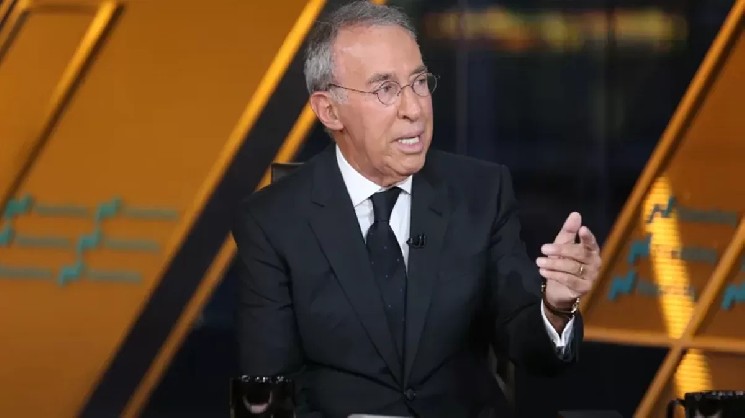

Billionaire investor Ron Baron, chairman and CEO of Baron Capital, made necessary feedback in an interview with CNBC concerning the newest market traits, long-term funding technique, and the way forward for Tesla.

Baron argued that buyers ought to have a look at the large image and seize alternatives, somewhat than specializing in short-term declines.

Ron Baron identified that the market has been primarily targeted on know-how and synthetic intelligence shares not too long ago. He identified that firms exterior these sectors, particularly small and medium-sized enterprises, have carried out comparatively poorly this 12 months. Baron famous that the most important shares available in the market account for many of the returns, and excluding them makes the general market return look decrease.

Explaining the fundamentals of his funding philosophy, Barron identified that inflation continues to erode the worth of cash. He stated folks might want to earn twice as a lot as they do now inside 15 years to keep up their buying energy.

However Barron’s important concept hinges on the truth that the inventory market and financial system double each 10 to 12 years, as they’ve all through his lifetime. Due to this fact, he argued, the way in which to guard and improve the worth of cash within the face of inflation is thru inventory funding, somewhat than by placing it in banks or bonds.

Ron Baron additionally briefly talked about cryptocurrencies when evaluating the efficiency of varied asset lessons. When discussing the potential of the inventory market, Baron briefly commented, “Bitcoin has clearly been nice.”

*This isn’t funding recommendation.