Bitcoin BTC$91,453.60 For the primary time in about two years, the community worth quickly fell beneath the community worth primarily based on Metcalf worth modeling, mentioned community economist Timothy Peterson.

This often indicators a late stage of market reset, he mentioned.

“This does not essentially point out a backside, however it does point out that a lot of the leverage has been eliminated and the ‘bubble’ has deflated,” Peterson mentioned.

Metcalfe Worth makes use of exercise and person base progress to estimate the basic worth of a community and has traditionally supplied helpful context throughout main cycle transitions.

The drop beneath community worth coincided with Bitcoin’s steepest decline this cycle, dropping by about 36% and pushing its value to about $80,000. This transfer depleted leverage, eradicated extra hypothesis, and set the stage for a pointy rebound. Bitcoin then rebounded above $90,000 as patrons intervened and community situations stabilized.

Throughout the 2022 bear market, Bitcoin traded beneath the Metcalf value all through the interval, whereas exercise and sentiment weakened. Because the begin of the brand new cycle in early 2023, costs have constantly outperformed this benchmark, supported by elevated participation and new capital inflows. This adjustment marks the primary significant break from that pattern.

Traditionally, intervals when Bitcoin has traded beneath its Metcalf worth have resulted in sturdy ahead returns. Below these situations, 12-month efficiency was constructive 96% of the time, with common progress of 132%, in contrast with 75% and 68% in different intervals, Peterson mentioned.

Tailwind for community progress

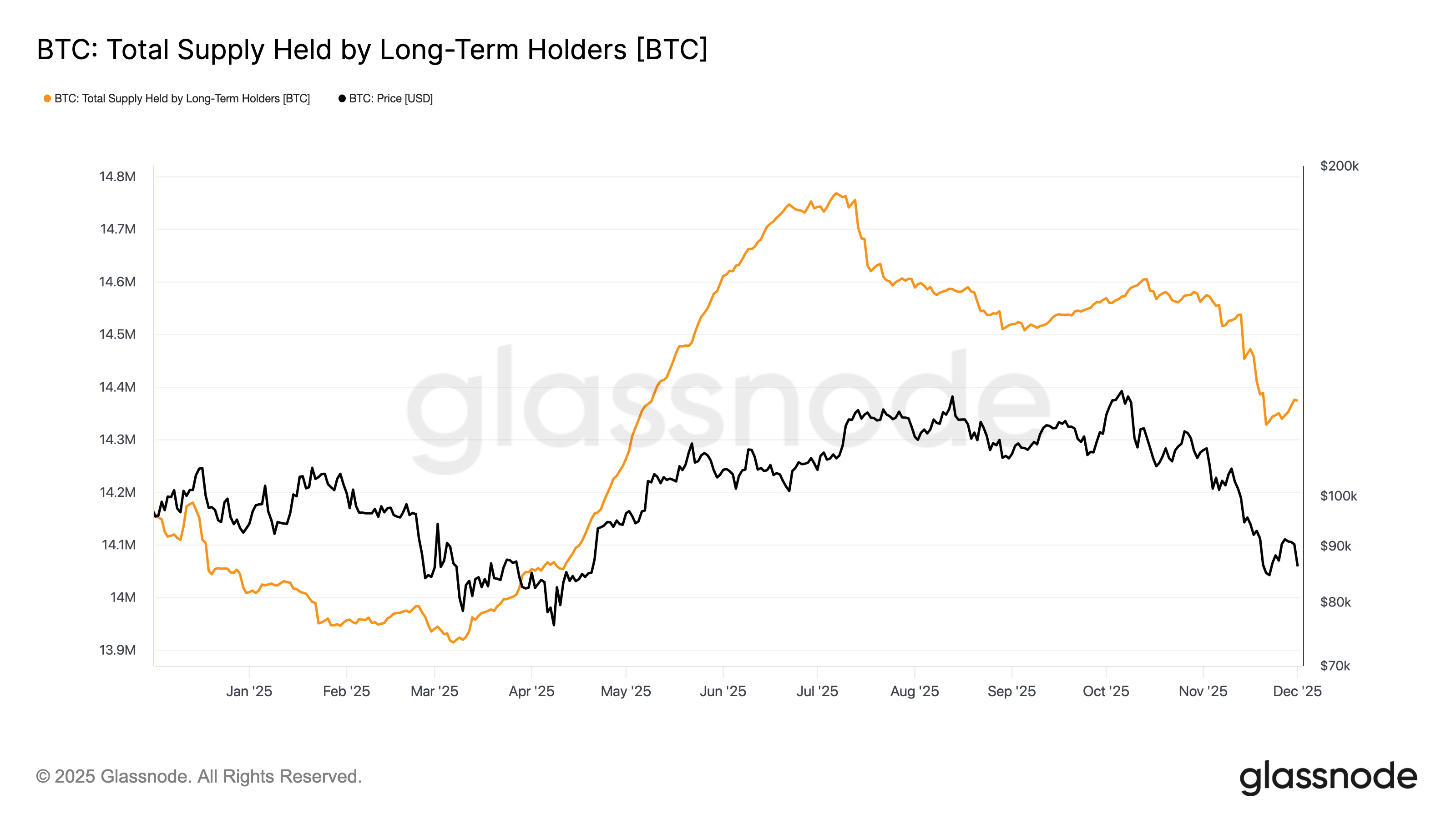

Moreover, the availability of long-term holders (LTH) has elevated considerably over the previous 10 days, rising by roughly 50,000 BTC. LTH is outlined as an investor who has held Bitcoin for at the least 155 days. This cohort has been one of many major sources of promoting strain over the previous 12 months. This discount in sell-side strain ought to present a significant tailwind for Bitcoin value because the coin continues to mature out of short-term hypothesis and into LTH wallets, and as LTH accumulates slightly than circulates throughout the web.