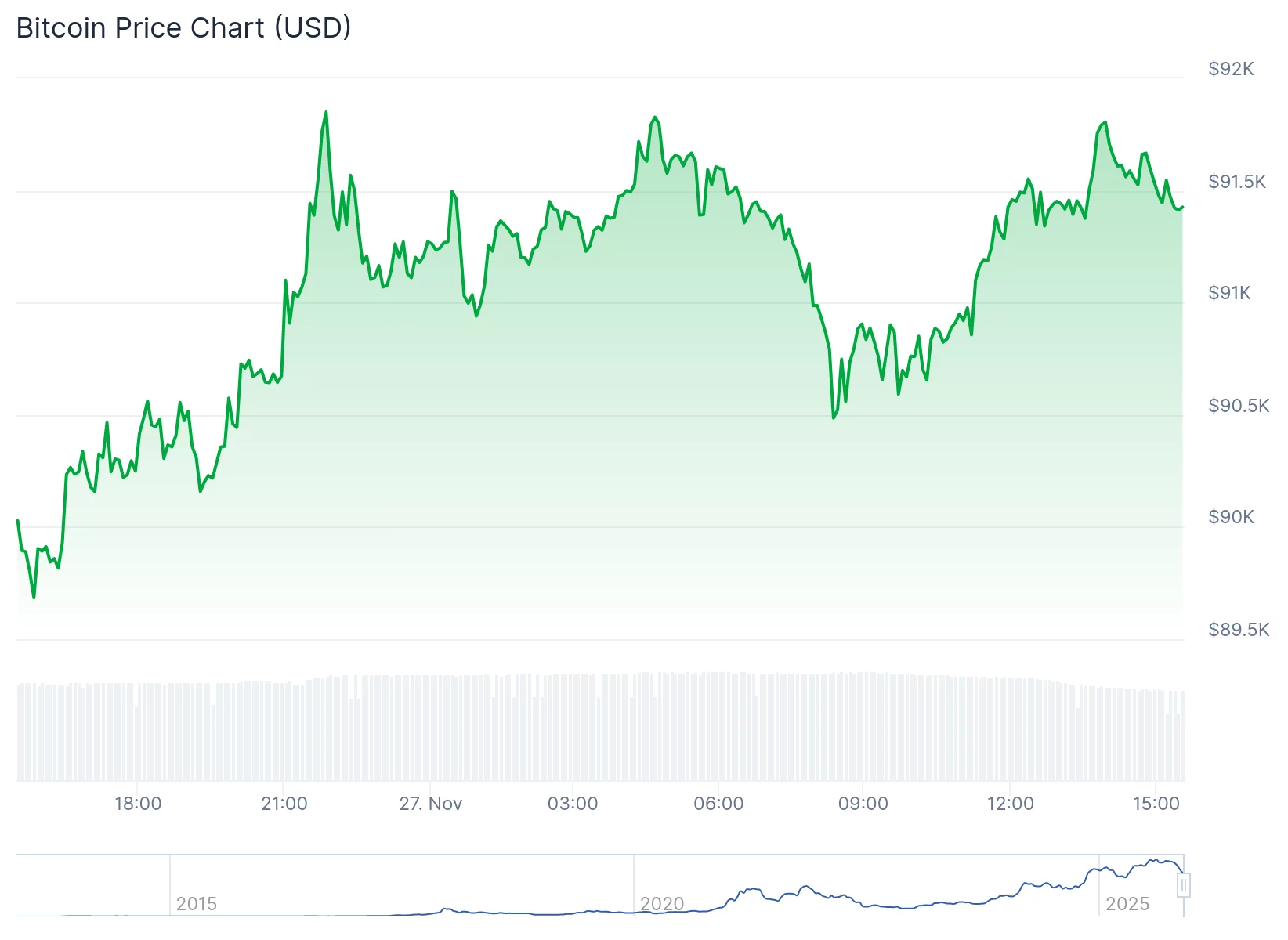

Bitcoin has recovered above a significant resistance stage after days of promoting stress, based on market knowledge, however institutional promoting by US-based traders continues.

abstract

- After a number of days of promoting stress, Bitcoin has rebounded above a key resistance stage.

- The Coinbase Premium Index stays unfavorable, indicating that US institutional traders are promoting extra aggressively than particular person merchants.

- Continued outflows from Bitcoin Spot ETFs have been recognized as a key issue behind the sustained promoting by institutional traders.

The Coinbase Premium Index, which compares Bitcoin (BTC) costs on Coinbase and Binance, stays in unfavorable territory, based on analyst Dirkforst. This indicator exhibits that institutional and US-based traders are extra energetic in promoting than retail merchants, as Coinbase primarily serves US institutional {and professional} traders, whereas Binance is broadly utilized by particular person members.

The continued sell-side stress is pushed partially by continued outflows of spot ETFs.

Darkhost stories that institutional promoting stress has eased since November 21, when the Coinbase Premium Index confirmed a pointy decline into unfavorable territory. Throughout this era, skilled traders had been extra aggressive than retail traders in offloading Bitcoin, which contributed to the market’s decline in direction of current lows.

The Coinbase Premium Index stays unfavorable, however the unfavorable depth has eased in current days. Analysts famous that though this indicator isn’t but constructive, developments point out enchancment.

Short-term reduction or lasting restoration?

Bitcoin has rebounded from the 200-day transferring common on the 3-day chart, a stage that has traditionally served as key help throughout corrections. The rebound pushed the cryptocurrency again towards close by resistance areas.

Bitcoin is at the moment buying and selling under each its 50-day and 100-day transferring averages, however it has turned decrease, indicating weak spot within the short-term development. Quantity through the decline exceeded quantity through the rebound, suggesting that sellers had been extra energetic than consumers.

Cryptocurrencies have skilled a big correction from their all-time highs in October. Market members proceed to observe whether or not current worth actions point out a short lived financial restoration or the start of a sustained restoration.