Bitcoin’s sharp correction from $110,000 to round $80,000 is said to heavy promoting by early whales with a price base close to $16,000. CryptoQuant CEO Ki Younger Ju famous that on-chain indicators point out that Bitcoin is presently within the “shoulder” part of the cycle, suggesting restricted upside potential within the quick time period.

This sell-off has overwhelmed institutional demand from ETFs and MicroStrategy, shaping the outlook for cryptocurrencies in 2025. In an interview with Upbit’s Upbitcare, Ju mentioned: > Early Bitcoin whales gasoline promoting strain

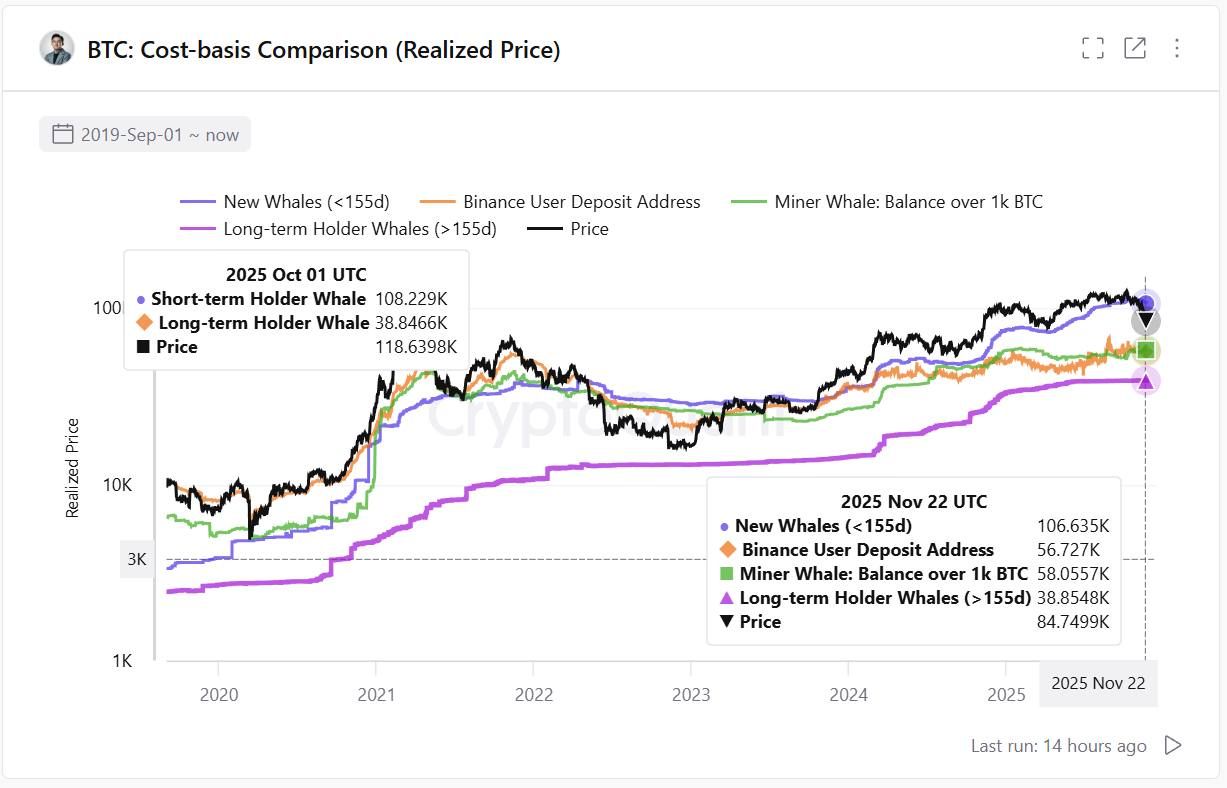

Ki Younger Ju explains that at the moment’s market is formed by competitors between two main teams of whales. Legacy whales holding almost $16,000 value of Bitcoin on a mean value foundation are promoting at charges value a whole bunch of tens of millions of {dollars} every day, and are beginning to notice big earnings. This persistent promoting is exerting sturdy downward strain on the Bitcoin value.

On the identical time, institutional traders by the Bitcoin Spot ETF and MicroStrategy are accumulating vital positions. Nonetheless, their buying energy doesn’t match the size of the preliminary whale gross sales. In response to Ju, the common value base for wallets holding 10,000 BTC or extra for greater than 155 days is often round $38,000. Binance merchants entered positions value round $50,000, so many market contributors have made earnings and may promote if they need.

Value-based comparability throughout completely different Bitcoin holder classes. Supply: CryptoQuant

The CryptoQuant CEO famous that inflows into spot ETFs and MicroStrategy had been driving the market greater in early 2025, however these inflows are actually declining. Outflows are beginning to dominate the market. For instance, the Bitcoin ETF recorded internet inflows of $42.8 million on November 26, 2025, bringing cumulative inflows to $62.68 billion, based on information from Pharcyde Traders. Regardless of these numbers, sustained promoting from early whales outweighs institutional accumulation.

Market cycle evaluation suggests restricted upside

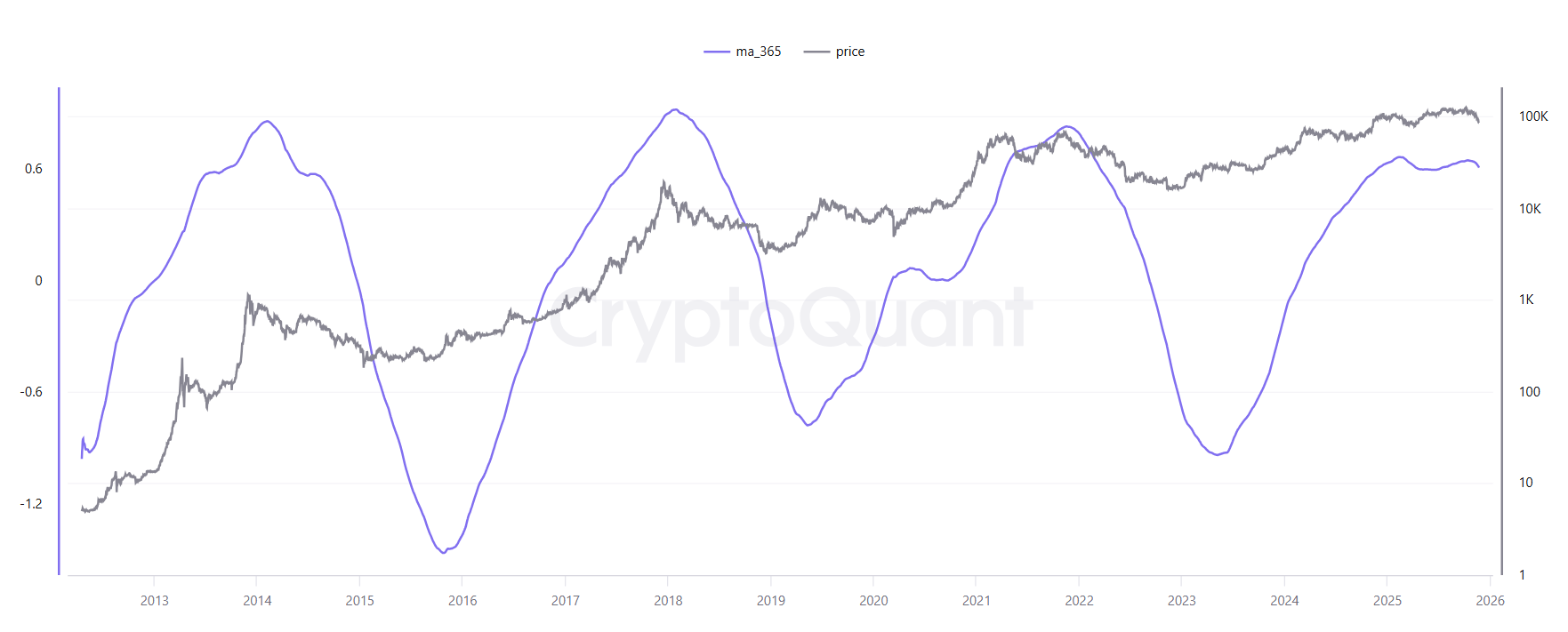

On-chain P&L metrics present vital perception into market cycles. Ju’s evaluation utilizing a P&L index utilizing a 365-day transferring common reveals that the market has entered a “shoulder” stage. This late-cycle situation signifies subdued development potential and elevated threat of correction.

The valuation multiplier displays a impartial to flat outlook. In earlier cycles, every new greenback amplified market cap development. Now, that synergy has light. This means that market leverage is inefficient and its construction doesn’t assist vital beneficial properties.

A revenue and loss index that exhibits Bitcoin’s present cycle place. Supply: CryptoQuant

Ju would not anticipate a dramatic 70-80% drop. Nonetheless, he believes a correction of as much as 30% is cheap. A drop from $100,000 may imply Bitcoin falls to round $70,000. He makes use of information from OKX futures lengthy/quick ratios, forex leverage ratios, and purchase/promote move patterns to assist this view.

Ju highlighted the significance of goal=”_blank” rel=”noopener”>current posts and urged merchants to make use of indicators for conviction quite than hypothesis. His focus continues to be on the interpretation of on-chain information, alternate exercise, and market construction.

By no means commerce with out information. pic.twitter.com/JnAtLwpdGa

— Younger Judgment_ November 27, 2025

This complete evaluation gives a grounded evaluation primarily based on on-chain proof. As early Bitcoin whales proceed to promote at a revenue, monetary establishments are going through robust occasions. Excessive leverage ratios, impartial valuation multipliers, and late-cycle stance restrict the market’s potential for vital upside within the close to time period.