Binance, the biggest cryptocurrency change by buying and selling quantity, has introduced the delisting of three altcoins. These embody Flamingo (FLM), Kadena (KDA), and Perpetual Protocol (PERP).

The choice precipitated value fluctuations for all three tokens, however FLM soared by double digits on the information, ignoring the standard delisting decline.

Binance delisting particulars and schedule

In accordance with Binance’s official announcement, spot buying and selling on FLM, KDA, and PERP will finish on November 12, 2025 at 03:00 UTC. Deposits made after November 13, 2025 03:00 UTC is not going to be credited. Lastly, withdrawals will not be potential after January 12, 2026.

“Spot buying and selling pairs of the aforementioned tokens might be eliminated. All buying and selling orders might be robotically eliminated after buying and selling on the respective buying and selling pairs is accomplished,” Binance stated.

Moreover, a number of Binance companies can even be affected by the delisting. Spot copy buying and selling for these altcoins will finish on November fifth.

In the meantime, margin transactions will finish on November 4th, and borrowing might be suspended from October thirtieth. Mining pool companies might be suspended on November 4th. Moreover, the converter service will not be obtainable after November sixth.

Futures contracts linked to FLM, KDA, and PERP stay obtainable. Nonetheless, Binance stated these could also be topic to further danger administration measures.

The choice follows the change’s common assessment course of, which evaluates listed belongings towards a number of standards. This contains group dedication, improvement exercise, buying and selling volumes, liquidity, community safety, transparency, and regulatory developments. This strategy permits Binance to stick to itemizing requirements whereas responding to altering market circumstances.

“At Binance, we commonly assessment every digital asset we checklist to make sure that it meets high-level requirements and business necessities. If a coin or token not meets these requirements or business circumstances change, we’ll conduct a extra detailed assessment and, in some circumstances, delist it. Our precedence is to make sure the most effective service and safety for our customers whereas persevering with to adapt to evolving market dynamics,” the change added.

Altcoins react to Binance’s newest delisting

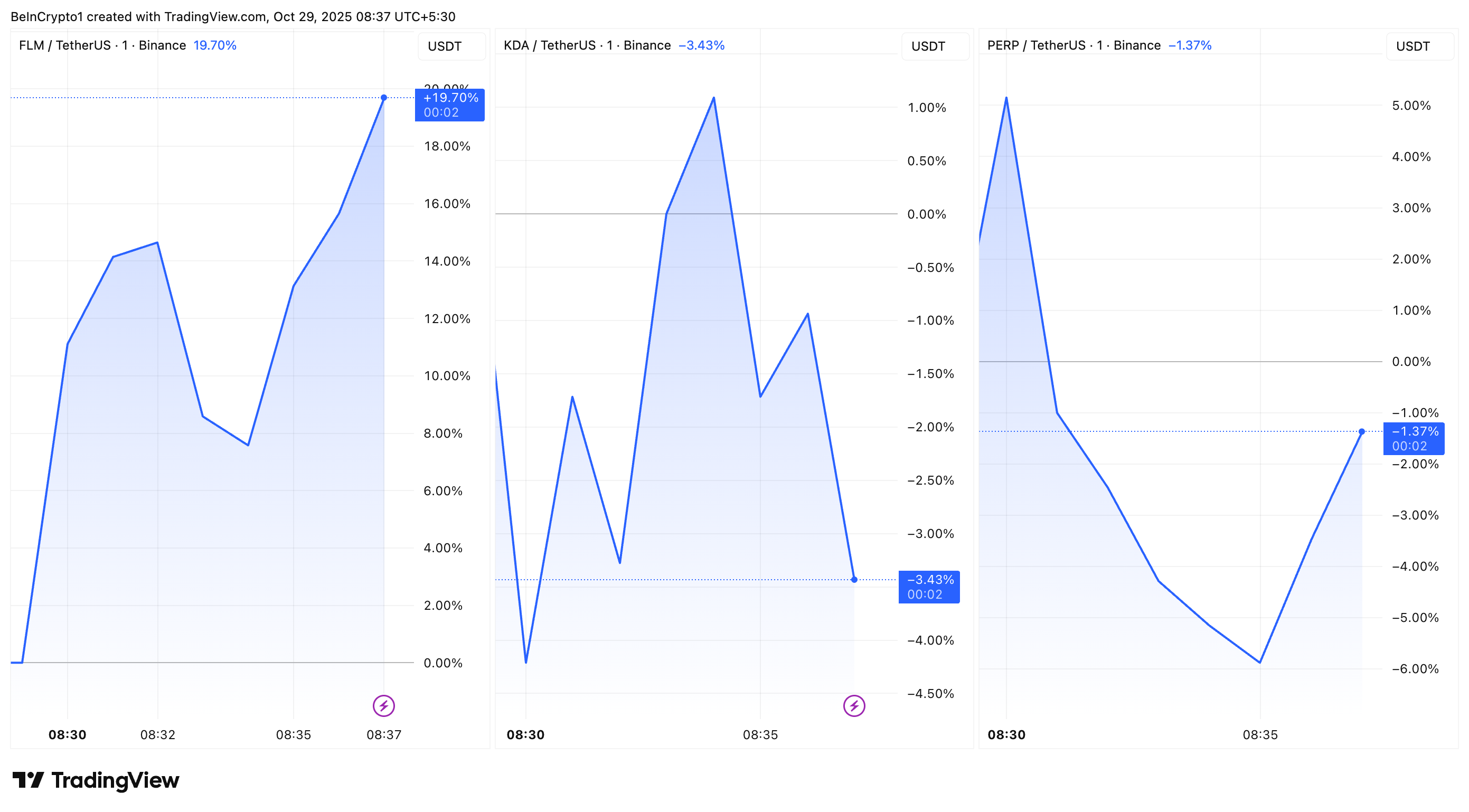

Market response to the delisting announcement was combined. KDA, which was already going through market headwinds because of Kadena Group’s exit, plunged 3.43%, additional deepening its continued decline.

PERP fell 1.37% on the information. The token operates on Ethereum’s Layer 2 Optimism community and helps a decentralized perpetual futures change.

Worth efficiency of FLM, KDA and PERP after Binance delisting. Supply: TradingView

In the meantime, FLM stunned the market by leaping 19.7% after asserting its delisting. The leap in costs is notable as a result of delisting bulletins usually set off a pointy decline together with lowered liquidity.

Nonetheless, this response mirrors the Alpaca Finance (ALPACA) incident, which soared 71% after Binance delisted the corporate earlier this 12 months. On the time, the coin’s hovering value raised issues of market manipulation amongst analysts and group members.

“Binance plans to delist FLM on November 12, 2025, however the token is surging…Massive pumps typically imply large dangers,” the market watcher posted.

The distinction between FLM, KDA, and PERP highlights the unpredictable nature of delisting occasions. Whereas KDA’s collapse deepens the continuing financial downturn, FLM’s shock rally displays how market sentiment and speculative buying and selling can defy expectations regardless of looming liquidity dangers.

The article Binance delisting causes market volatility for 3 altcoins appeared first on BeInCrypto.