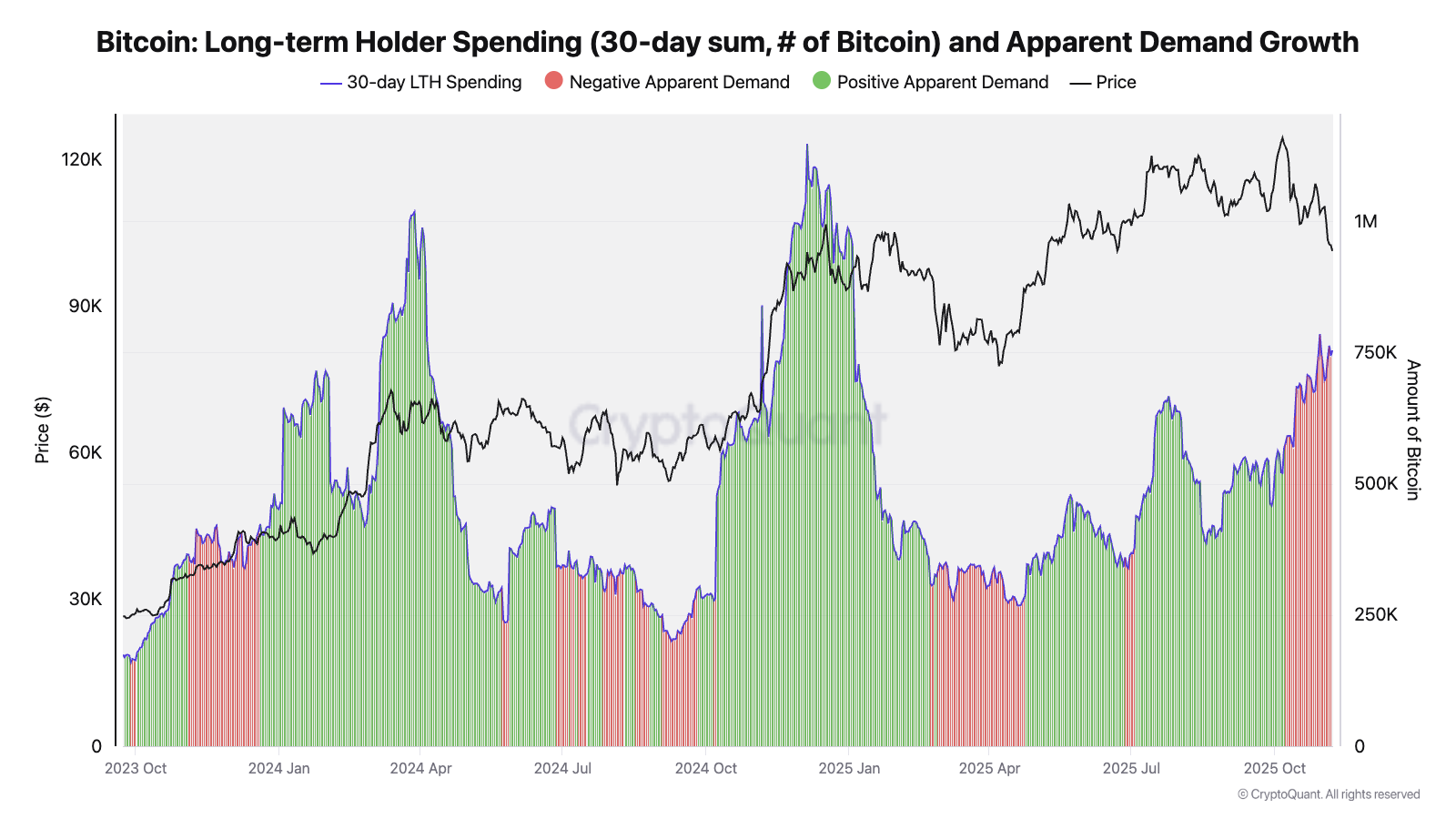

BTC’s obvious demand progress turns unfavourable

In a latest put up on the X Platform, Julio Moreno, Head of Analysis at CryptoQuant, admitted that long-term Bitcoin holders have certainly been offloading their property over the previous few weeks. Nonetheless, the crypto knowledgeable identified that the elevated gross sales exercise by LTH just isn’t new.

Moreno mentioned it’s normal for long-term Bitcoin buyers to chip away at a few of their holdings throughout bull markets in an try and revenue whereas costs are excessive. What’s totally different this time round is that there isn’t any corresponding demand to mop up these off-roads.

To help this, Moreno shared a graph summarizing long-term holder spending and obvious demand progress over the previous few years. For context, obvious demand progress measures the distinction within the quantity of an asset (on this case Bitcoin) that’s acquired in comparison with the quantity that’s created (mined).

Supply: @jjc_moreno on X

CryptoQuant’s head of analysis identified that regardless of the obvious progress in demand, Bitcoin costs have beforehand reached document highs in periods of elevated promoting by long-term holders. As seen within the chart, this occurred through the all-time excessive rally durations of January-March 2024 and November-December 2024.

The highlighted chart additionally exhibits that long-term Bitcoin holders have been promoting since October, which isn’t significantly misplaced. Nonetheless, obvious demand progress has slowed, suggesting there was no shopping for strain to soak up LTH provide at greater costs.

In the end, this on-chain remark means that we should always not focus an excessive amount of on the gross sales actions of long-term Bitcoin holders. For BTC costs to show round within the coming weeks, we are going to first have to see an obvious improve in demand.

Bitcoin value overview

As of this writing, the flagship cryptocurrency has recovered over $100,000 and is valued at round $103,700, reflecting a rise of virtually 3% up to now 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView