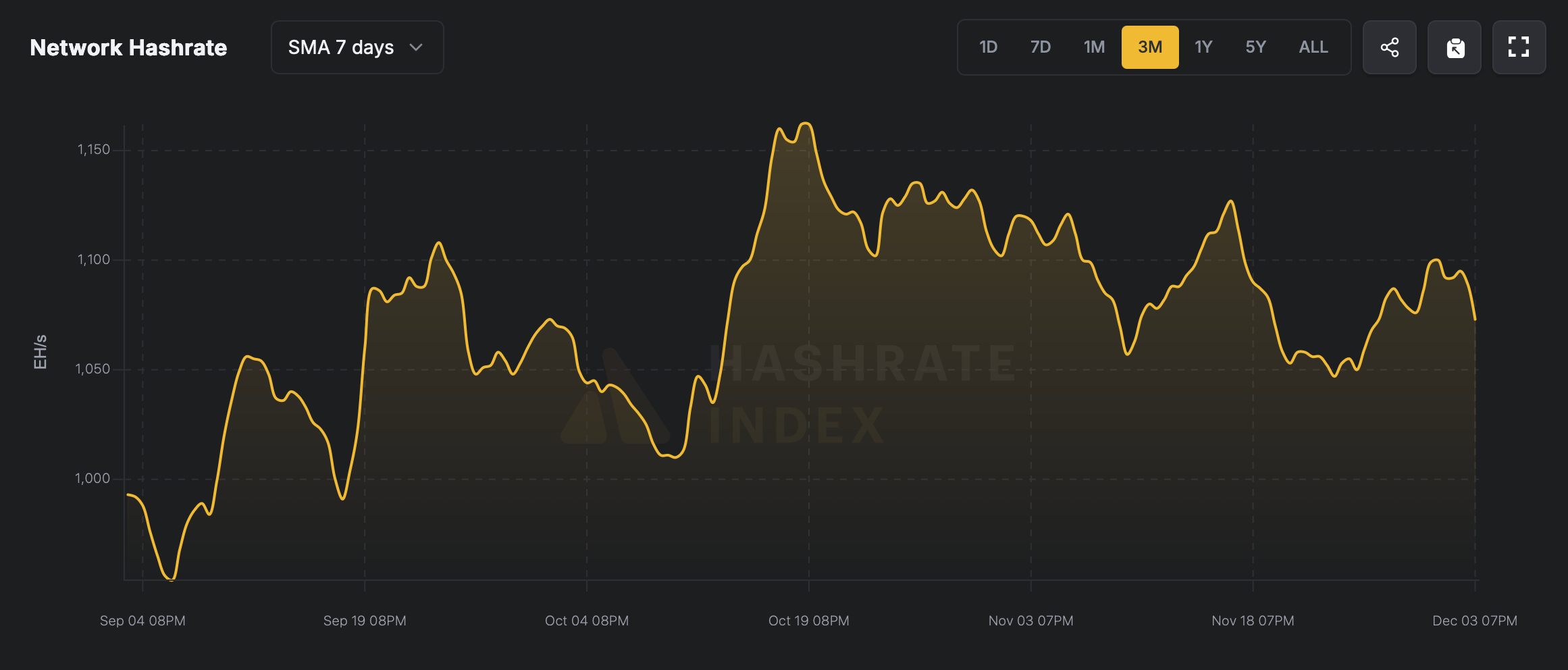

Bitcoin miners are lastly taking a breather as hash worth rises from the basement after hitting a extreme low just some days in the past that put operations underneath stress. Regardless of this drop in income, the community’s hashrate has maintained its place, hovering inside a slim band between 1,050 exahashes per second (EH/s) and 1,100 EH/s.

Miners welcome hash worth rebound

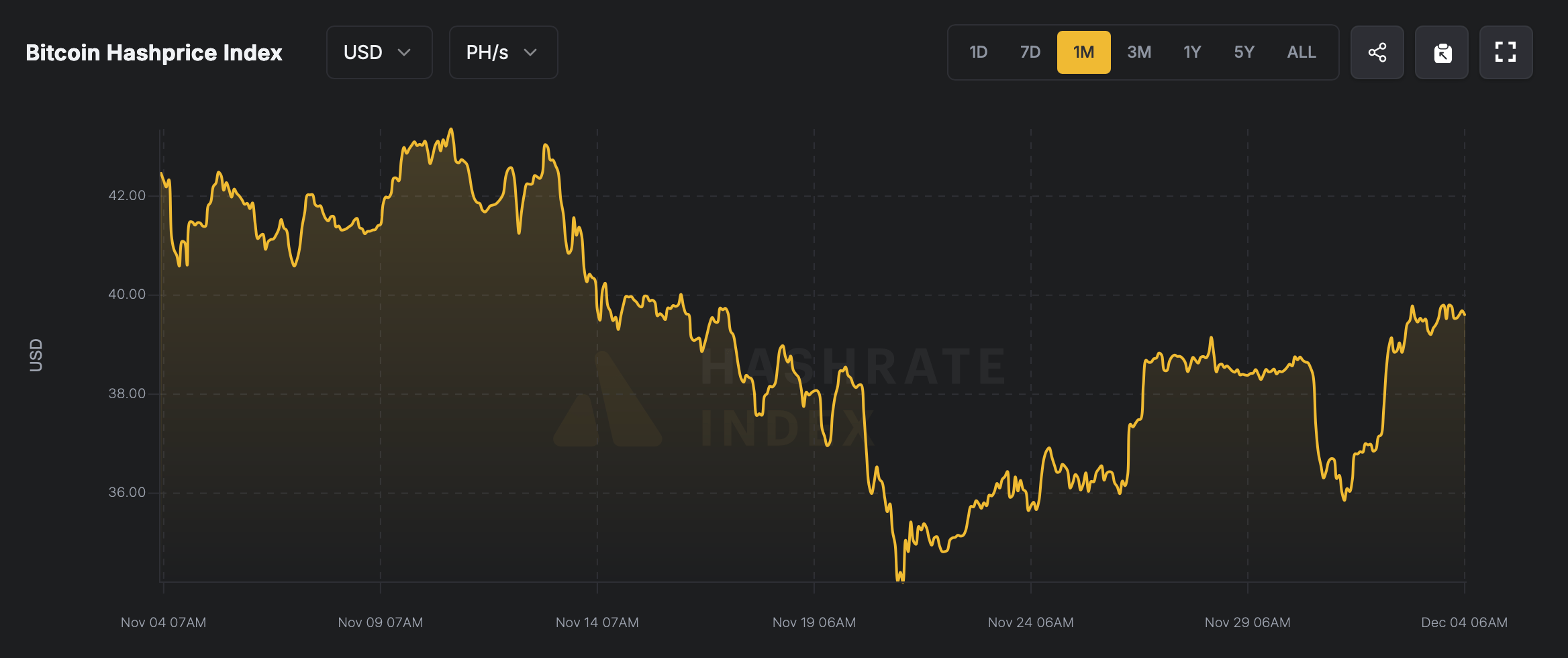

The current rise in Bitcoin costs has given BTC miners a much-needed breath of recent air after weeks of declining revenue. On the final day of November, Hashprice bottomed out at $36.35 per petahash per second (PH/s), in keeping with numbers from hashrateindex.com.

Merely put, hash worth is the sticker worth of 1 petahash of computing energy, which is basically the worth {that a} miner expects for all of its output. Just some days later, on December 1st, the hash worth was nonetheless depressed at $35.85 per petahash. The most recent worth motion over the previous day reversed the situation, with miners pulling in round $39.79 per PH/s because the hash worth inched again in direction of the $40 zone.

Bitcoin hash worth for the final 30 days.

Regardless of the drop in every day returns, Bitcoin’s general hashrate has remained solidly above the 1 ZettaHash/Second (ZH/s) mark for fairly a while, and has by no means fallen beneath that threshold in years. Due to that stability, the block spacing has remained comparatively uneventful, so the anticipated problem changes on December eleventh is probably not a lot of a reduction.

In the mean time, miners nonetheless have about half of the two,016 block problem epoch left, so issues might change, however present estimates point out a modest decline of 1.34%. The block interval was barely behind the goal of 10 minutes, averaging about 10 minutes and eight seconds on Wednesday. If returns enhance, block occasions might speed up as hashrate will increase, and problem epoch estimates might simply change accordingly.

Bitcoin hashrate over the previous 3 months.

At at this time’s hash worth stage, the indicator remains to be 7.98% beneath its stage from 30 days in the past. On prime of that, November ranked because the fourth weakest month for miner income in 2025. Miners can overcome this predicament in quite a lot of methods, and being publicly traded is a large benefit. Corporations outdoors the civilian realm have relied closely on debt financing to construct up their army this 12 months, with many pivoting deeper into synthetic intelligence (AI) and high-performance computing (HPC) companies.

learn extra: Charles Schwab plans to broaden crypto buying and selling within the first half of 2026

AI and HPC have powered many Bitcoin mining operations by injecting further income streams. Lastly, Bitcoin mining tools continues to stage up, with producers pushing the boundaries of application-specific built-in circuit (ASIC) efficiency. As we speak’s machines are able to greater than 0.5 petahash (1,000 terahash per second), and a full 1 PH/s unit is already inside attain.

Total, the sector is tottering on slim revenue margins resulting from a mixture of grit, innovation and borrowed oxygen, however miners are by no means going to face nonetheless. With secure hash costs, diversified income streams, and the horsepower of next-generation ASICs, miners are having fun with some old style luck.

Incessantly requested questions ❓

- What’s Hash Worth?Hash worth measures how a lot income miners earn for every petahash (or TH/s or EH/s) of computational energy.

- Why has miner income decreased lately?Revenues have cooled as Bitcoin costs have weakened and hash costs have fallen to their lowest ranges this 12 months.

- How do miners survive?Many miners have turned to debt financing, AI companies, and high-performance computing (HPC) to extend their incomes.

- Are mining machines changing into extra environment friendly?Sure, producers have been rolling out extra highly effective ASIC rigs all 12 months lengthy, with half-petahash models now widespread, and 1 PH/s fashions additionally on the way in which.