21Shares, a number one cryptocurrency exchange-traded product (ETP) supplier, is increasing its providing in Europe with the launch of six extra funds on Swedish inventory trade Nasdaq Stockholm.

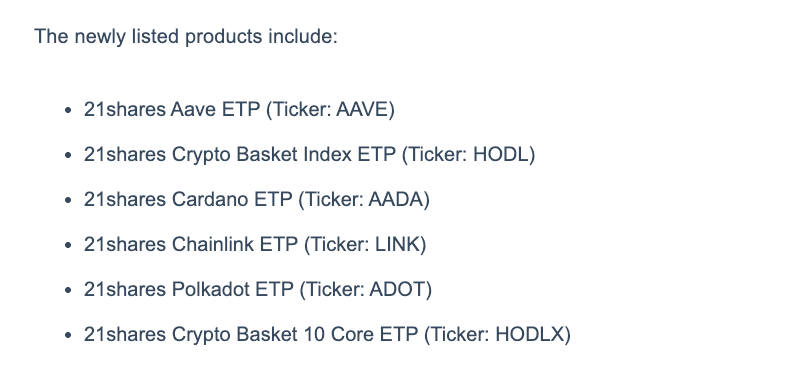

21Shares on Thursday introduced the cross-listing of six extra merchandise on Nasdaq Stockholm, together with ETPs for Aave (AAVE), Cardano (ADA), Chainlink (LINK), Polkadot (DOT) and two cryptocurrency basket merchandise.

With this growth, 21shares now provides a complete of 16 ETPs on Nasdaq Stockholm. That is only a few of the a number of ETPs out there on different European exchanges similar to SIX Swiss Change, Deutsche Börse Xetra, and Euronext Amsterdam.

The brand new launch comes a day after 21Shares launched the Solana (SOL) exchange-traded fund (ETF) on Wednesday, including to a sequence of SOL ETF launches.

21Shares manages $8 billion in property underneath administration

“We proceed to see sturdy demand from Nordic buyers looking for numerous and cost-effective entry to digital property by means of regulated exchanges,” mentioned Alistair Biers Perry, head of EU investments at 21Shares.

“This growth permits us to supply a good broader toolkit of single-asset and index-based crypto ETPs, permitting each retail and institutional buyers to tailor their digital asset exposures inside a trusted and clear framework,” he added.

Record of newly launched 21Shares crypto ETPs on Nasdaq Stockholm. Supply: 21 shares

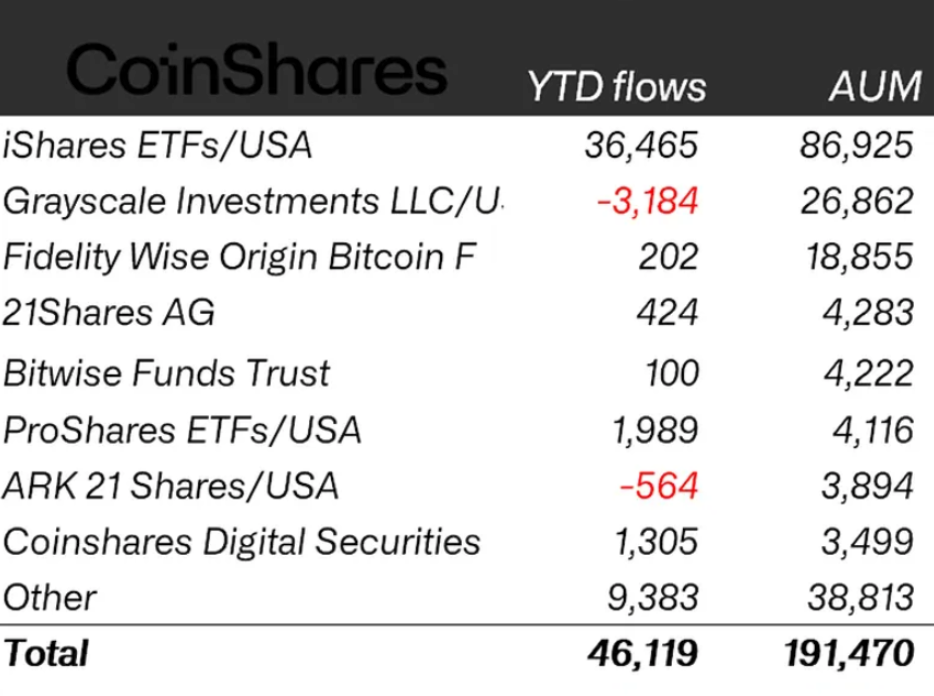

Listed on a number of exchanges in Europe and the US, 21Shares is without doubt one of the largest crypto ETP suppliers, with roughly $8 billion in property underneath administration worldwide. This represents about 4% of the whole $191.5 billion in crypto ETFs issued worldwide.

Roughly half of 21Shares’ AUM is held in US crypto ETFs issued in partnership with Cathie Wooden’s ARK Make investments, based on CoinShares information.

Yr-to-date inflows and working balances as of Monday for European and US crypto ETF/ETP issuers. Supply: CoinShares

So many crypto ETFs

The 21-share crypto ETP growth comes amid a wave of recent crypto funds flooding the U.S. market, together with the debut of the Spot XRP (XRP) ETF on the Nasdaq trade final week.

Following Canary Capital’s launch of the primary spot XRP ETF, extra XRP funds are anticipated to debut within the coming days, together with Bitwise and Grayscale ETFs scheduled to launch at present and Monday, respectively.

sauce: james seifert

XRP has change into the sixth asset to again a single-asset crypto ETF within the U.S., following Bitcoin (BTC), Ether (ETH), Solana, Litecoin (LTC), and Hedera (HBAR), based on ETF professional Nate Geraci.

Regardless of rising optimism about new U.S. crypto ETFs, the Bitcoin ETF, a gateway crypto fund that started buying and selling in January 2024, has struggled lately.

Associated: BTC regains $92,000 as US Bitcoin ETF suffers 5-day catastrophe

BlackRock’s iShares Bitcoin ETF (IBIT) posted its worst outflow in historical past on Tuesday, with greater than $520 million leaving the fund, based on Bloomberg ETF analyst Eric Balchunas.

After 4 consecutive weeks of outflows, year-to-date inflows into Bitcoin ETFs fell to $27.4 billion, about 30% under final 12 months’s whole of $41.7 billion, based on information from CoinShares.

Journal: Saylor denies Bitcoin decline, rises to high chart with XRP ETF debut: Hodler’s Digest, November 9-15