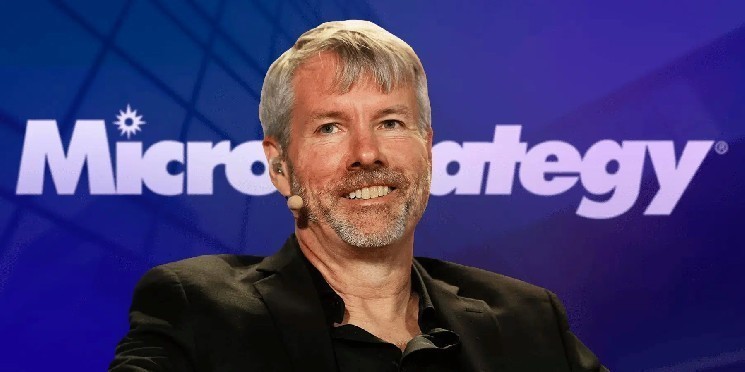

There’s rising speak that Bitcoin-focused firm Technique (previously MicroStrategy) may very well be faraway from MSCI indexes, however firm chairman Michael Saylor insisted that its working mannequin is powerful and that this risk is not going to affect the corporate’s roadmap.

MSCI has proposed eradicating “digital asset treasury firms” whose portfolios are largely comprised of cryptocurrencies from its index. He mentioned such firms “might exhibit traits much like mutual funds,” however that such a construction will not be appropriate for an index. The ultimate choice will likely be introduced on January fifteenth.

In his newest submit, Saylor defined that Technique is an working firm. He identified that along with its Bitcoin reserves, it additionally has a $500 million enterprise software program division that has been serving companies and public establishments for greater than 20 years.

“Whereas we perceive that index suppliers often overview their methodology, Technique will not be an ETF, neither is it a closed-end fund, and positively not a passive agent for Bitcoin. We produce, function, and develop like every other enterprise,” Saylor mentioned. He added that inclusion or removing from the index doesn’t change the corporate’s technique, operations, or long-term beliefs in BTC.

JPMorgan issued a be aware this week warning that the technique’s removing from the index might lead to billions of {dollars} in detrimental outflows. Analysts estimate that the potential exclusion from MSCI might lead to $2.8 billion in outflows from passive funds. Total, roughly $9 billion of Technique’s market capitalization is estimated to be associated to passive index-tracking ETFs and mutual funds.

The plummeting worth of Bitcoin can be placing stress on Technique shares, which have misplaced practically 40% of their worth this 12 months.

*This isn’t funding recommendation.