Asset tokenization is nearing a breakthrough second as adoption by institutional buyers accelerates, with Grayscale suggesting the sector may broaden 1,000x by 2030 and develop into the core of worldwide capital markets.

Tokenized property predicted to develop 1,000x as Grayscale indicators structural modifications in capital markets

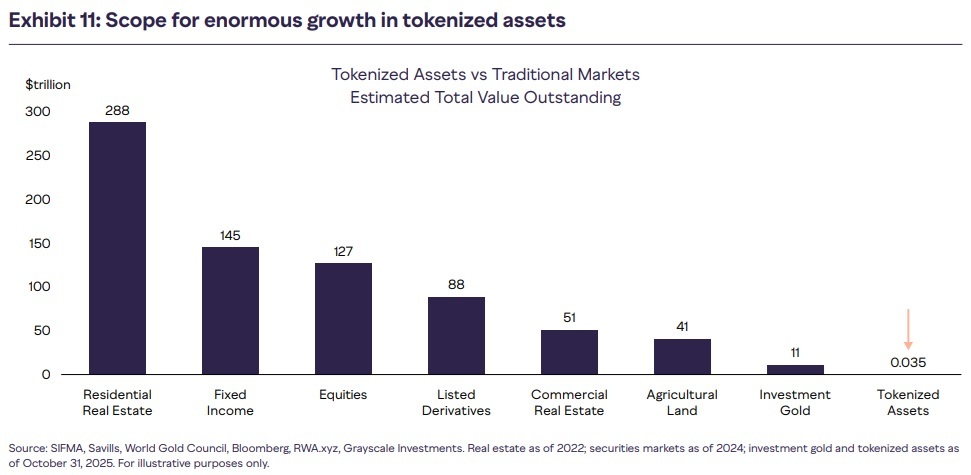

As monetary establishments develop into extra concerned, asset tokenization is rising as a structural change in digital finance, anticipated to develop far past its present scale. Grayscale Investments launched its 2026 Digital Asset Outlook final week, figuring out that asset tokenization has reached an inflection level and predicting that the sector may broaden roughly 1,000 occasions by 2030 because it turns into extra built-in into international capital markets.

Grayscale remains to be in its infancy as a marketplace for asset tokenization, however is getting into a interval of accelerated enlargement as infrastructure and coverage circumstances enhance. “Grayscale expects asset tokenization to develop quickly within the coming years as a consequence of extra mature blockchain know-how and elevated regulatory readability,” the report states.

The Outlook additionally outlines a long-term development trajectory that has the potential to considerably reshape capital markets, stating:

In our view, it might not be shocking to see tokenized property improve by as much as 1,000x by 2030. This development may improve the worth of blockchains and varied supporting functions that course of transactions for tokenized property.

The corporate emphasised that the minimal share of tokenization in international fairness and debt markets at this time displays early adoption somewhat than restricted potential, as monetary establishments more and more worth on-chain issuance, settlement, and asset administration.

These dynamics join tokenization on to broader themes shaping digital property, together with regulatory harmonization, stablecoin adoption, and deeper integration between conventional finance and public blockchains.

learn extra: Grayscale Information recordsdata for IPO with SEC for NYSE itemizing concentrating on ticker GRAY

Grayscale’s analysis additionally identifies infrastructure that may profit as adoption accelerates. Report particulars:

Presently, the principle blockchains for tokenized property are Ethereum (ETH), BNB Chain (BNB), and Solana (SOL), however this checklist could evolve over time.

These networks presently help the most important share of decentralized tokenized property, backed by liquidity, developer exercise, and operational resilience. Past the bottom layer community, middleware, and knowledge suppliers are thought of important to scalable and compliant tokenization.

“Relating to utility help, we consider Chainlink (LINK) is especially well-positioned given its distinctive software program know-how suite,” Grayscale added.

Total, this outlook presents asset tokenization as a practical path to blockchain adoption, somewhat than a speculative narrative. Efficiencies comparable to fractional possession, sooner settlement, and decreased coordination prices align carefully with institutional priorities, positioning tokenization because the cornerstone of a brand new institutional period for digital property, regardless of persevering with authorized and jurisdictional challenges.

FAQ ⏰

-

Why is asset tokenization reaching an inflection level at Grayscale?

Institutional participation, regulatory readability, and mature blockchain infrastructure are converging to drive real-world adoption. -

How briskly is the asset tokenization market prone to develop?

Grayscale predicts that tokenized property may develop roughly 1,000 occasions by 2030. -

Which blockchains are presently main the issuance of tokenized property?

Presently, Ethereum, BNB Chain, and Solana help the most important share of tokenized property. -

Why is Chainlink essential for asset tokenization?

Chainlink offers important middleware that permits compliant, scalable, data-driven, tokenized property.