Bitcoin BTC$108,222.79 Holders going through excessive taxes have a brand new choice to ease their burden by changing their debt into income-generating mining {hardware}.

Cryptocurrency finance firm Arch is rolling out TaxShield, which permits traders to deduct the price of mining tools from their taxable revenue by making the most of a selected provision of the US tax legislation (bonus depreciation beneath IRS §168(okay)).

Here is the way it works: Customers pledge Bitcoin as collateral for overcollateralized loans from Arch and use the mortgage proceeds to buy and host mining rigs by Blockware. Buyers can deduct your complete buy quantity within the first yr, probably wiping out tons of of 1000’s in taxes whereas persevering with to earn month-to-month mining rewards in BTC.

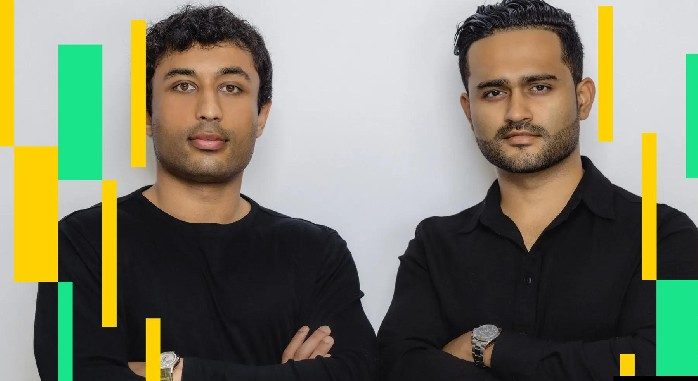

Arch co-founders Himanshu Sahai and Dhruv Patel advised CoinDesk in an interview that the service, developed in collaboration with outstanding Bitcoin educator Mark Moss and Blockware, is primarily focused at high-income BTC holders. They defined {that a} buyer with $1 million in taxable revenue might probably scale back their federal tax invoice by roughly $400,000 whereas sustaining their BTC publicity and incomes mining revenue.

That is a part of a broader push by Arch, finest recognized for its crypto-backed loans, to construct a collection of area of interest providers generally out there in conventional finance however aimed toward high-net-worth digital asset holders.

“Many individuals who’ve constructed vital wealth in digital belongings over the previous 12 to fifteen years haven’t had entry to the identical degree of high-quality monetary providers that they’ve entry to in the true world,” Sahay advised CoinDesk.

The founders say their long-term objective is to evolve right into a next-generation wealth administration platform that handles non-public bank-like providers for crypto holders: lending, revenue, custody, and tax planning.

TaxShield follows the latest launch of Perpetual Earnings, one other product constructed with Mark Moss that permits Bitcoin holders to earn common tax-advantaged revenue with out having to promote their belongings.

Final yr, Arch secured $70 million in debt funding from Galaxy and a $5 million fairness spherical led by Morgan Creek Digital and Citadel Island Ventures to increase its platform.

Arch plans to start buying and selling within the coming months and can be contemplating introducing card merchandise past that, the co-founders mentioned.

Learn extra: Bitcoin-backed loans are about to get cheaper world wide: Ledn co-founder