The vast majority of tokens launched on centralized exchanges (CEX) in 2025 have been unable to maintain their listed value ranges in a 12 months that’s more likely to finish in a bear market.

Based on a examine by market aggregator Cryptorank, 83% of newly listed tokens are at the moment buying and selling beneath their preliminary value, and no cash on prime centralized exchanges had a constructive return on funding of greater than 20%.

Tokens traded above the listed value chart. Supply: Cryptrank.

Cayman Islands-based Gate.io is in ‘pole place’ by way of relative token efficiency this 12 months, with 18% of its tokens buying and selling above their listed value. MEXC ranks second with 15.59%, adopted by Bybit and Bitget with 14.47% and 13.86% respectively.

US-listed Coinbase and Seychelles’ KuCoin are concentrated within the center, with 12.73% and 12.15% of their listed tokens buying and selling above their debut value degree. On the backside, HTX recorded 9.09%, OKX 8.62%, Crypto.com 6.67%, and Binance rounded out the category with simply 6.06%.

CEX is closely traded, however the token’s efficiency is bleak

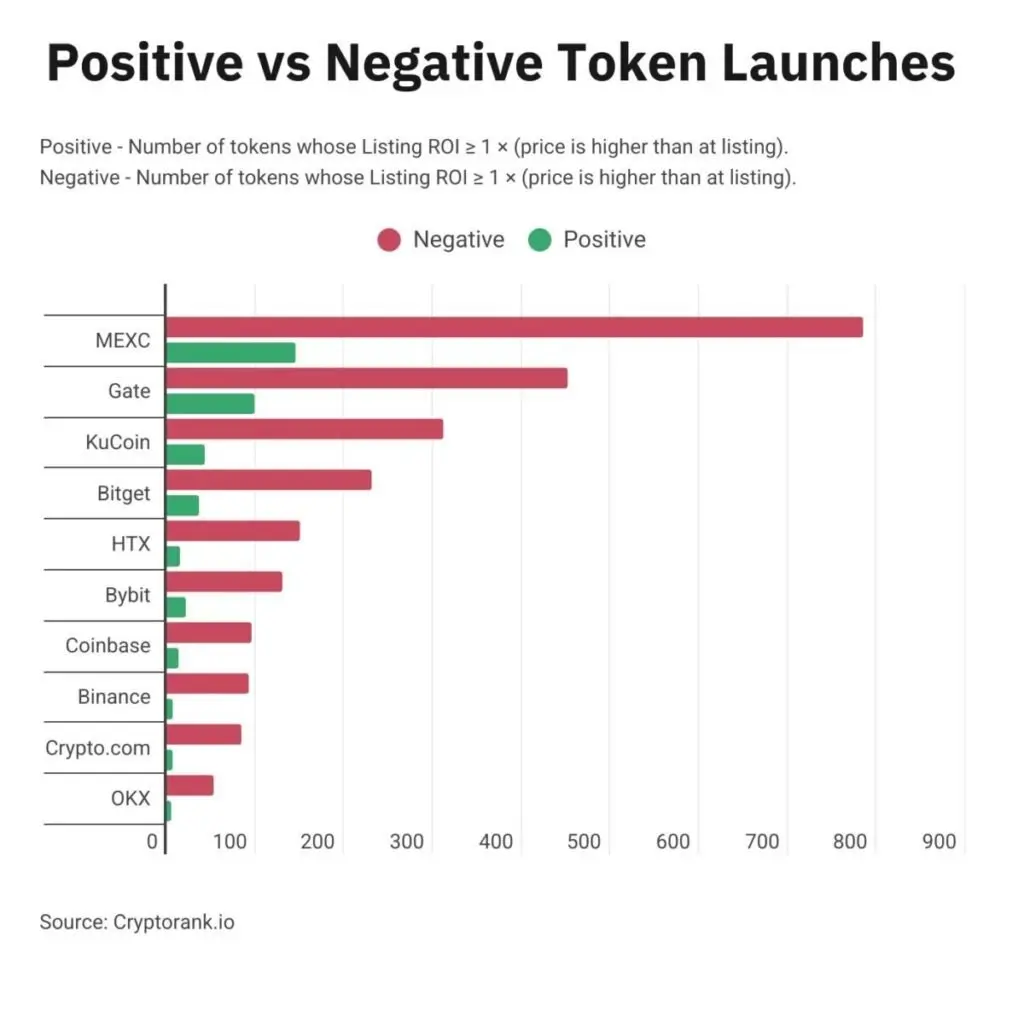

Trying on the constructive vs. unfavorable token launch chart shared by Cryptorank, efficiency chief MEXC has probably the most underperforming belongings, with 800 tokens, and fewer than 200 tokens buying and selling above the worth they entered the market.

First in line within the earlier class is Gate.io’s loss column with round 500 tokens traded, and above that simply over 100 tokens. KuCoin additionally has a notable imbalance in ROI stability, with round 300 tokens with unforgettable efficiency versus a small quantity in constructive territory.

Optimistic Token ROI and Adverse Token ROI. Supply: Cryptrank.

Mid-sized trade Bitget counts 250 tokens buying and selling beneath their itemizing value and only some dozen above it. HTX and Bybit have every recorded over 100 tokens beneath the floor. Lastly, Coinbase and Binance nonetheless present a transparent bias in direction of unfavorable efficiency regardless of having fewer tokens listed general.

Crypto market doom clouds come from Bitcoin’s risky 12 months

The crypto market this 12 months was as soon as once more dominated by Bitcoin’s poor efficiency, sharing the spoils with altcoins. The most important coin by market capitalization is down virtually 8% year-to-date, which is why nearly all of merchants imagine we’re in a bear market. The one instances BTC ended the 12 months within the purple have been in 2014, 2018, and 2022, all of that are thought of bear years.

Bitcoin costs plummeted by 10% following the tip of liquidation on October tenth, dropping greater than $14,000 in a single session. “Gold is performing like Bitcoin. Bitcoin is performing like Boomer shares. Boomer shares are performing like meme cash. That is the worst doable timeline,” joked dealer CryptoUB on X.

Based on CryptoQuant contributor Wu Mingyu, the Bitcoin cycle momentum BCMI index fell to the 0.5 zone on October twenty first, however market watchers didn’t contemplate this a cycle prime.

Since then, Bitcoin value and BCMI have fallen additional because the market resets its value ranges and sellers return their cash to the market. Umingyu defined that on the backside of significant cycles, reminiscent of in 2019 and 2023, the BCMI reached a variety of 0.25 to 0.35. This might imply that BTC could not have the ability to keep its upward momentum till no less than the primary quarter of 2026.

As of this replace, Bitcoin was buying and selling round $86,881, down just below 1% on the day. A restoration try in early buying and selling briefly pushed the worth in direction of the $87,000-$89,000 vary, however the bulls have been unable to maintain the momentum.

A consolidation beneath the psychologically essential $90,000 degree shouldn’t be what Maxis was searching for over Christmas, and if downward stress resumes, Bitcoin might take a look at $84,000 or fall to the $82,000-$83,000 help degree.

In different information, the US Spot Bitcoin ETF recorded internet outflows of $188.64 million on Tuesday, in keeping with information from SoSoValue. Cumulative internet inflows into this funding car at the moment stand at $57.08 billion, with whole belongings held in BTC funds at $114.29 billion, simply over 6% of Bitcoin’s market capitalization.