President Trump-backed $ABTC simply suffered its first income drop as a public firm. This “not only a miner, not only a monetary supervisor” firm is at present concentrating on 50 EH/s to strengthen its BTC-focused development technique.

The next visitor submit is from bitcoinminingstock.io, A public market intelligence platform that gives knowledge on corporations uncovered to Bitcoin mining and crypto treasury methods. First revealed by Cindy Feng on November 20, 2025.

Whereas a lot of the Bitcoin mining sector is pivoting in the direction of AI and HPC infrastructure, American Bitcoin (Nasdaq: ABTC) is taking a really totally different method. It’s scaling as much as be a top-level Bitcoin miner and is trying to develop a large BTC fund, however claims it isn’t there but. simply Miner or passive BTC car. However the central query is whether or not the economics can justify their ambitions at a time when a lot of their friends are pivoting away from Bitcoin mining.

Let’s take a better have a look at the corporate’s first quarterly outcomes as a Nasdaq-listed firm.

Present Bitcoin mining standing

The corporate was born on March 31, 2025 and listed on the Nasdaq on September 3. In that quick timeframe, it moved rapidly.

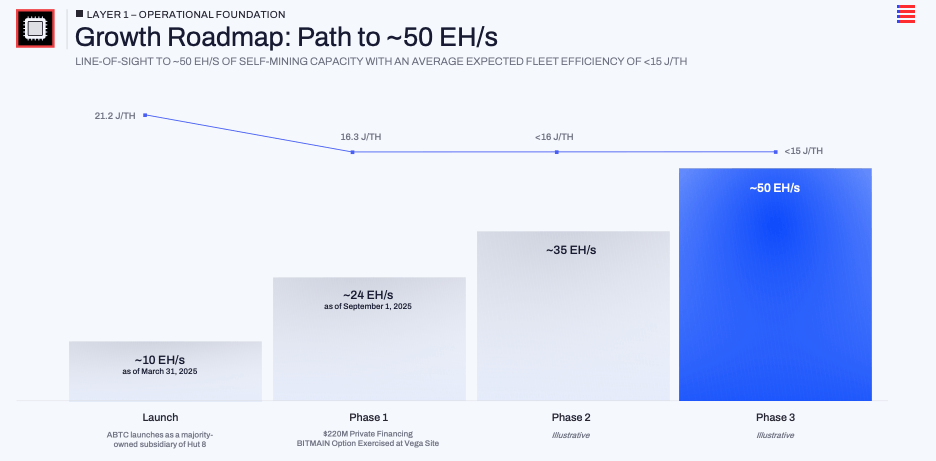

By the tip of the third quarter, we reported put in capability with a mean fleet effectivity of ~25 EH/s. 16.3J/TH. The first driver was the train of the brand new miner’s buy choice of roughly 14.8 EH/s on the Vega website in Texas. Assembly with administration gives a roadmap for subsequent objectives ~50 EH/sec.

that screenshot Investor presentation (12 pages).

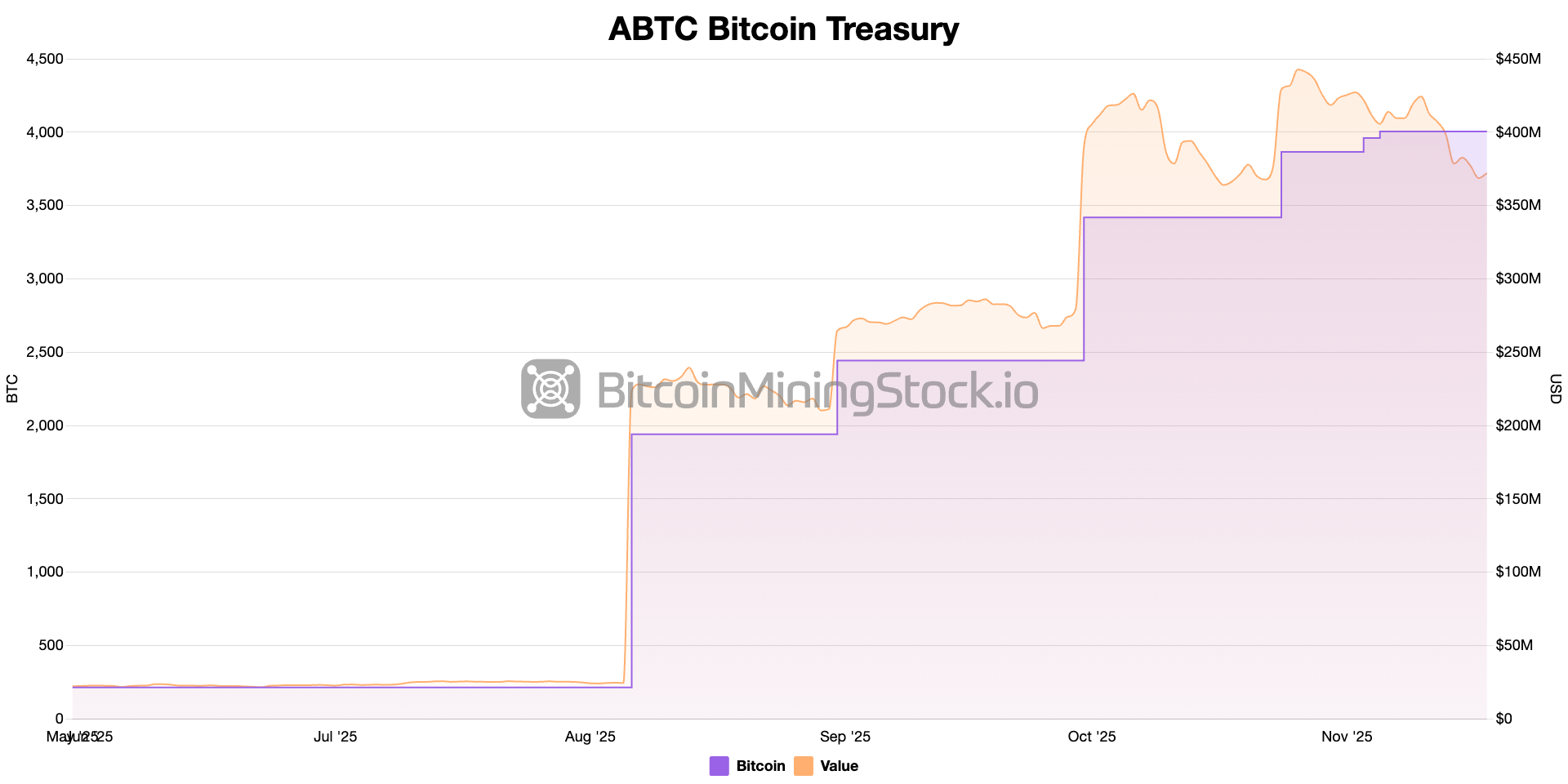

In the identical quick time frame, Bitcoin reserves went from zero on April 1st to 3,418BTC As of September thirtieth (as of this writing, the quantity has reached 4000BTC+). Administration translated this to 371 Satoshis per share, highlighting an roughly 50% enhance in BTC per share since itemizing. They freely need the market to take discover Bitcoin per share As the first worth lens, not simply income or headline hashrate.

In abstract, American Bitcoin is a deliberate and centered wager. Bitcoin mining and scaling your BTC holdingsby no means depart them.

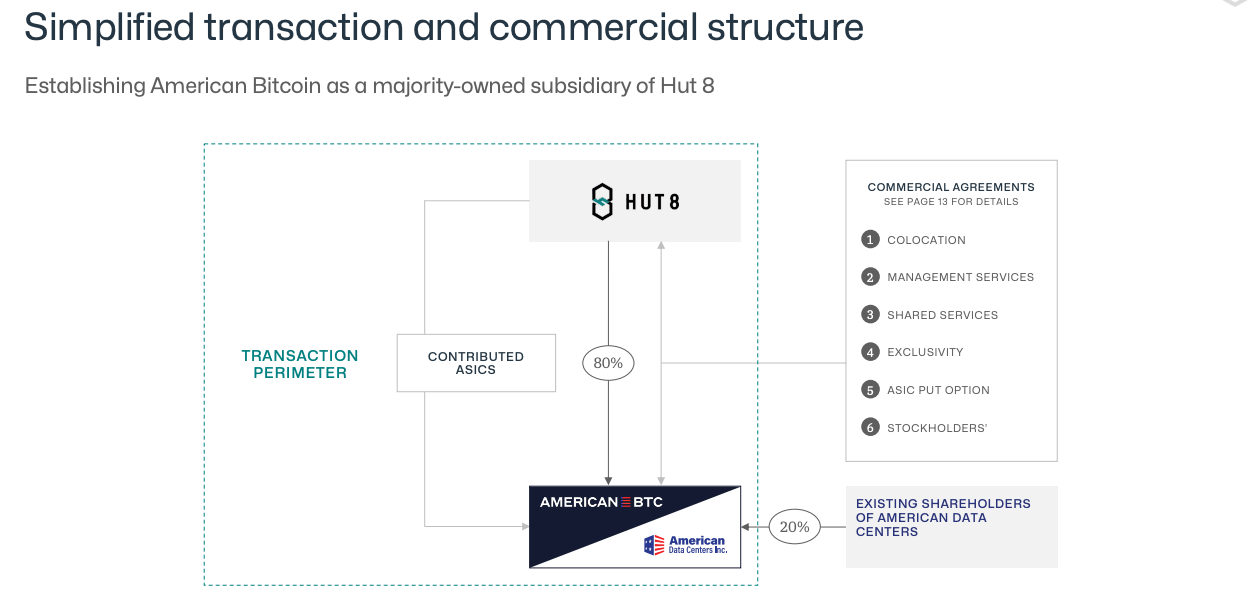

The asset-light mannequin is a magic recipe

Uniquely, American Bitcoin’s Bitcoin mining operations are tied to a partnership with Hut 8. We do not personal any main infrastructure. hut 8 Develop and function the location, negotiate with energy corporations, and supply the bodily atmosphere for miners. american bitcoin They purchase and fund ASIC fleets, pay internet hosting and repair charges, and focus their capital on miners and Bitcoin reasonably than substations and buildings. Within the third quarter, administration stated: SG&A bills are roughly 13% It is a moderately lean price base and is in step with the argument that not proudly owning the infrastructure reduces fastened overhead prices.

Relationship between Hut 8 and Bitcoin within the US (Screenshot from Hut 8 presentation, web page 11).

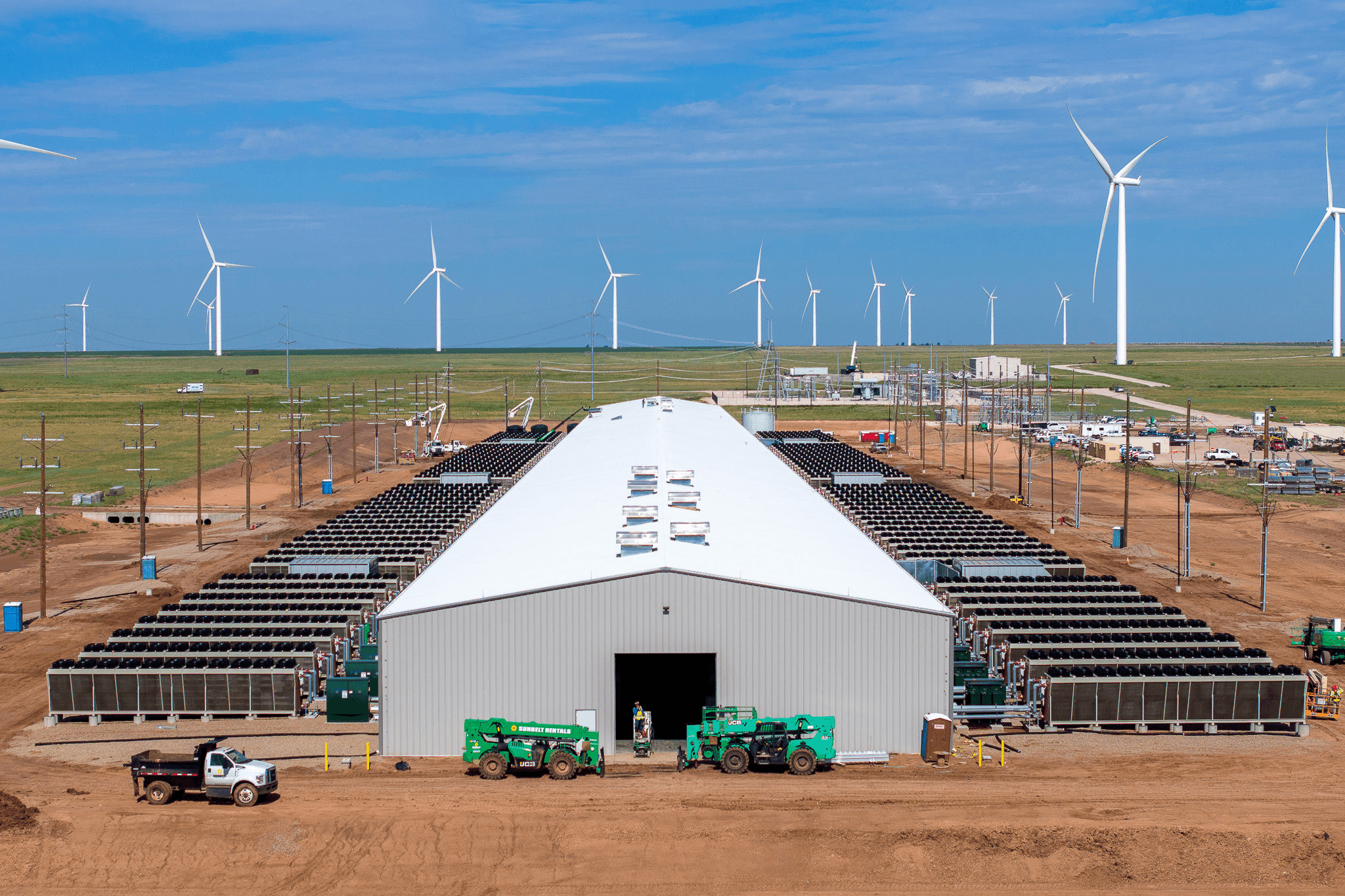

Vega in Amarillo is a major instance. Within the third quarter earnings name, Asher Genuto stated that American Bitcoin at present accounts for greater than 95% of the native co-op’s load, and that it operates as follows. Behind-the-meter clients for totally abateable wind farms. If there’s a want to cut back the load on the grid throughout peak occasions, mines may be powered off instantly. Administration’s argument is that AI and HPC knowledge facilities can’t do this with out disrupting clients. Giving Bitcoin Mining a Area of interest Market: Low-cost and may soak up intermittent energy and preserve it out of the way in which when the ability grid is below load. In some methods, the Vega website is a template for the way American Bitcoin believes it may well preserve manufacturing prices beneath spot, at the same time as competitors will increase.

Vega website (Photograph courtesy of Hut 8).

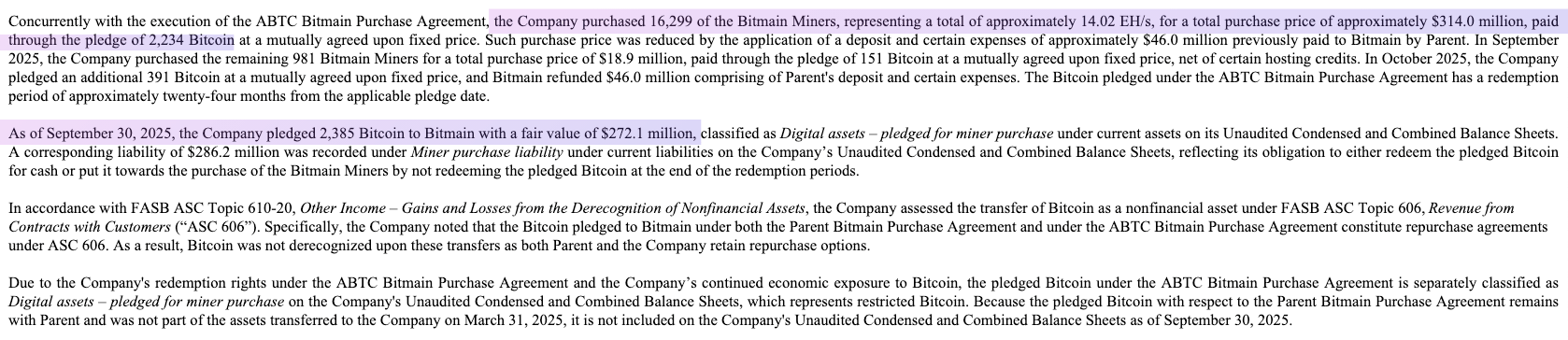

Add to {that a} financing twist. As a substitute of paying miners fully in money, American Bitcoin structured the Bitmain transaction by pledging massive blocks of Bitcoin as collateral for the acquisition of recent ASICs.

The mix of outsourced infrastructure, versatile energy, and BTC-backed gear financing is the actual mechanism behind the 50 EH/s objective.

What does Q3 inform us concerning the economics of this mannequin?

Our first quarter as a public firm gives a small however helpful check of our core thesis.

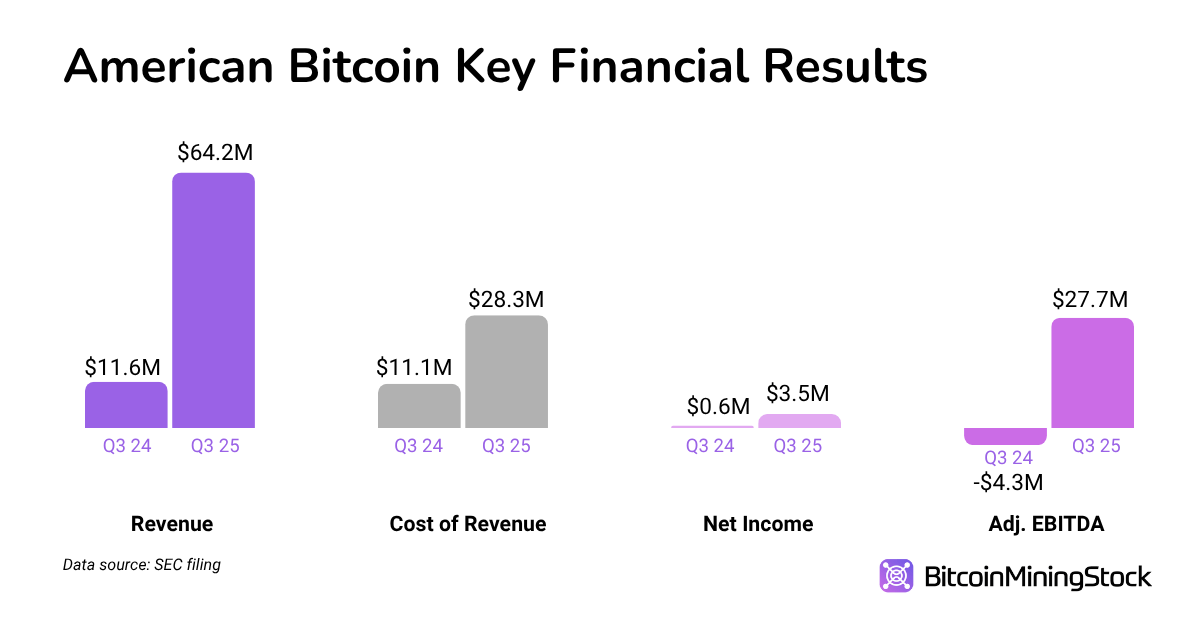

In Q3 2025, American Bitcoin reported income of $64.2 million. Price of income was $28.3 million. 56% gross revenue margin. This quantity already contains each the electrical energy price and the Hut 8 colocation price. In the course of the convention name, administration identified that in case you separate out simply real-time vitality prices and the worth of mined Bitcoin, the efficient margin could be nearer to 69%. Though it is a non-GAAP measure, it’s in step with the corporate’s claims. It claims that next-generation {hardware} put in on its versatile wind farm website will enable it to mine Bitcoin for about half the price of shopping for Bitcoin on the open market.

Profitability metrics remained robust regardless of fluctuations in Bitcoin costs. The corporate recorded a $5.5 million mark-to-market loss on its BTC holdings, however its web revenue remained at $3.5 million. Adjusted EBITDA almost doubled to $27.7 million. That is the primary dependable consequence for a enterprise that did not exist 12 months in the past.

There’s a clear capital technique at work on the stability sheet. To broaden hashrate, American Bitcoin used a BTC collateral construction to finance miner purchases on Vega, reasonably than relying fully on money. As of the tip of the quarter, 2,385 BTC of the three,418 BTC had been pledged as collateral below these preparations. In different phrases, the identical Bitcoin that underpins the “accumulation” story can also be getting used to gasoline hashrate development.

Bitcoin promised to ASIC (Be taught extra (Listed on pages 21 and 22).

These outcomes can’t show that the mannequin is powerful by all cycles. However to date they’ve proven that: The asset-light construction permits us to extend each hashrate and BTC holdings whereas offering a wholesome margin.

last ideas

Bitcoin’s first quarter as a publicly traded firm in America exhibits quick execution and dependable early economics. Its asset-light mannequin has delivered stable gross margins and allowed the enterprise to scale rapidly with out the heavy infrastructure burden typical of conventional miners. However the actual check can be whether or not this “not simply the miners, not simply the Treasury” method will maintain up, particularly if Bitcoin costs fall.

For traders, it is vital to control how the story unfolds. 50EH/sec and Stability held per share continues to extend It turns into vital. However possibly you are additionally on the lookout for solutions to some questions: For the reason that firm has two-thirds of its Bitcoin as collateral, how does it handle danger throughout a downturn? What occurs if the Hut 8 growth pipeline stalls? And the way lengthy will fairness issuance and BTC-backed funding final as market situations change… The solutions to those questions will enable you to kind a clearer principle of your personal.