Bitcoin’s current rally above $110,000 is dealing with headwinds. Key on-chain metrics reveal that capital inflows are beginning to gradual, casting doubt on the near-term sustainability of the rally.

Bitcoin is at present buying and selling round $111,200, perched precariously inside key worth ranges that analysts acknowledge as essential in figuring out the subsequent large transfer. The sideways investor momentum highlighted by CryptoQuant information means that the underlying bid worth could also be weakening and will doubtlessly be prepared to check the decrease certain of help.

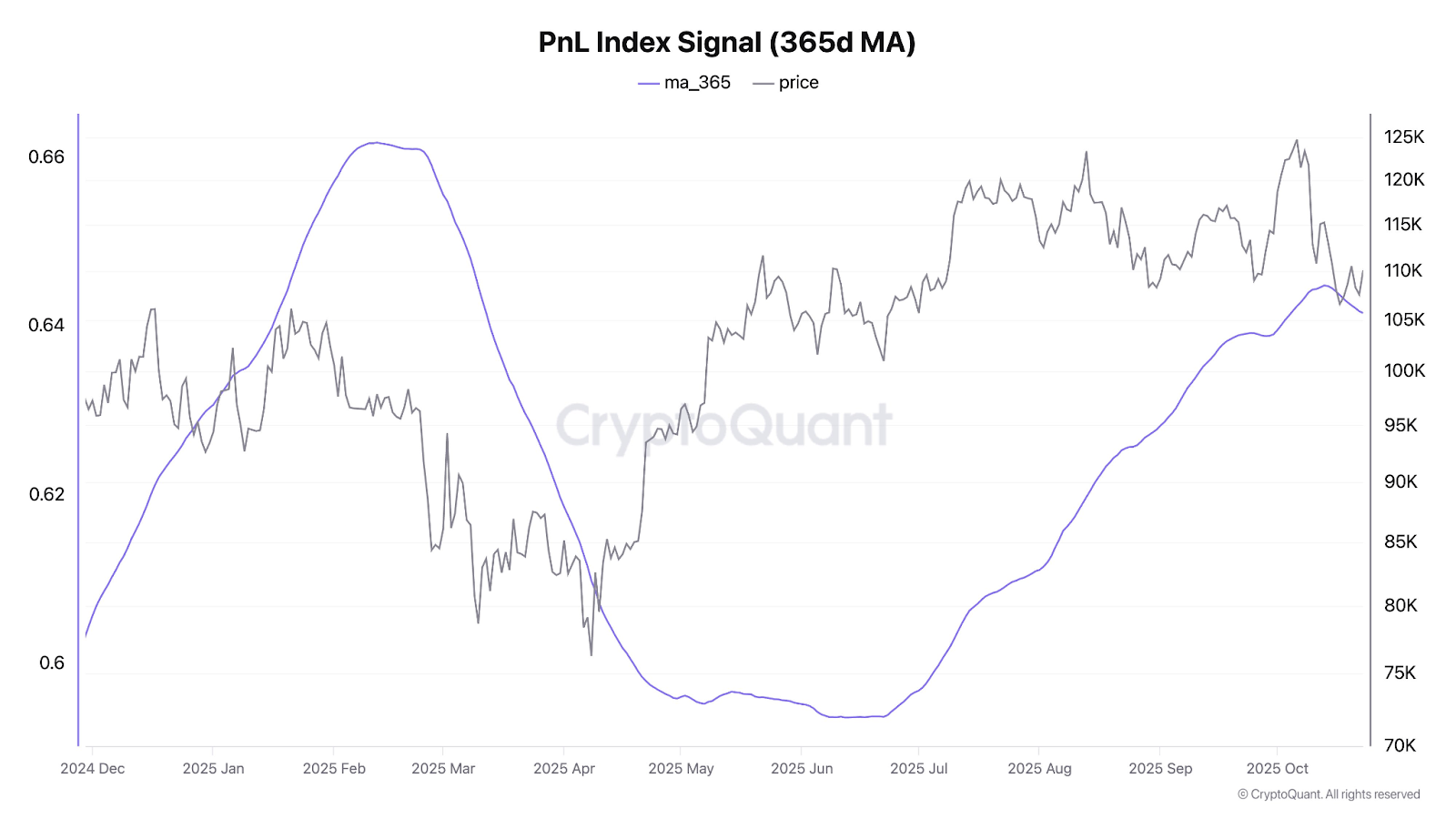

On-chain sign: CryptoQuant P&L index exhibits flattening of Bitcoin inflows

Consider market momentum like water stress. If there’s a considerable amount of inflows, costs will rise, but when the stress subsides, it is going to be troublesome to take care of present ranges. CryptoQuant CEO Ki Younger Ju factors out this very state of affairs that’s at present unfolding. He highlights the Bitcoin Revenue and Loss Index, a metric that tracks total profitability and momentum for traders, which began to plateau in October after recovering in the beginning of the 12 months.

Bitcoin capital inflows are slowing down once more. pic.twitter.com/UBreC1bAwR

October twenty fourth

This flattening, visualized within the 365-day transferring common, is just not essentially an indication of a crash, however it’s a vital warning. This implies that the wave of recent cash chasing Bitcoin’s rise has waned.

Supply: Ki Younger Joo of X

After robust development in late 2024 and early 2025, there was a pointy decline in Might and a restoration in mid-year, however this new stagnation means that traders’ urge for food for funding could attain a plateau within the quick time period. If new inflows do not increase demand, the market is more likely to fall.

Associated: Bitcoin worth prediction: BlackRock provides $73 million to holdings

Swissblock defines $109,000 to $114,000 as BTC’s “cost-based battleground”

Analytics agency Swissbloc described Bitcoin’s present worth vary of $109,000 to $114,000 as a “cost-based battleground” for many holders. Sustaining at this degree might sign the beginning of a reaccumulation section, whereas falling under this degree might set off a broader decline.

Bitcoin’s battleground is ready between $109,000 and $114,000, which is the cost-based zone for many holders.

This vary defines the fragile market stability.

Maintain the above → Re-accumulation section

Loss → Draw back threat once moreThis can be a positive line between restoration and give up. pic.twitter.com/zFjz1IuPzS

— Swiss Block (@swissblock__) October 23, 2025

Glassnode information additionally exhibits concentrated promoting in the identical vary, indicating merchants are hedging for power somewhat than including publicity.

Supply: Glassnode

Customary Chartered repeats dip name under $100,000 earlier than subsequent rally

In the meantime, Customary Chartered’s Jeffrey Kendrick warned that Bitcoin might briefly fall under $100,000 earlier than recovering, noting that the current pullback from October’s $126,000 excessive is a wholesome correction inside a long-term uptrend.

In keeping with TheBlock, Kendrick mentioned that such a pointy selloff might current a “purchase on the purchase” alternative, and that this might be the final time Bitcoin trades under six digits.

BTC Worth Evaluation: Holding $104,000 Assist Will Be Necessary

Wanting on the each day chart, Bitcoin’s present consolidation round $111,000 displays this uncertainty. Costs stay trapped inside the descending channel established for the reason that rejection from $126,000 in mid-September.

Quick resistance is close to $113,500. A decisive breakout above this degree and subsequent breakout of the channel border close to $125,000 (which additionally coincides with the resistance above the Bollinger Band) is required to override the bearish warning and goal the all-time excessive close to $130,000.

On the draw back, a key help zone is situated round $104,000. This degree represents the decrease trendline of a descending channel and roughly coincides with the 100-day transferring common. A break under $104,000 would considerably enhance the possibilities of Kendrick’s sub-$100,000 forecast being met, doubtlessly focusing on the $96,000 space as a retest of the earlier accumulation zone.

Present momentum indicators present little direct course. The RSI is hovering round 47 (impartial) and the MACD stays barely unfavorable however has flattened, suggesting stabilization. The stability of energy (BoP) displays a wait-and-see angle on account of slowing capital inflows, confirming that purchasing stress is at present restricted.

Associated: Why did BTC, ETH, XRP, ADA fall in October and might they get well earlier than Halloween?

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.