Bitcoin’s short-term momentum weakened following the market crash on October tenth. Nonetheless, on-chain knowledge platform CryptoQuant reviews that long-term structural demand for Bitcoin stays robust.

In a report launched Friday, the corporate cautioned that it’s untimely to view the present market as a “season finale.” One other analysis agency, Tiger Analysis, forecast a goal of $200,000 for the fourth quarter, citing continued on-line shopping for regardless of a pointy rise in volatility.

Dolphin cohort: a key indicator of structural demand

Analysts at CryptoQuant counsel that the approaching weeks might be vital relying on whether or not the speed of accumulation accelerates. They characterize the present market as a “late-maturity section” of an ongoing uptrend cycle, reasonably than a definitive finish.

The evaluation focuses on the “dolphin” cohort, which holds between 100 and 1,000 BTC per pockets. This group contains giant holders of ETFs, firms, and rising buyers.

The Dolphin group at the moment accounts for the most important share of Bitcoin provide, holding roughly 5.16 million BTC, or 26% of the whole provide. Traditionally, modifications in dolphin collective holdings have been essentially the most constant indicator of Bitcoin value momentum.

Accumulation drives the cycle

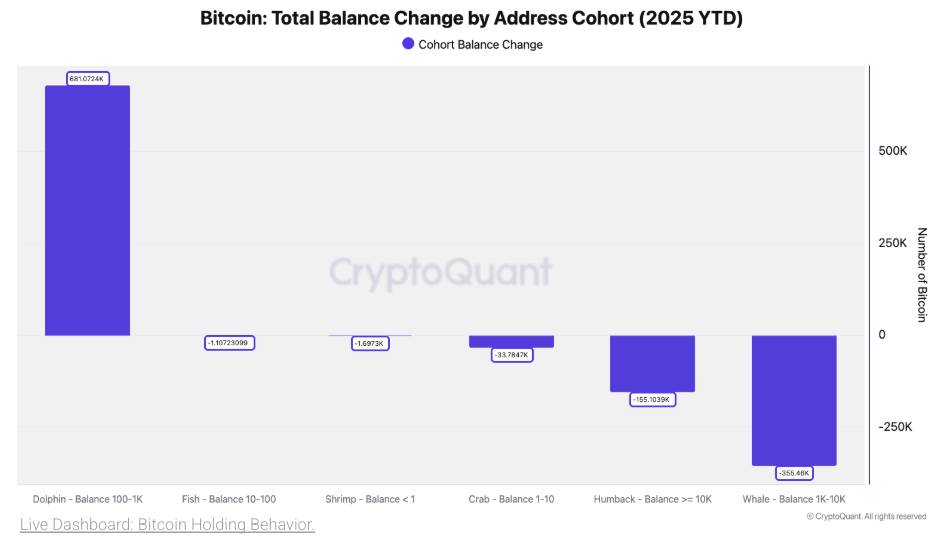

In 2025, the Dolphin Cohort was the one group to extend its whole steadiness year-over-year, including over 681,000 BTC. Conversely, 5 different cohorts skilled internet decreases of their holdings.

Bitcoin: Whole steadiness change by tackle cohort (2025 YTD). Supply: CryptoQuant

CryptoQuant famous that the annual development price of Dolphin belongings stays constructive, suggesting that the bullish cycle isn’t over but. The group’s present annual holdings are 9.07 million BTC, exceeding the 365-day shifting common of 730,000 BTC.

Quick-term challenges and value targets

Nonetheless, the corporate warned towards complacency. The October 10 crash weakened the short-term momentum and required a brand new section of accumulation for Bitcoin to check and break the $126,000 stage. The month-to-month accumulation price might want to speed up once more for the uptrend to renew and attain new all-time highs.

CryptoQuant recognized $115,000 as a short-term resistance stage and $100,000 as a right away help stage, warning {that a} break beneath $100,000 might set off a major correction to $75,000.

Institutional help that promotes optimism

In the meantime, Tiger Analysis launched its personal short-term outlook on the identical day, providing a extra bullish outlook. They argued that the October 10 crash and subsequent liquidations supplied proof that the market had moved from a retail-driven mannequin to an institutional-driven mannequin.

Not like the decline in late 2021, which noticed widespread panic promoting amongst retail buyers, the latest correction was restricted. Tiger Analysis mentioned institutional buyers have continued to purchase after the correction, and additional institutional participation might result in a wholesome continuation of the bull market in the course of the present correction.

They predicted that the Fed’s continued rate of interest cuts can be a powerful catalyst for inventory costs to rise within the fourth quarter, elevating their value goal to $200,000.

Analyst units Bitcoin value goal at $200,000 – is it real looking by Christmas? The submit appeared first on BeInCrypto.