Bitcoin costs took a giant hit this week, with mining revenues falling together with it as the worth per petahash fell even deeper than the April hunch. Miners are feeling the squeeze from a troublesome pricing atmosphere and skinny on-chain charges related to newly found block rewards.

Bitcoin mining calculations develop into merciless resulting from payment depletion and hash value crater

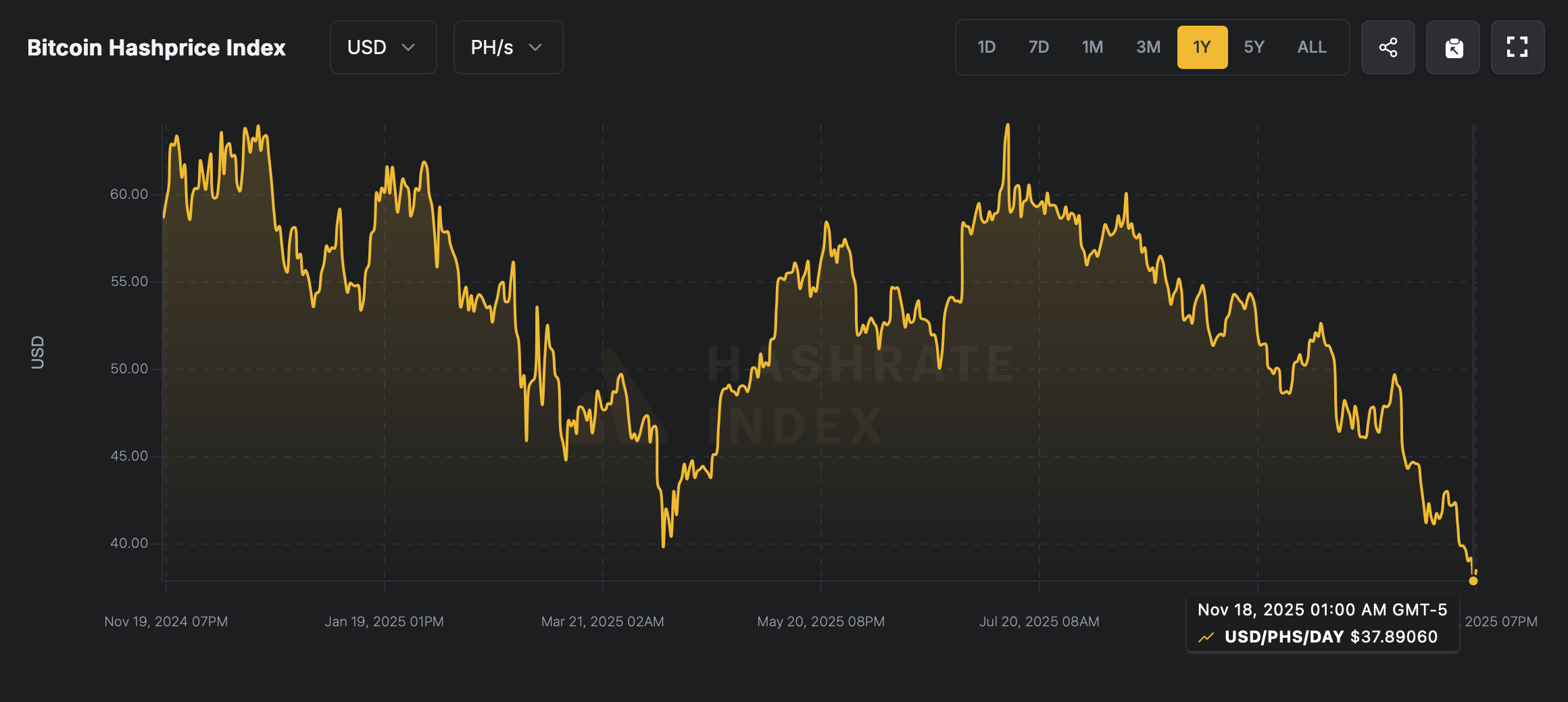

Bitcoin’s hash value (the anticipated worth of hash energy in petahash per second (PH/s) per day) has fallen to an all-time low since Luxor Metropolis started monitoring the index in December 2016.

A lot of that income decline could be traced again to the 2020 and 2024 halvings, which had been compounded by the dramatic decline in on-chain charges of their aftermath. At the moment, when a miner lands a block, solely about 0.73% is paid out from transaction charges, and the remainder is tied to a subsidy of three.125 BTC.

Supply: Luxor hashrateindex.com.

Bitcoin closed at $79,874 on April 7, 2025, and the hash value (worth of 1 petahash) remained at $39.83. Quick ahead to November 19, 2025, and the worth of Bitcoin is $91,172, a rise of $11,298 per coin, however a decrease estimate of $38.14 per PH/s.

Yesterday, the hash value fell additional to $37.48 per PH/s. At charges like these, until one thing is launched, Bitcoin miners will discover themselves in an financial mess from which there isn’t any straightforward manner out. Because it seems, the numbers paint a really easy image. The miners can not proceed down this path until one thing provides manner.

Both the worth of Bitcoin must rise sufficient to compensate for the decline in income, or on-chain exercise must warmth up considerably to offer extra significant charges. If neither occurs, the present squeeze is not going to final lengthy and miners can be pressured to rethink their operations, whether or not meaning upgrading their fleets, shifting extra rapidly to synthetic intelligence (AI), consolidating, or pursuing different income streams.

Incessantly requested questions ❓

- What’s Bitcoin hash value? That is the estimated each day worth of 1 PH/s of mining energy primarily based on value, problem, and costs.

- Why is mining income reducing? Hashprice has fallen to file lows as on-chain charges shrink and subsidies make up the vast majority of funds.

- How will miners be affected? Regardless of the rise in Bitcoin costs, many firms are dealing with shrinking margins because the income per petahash decreases.

- What might change the outlook? Elevated charges, vital value will increase, and operational adjustments reminiscent of AI integration might ease the strain.