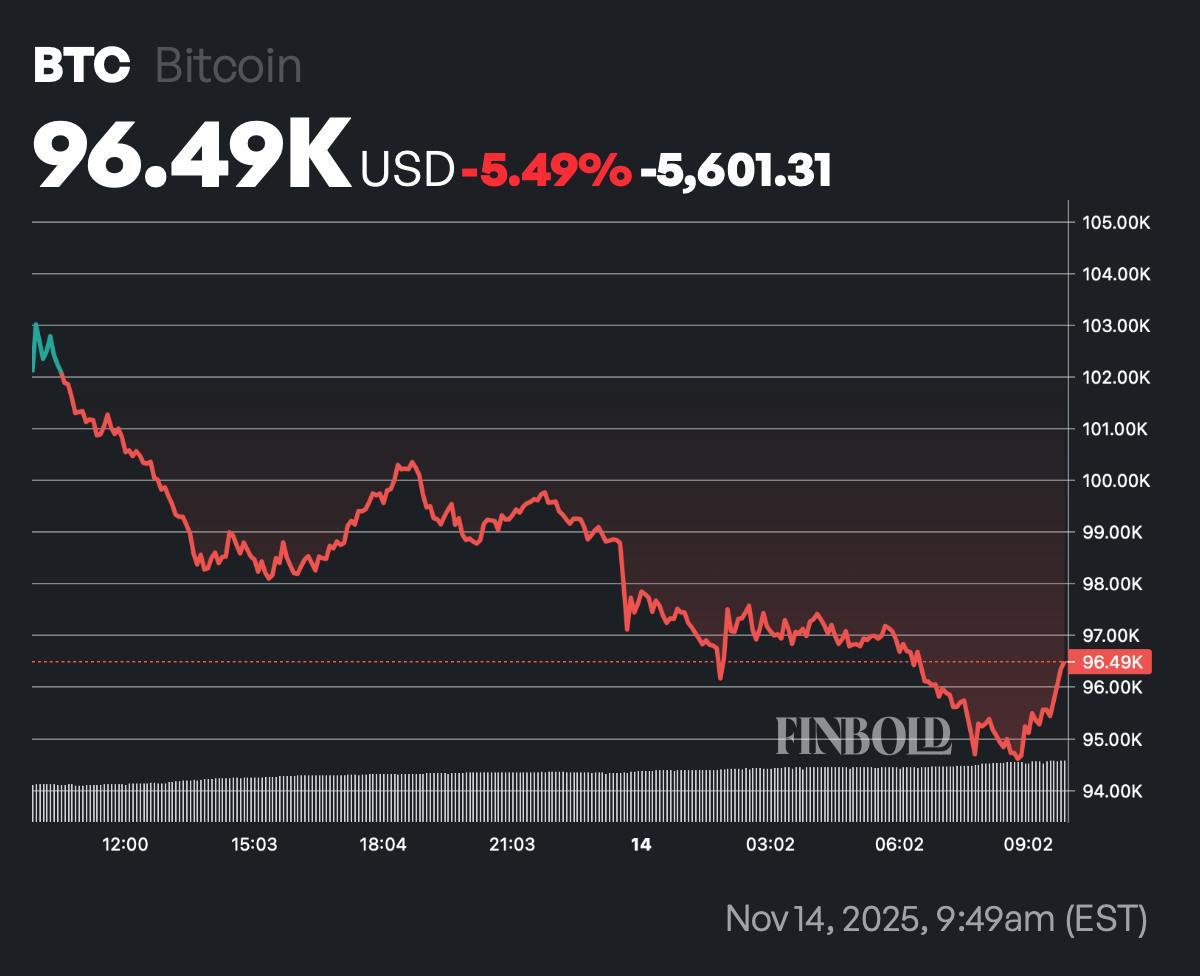

Bitcoin (BTC) fell 5.49% over the previous 24 hours, dropping to $95,383 earlier than trying to stabilize above $96,000.

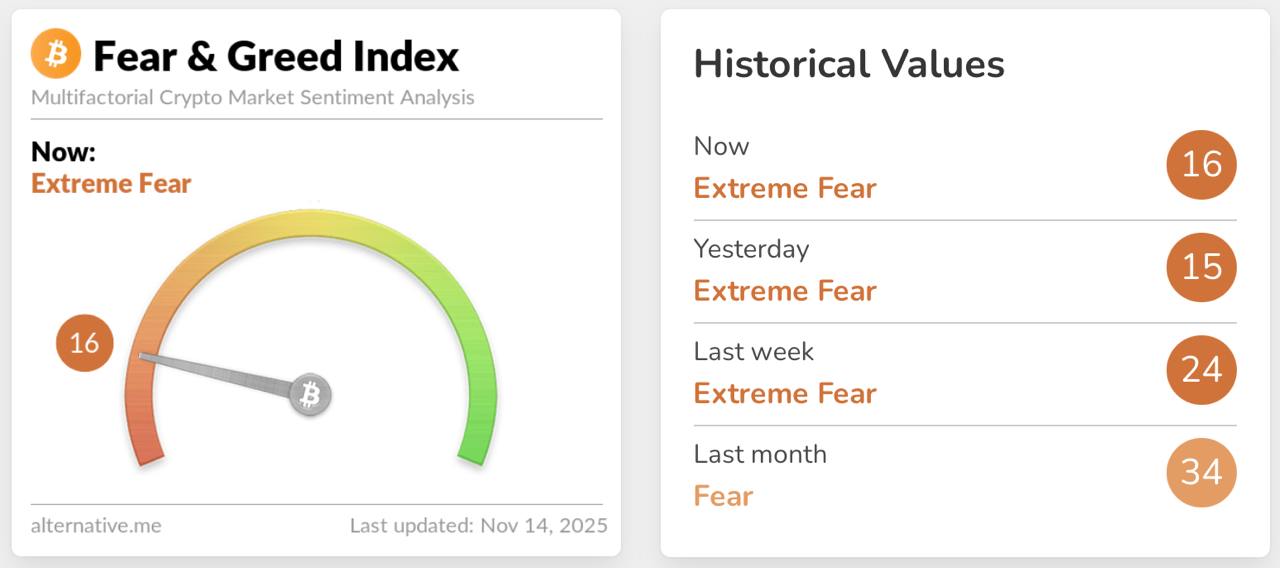

The selloff hit sentiment onerous. Bitcoin’s Worry and Greed Index fell to fifteen on November thirteenth and rose to 16 on November 14th, firmly in excessive worry territory.

The sell-off intensified after the Federal Reserve dominated out a December rate of interest reduce, a call that spooked danger belongings throughout world markets. Bitcoin’s decline coincided with a 2% decline within the Nasdaq, reflecting the asset’s continued sensitivity to macro catalysts. Each TradFi and cryptocurrencies confronted simultaneous outflows as US Treasury yields rose and liquidity tightened.

The macro context explains a lot of the strain. Rising rates of interest diminished turnover in speculative belongings, and the bond market response triggered widespread danger aversion throughout equities, tech and digital belongings. Bitcoin stayed roughly in keeping with main U.S. indexes throughout buying and selling on Thursday, highlighting how rapidly sentiment modified after the Federal Reserve took a extra restrictive stance.

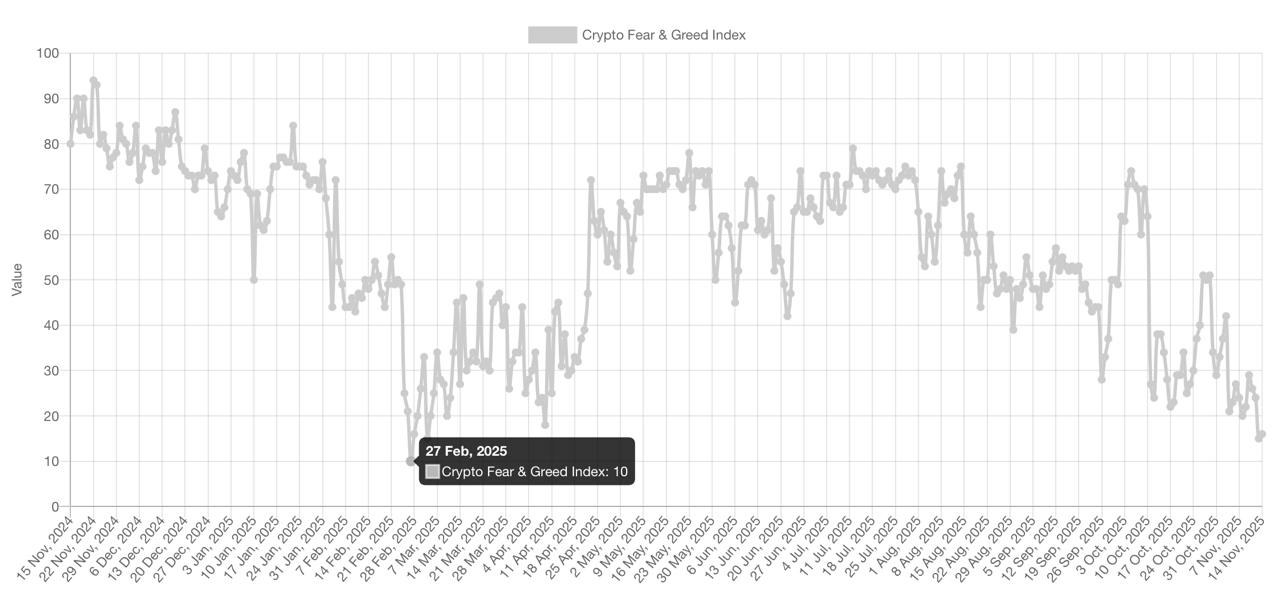

Historical past of Bitcoin Worry and Greed Index

Historic sentiment information confirms the severity of the decline. The index hovered round 34, the usual “worry” studying, final month, fell to 24 final week, and eventually fell into the mid-teens this week. The final time the index reached an analogous low was on February 27, 2025, when the index reached 10, following weeks of great declines.

Regardless of the pullback, Bitcoin is now approaching the zone that has historically attracted long-term consumers. In previous cycles, excessive worry readings have typically coincided with native bottoms, particularly when macro-driven promoting outpaces crypto-native fundamentals. However with rising Treasury yields and strain on tech shares, the market might have a clearer sign from the Fed earlier than it regains confidence.