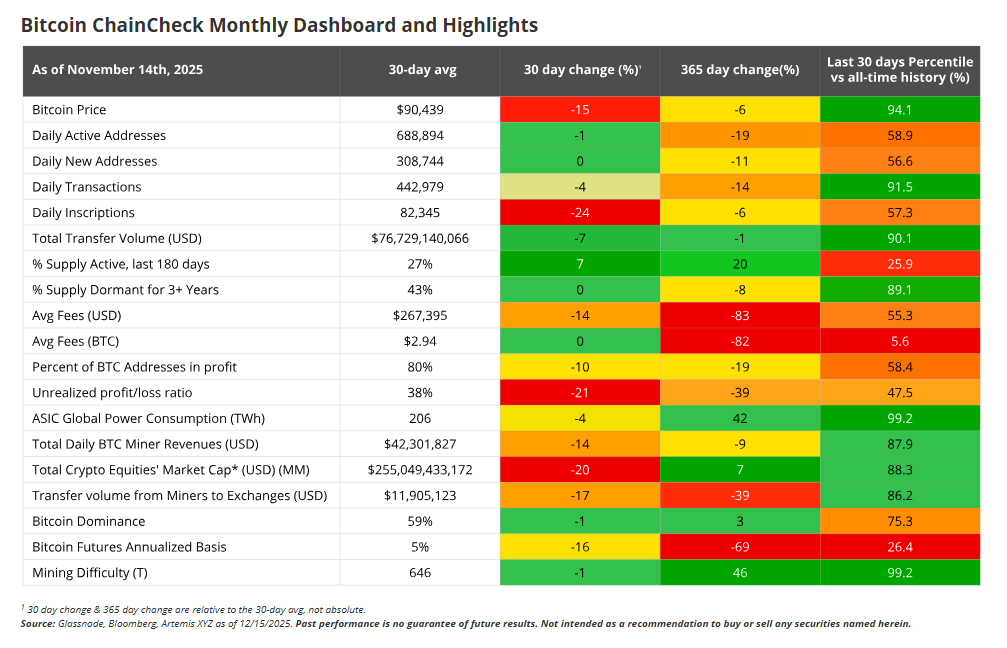

Based on VanEck analysts, Bitcoin’s hashrate fell by 4% within the month ending December fifteenth. This transfer caught the eye of market watchers, as hashrate declines up to now have usually preceded worth will increase.

VanEck’s Matt Siegel and Patrick Busch level to a historic sample by which Bitcoin’s 90-day ahead return was constructive 65% of the time when the hashrate fell over the previous 30 days, in comparison with 54% when the hashrate rose. Numbers are necessary right here, and merchants deal with them as a part of the proof combine.

Hashrate compression can inform restoration

Studies have revealed {that a} longer time horizon seems to be advantageous for the bulls. When the hashrate shrunk and remained at a low degree, the possibilities of restoration improved extra broadly. Following 90 days of destructive hashrate progress, Bitcoin’s 180-day return was constructive 77% of the time, with a mean return of 72%.

Supply: VanEck

The calculations are clear and the sample is constant sufficient to get buyers’ consideration. The financial scenario of the miners additionally provides to this story. The breakeven electrical energy worth for the 2022 Bitmain S19 XP has fallen practically 36% from $0.12/kWh in December 2024 to $0.077/kWh by mid-December. This variation will squeeze margins and drive stretched operators to rethink their rigs.

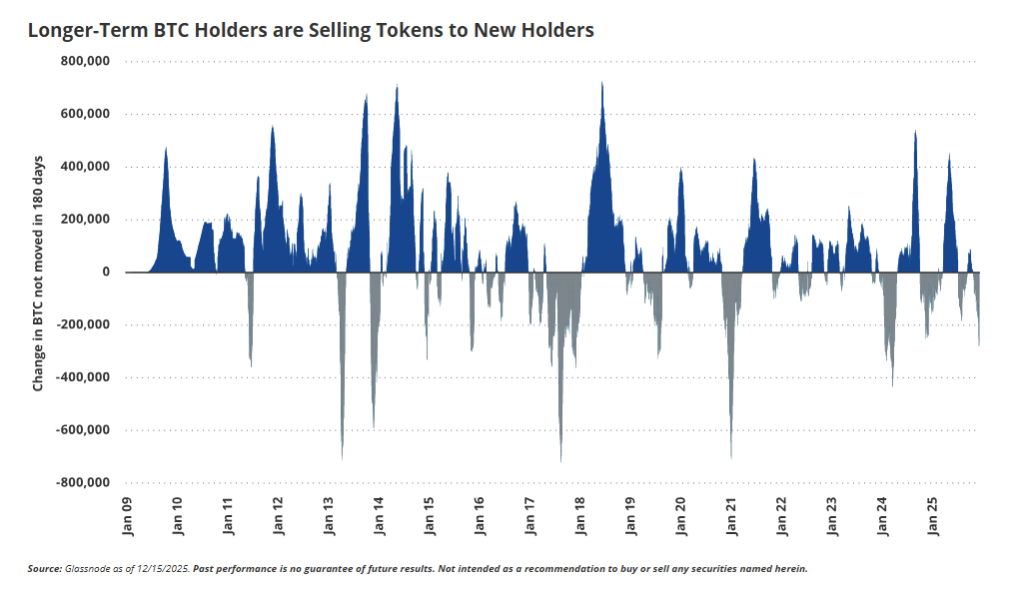

Miner withdrawal, market surveillance

Some capability has left the community. VanEck hyperlinks the current 4% decline to the shutdown of about 1.3 gigawatts of mine energy manufacturing in China. Analysts additionally warn that rising demand for AI computing might take capability away from Bitcoin, a development that might wipe out 10% of the community’s hashrate.

This might redistribute mining actions and focus operations the place energy and coverage align. On the similar time, help for mining has not disappeared around the globe. Based on reviews, as much as 13 international locations are supporting mining operations, together with Russia, Japan, France, El Salvador, Bhutan, Iran, UAE, Oman, Ethiopia, Argentina and Kenya.

Worth and market situations

Bitcoin is buying and selling round $88,600, down practically 30% from its document excessive of $126,080 on October sixth. Markets are quiet in the direction of the top of the yr, and skinny liquidity might masks actual momentum.

Supply: VanEck

BTC was noticed to be steady close to $89,000 in current reviews, however it remained vary sure as merchants weighed provide and demand indicators. Actions amongst different property are additionally necessary. Gold rose above $4,400 an oz and silver hit $69.44 an oz, strikes some buyers see as a part of a broader safe-haven bid.

The info factors recommend cautious optimism. Miner capitulation has traditionally served as a contrarian sign. Weak miners will exit, issue might be adjusted, and surviving operators will face much less short-term promoting stress. This sequence stabilizes the value and units the stage for months of earnings.

Featured picture from Pixabay, chart from TradingView