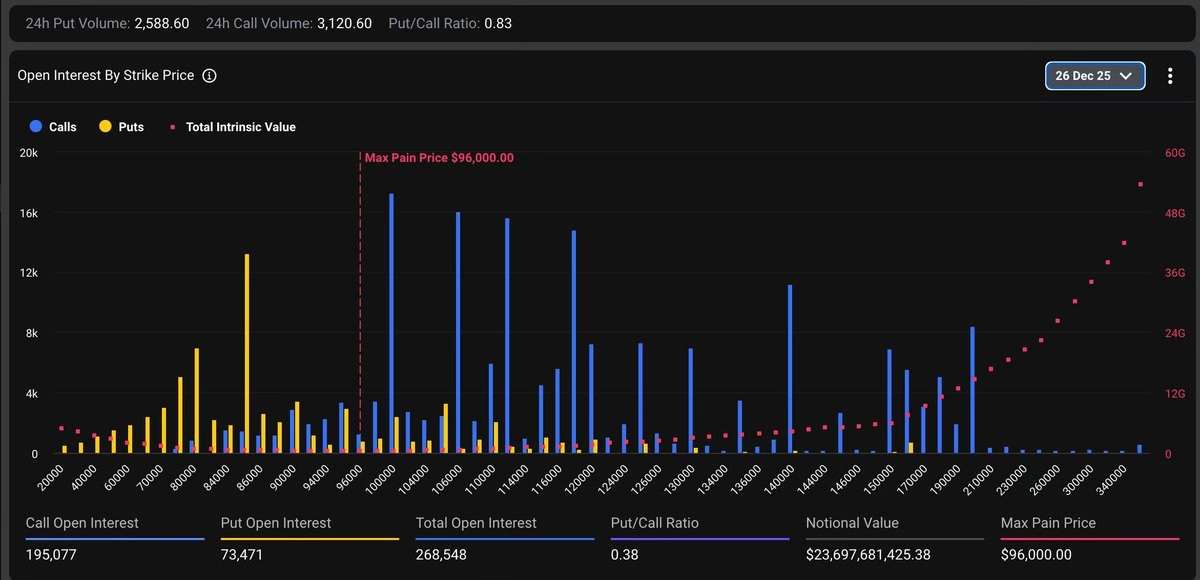

Roughly $23.6 billion value of Bitcoin (BTC) choices are scheduled to be taken off the books on Friday, December twenty sixth, marking the most important expiration of BTC choices in historical past.

Extra particularly, open curiosity knowledge coin glass As of December 23, name choices had been concentrated between $100,000 and $120,000, indicating that many merchants are focusing on additional upside.

On the draw back, put choices are concentrated round $85,000, suggesting that key assist ranges are being carefully monitored. The value at which choice holders incur the best loss, the so-called max-pay degree, is round $96,000.

To place issues into perspective, this yr’s $23.6 billion compares to final yr’s $19.8 billion and 2023’s $11 billion.

Some of the vital Bitcoin occasions

Regardless of the magnitude of the deadline, the positioning may be thought of constructive. So with a put-call ratio of 0.38, it seems that merchants are on the lookout for upside publicity slightly than draw back safety.

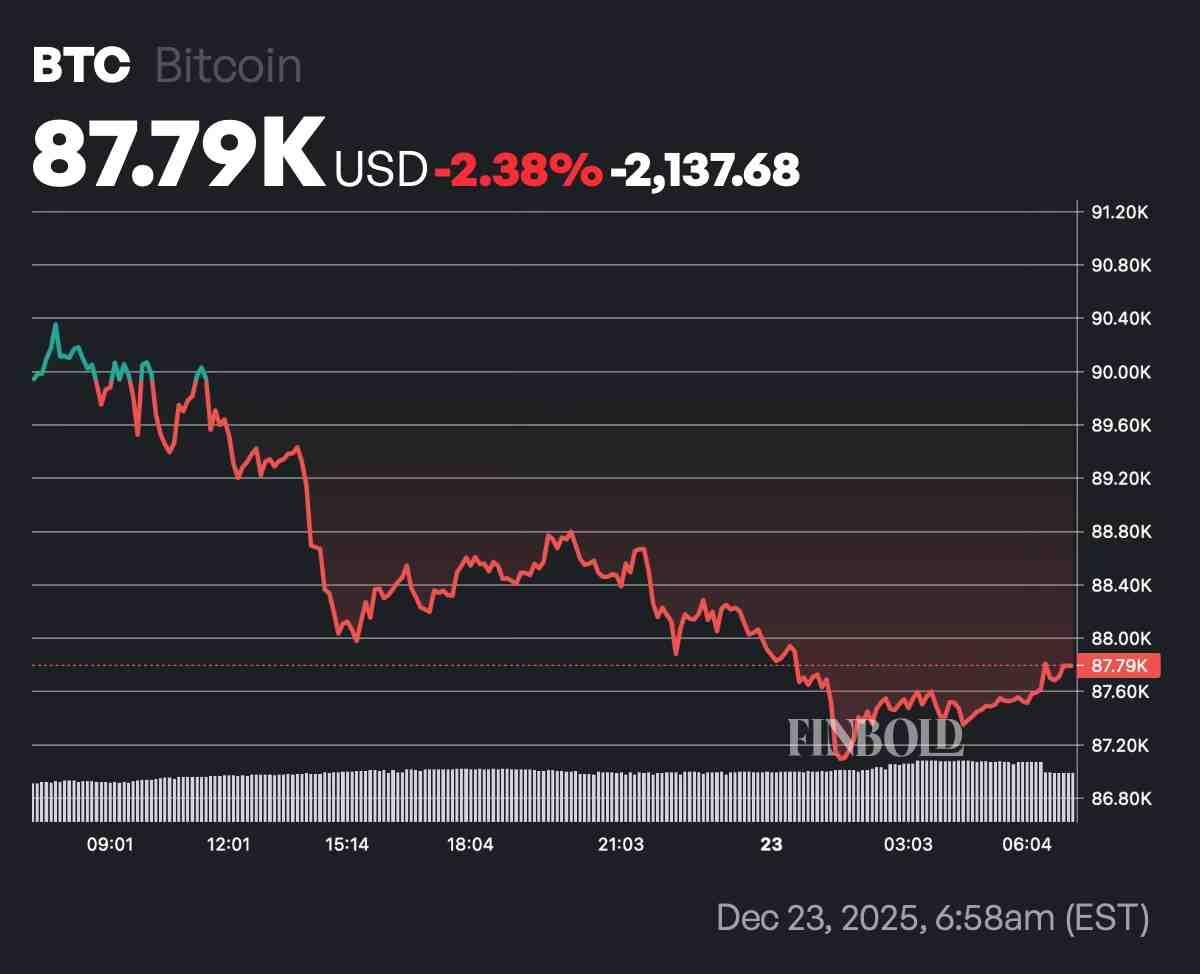

On the time of writing, Bitcoin is buying and selling round $87,800, down 2.38% on the day. Nonetheless, buying and selling tends to be risky earlier than the expiration of a significant choice, so a brand new sharp transfer is probably going because the contract rolls off and open curiosity resets.

Given the magnitude of this occasion, even small value actions close to expiration may cause risky fluctuations as merchants shut positions and unwind hedges.

The timing can be notable, touchdown throughout a vacation week when market liquidity is usually skinny. In different phrases, giant orders may cause costs to maneuver extra aggressively than regular.

In the end, the staggering numbers underscore how the market has turn out to be more and more dominated by monetary establishments, with derivatives flows more and more driving value actions in all instructions.

Featured picture through Shutterstock