Altcoin buying and selling stays comparatively excessive on Binance, accounting for 60% of all trades. Regardless of the slowdown in BTC and ETH buying and selling, the altcoin market stays lively.

Binance is popping into an altcoin venue, with as much as 60% of buying and selling quantity tied to its massive token portfolio. On the similar time, BTC and ETH exercise has been declining, with continued promoting stress in small volumes.

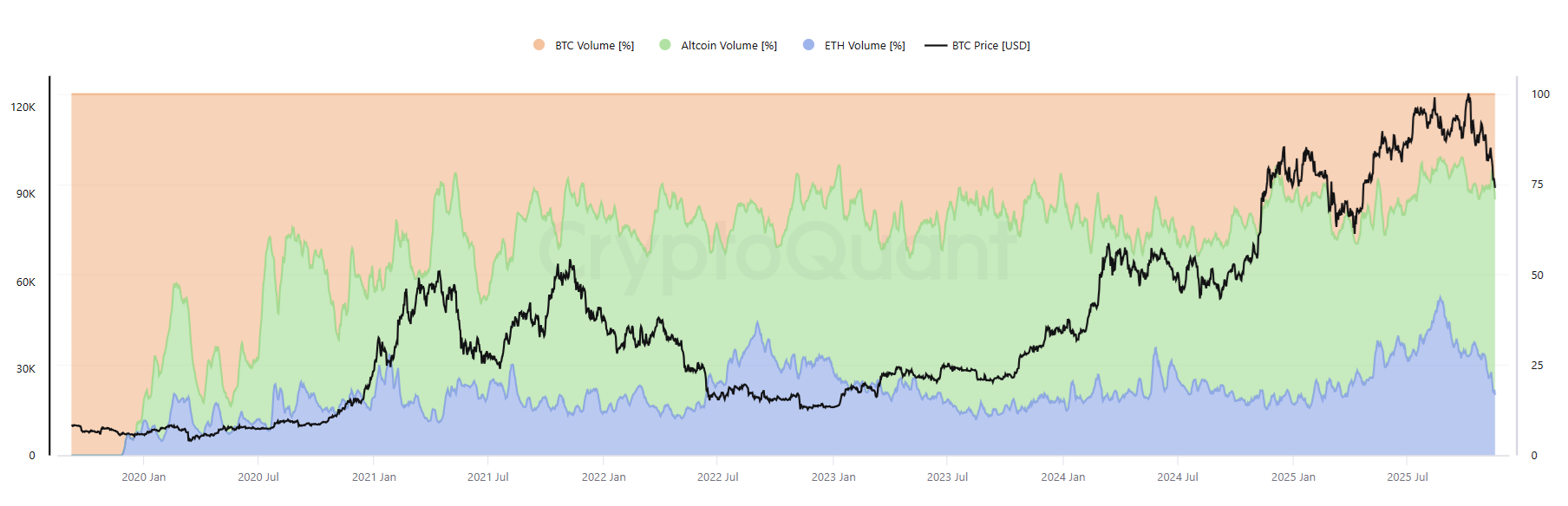

Altcoin buying and selling quantity has recovered on Binance and now accounts for over 60% of buying and selling exercise. Each BTC and ETH buying and selling exercise declined much more considerably. |Supply: CryptoQuant.

Regardless of the comparatively gradual season for altcoins, there are some distinctive parts to Binance’s asset choice. Alternate hosts preserve observe of stablecoin liquidity and supply enough funds for hypothesis. Moreover, this change handles essentially the most liquid altcoins, permitting for speculative buying and selling with enough liquidity.

The change additionally provides fastidiously chosen tasks and sometimes invitations market makers to generate extra buying and selling quantity. Each BTC and altcoins are unstable, and merchants could also be profiting from that volatility for potential short-term earnings.

Regardless of the market downturn, altcoin buying and selling on Binance has returned to early 2025 ranges and exhibits no indicators of slowing down. The added exercise comes from reawakened outdated cash like ZCash (ZEC), Binance’s personal choose tokens, and occasional pumps from older property.

Altcoins compete for consideration with BTC

Primarily based on simply the altcoin season index 26 Level, it is BTC season now. Altcoins have underperformed throughout Bitcoin’s decline, with main cash falling to the $85,000 vary.

The current curiosity in altcoins comes within the wake of the extreme earnings of sure property. Leaders which have outperformed BTC embrace ZEC and ASTER, pushing your entire sector larger. Nevertheless, small or forgotten altcoins stay illiquid and dangerous, and there’s no market to lift all their property.

Merchants stay cautious of outdated historic narratives about altcoin all-seasons. Up to now, the autumn of BTC led to the growth of altcoins. Nevertheless, the market in 2025 faces completely different pressures, and among the outflows from BTC is not going to find yourself within the altcoin market.

As an alternative, inflows are concentrated in particular blue-chip tokens and ecosystems, with occasional meme token pumps. This time, the mass adoption of the meme shouldn’t be there to assist the final sense of lively commerce.

Altcoins additionally rose as a result of launch of derivatives buying and selling and perpetual futures DEXs. Whereas Binance and different centralized exchanges are used as hedging instruments and arbitrage, a good portion of altcoin exercise has moved to HyperLiquid and different markets.

Altcoin market stays cautious

Regardless of the comparatively excessive share of altcoins on Binance, merchants are nonetheless comparatively cautious.

In early October, altcoin buying and selling peaked at greater than 82% of all Binance exercise on expectations of a month of continued features.

Altcoins broke out in 2025, with some returning to their highest costs since 2021. Nevertheless, not all property have recovered, and a few are literally extending multi-year bear markets.