Ethereum is at the moment buying and selling above the $3,000 degree, offering some surface-level stability after weeks of volatility. Nevertheless, underneath this worth resilience, market sentiment stays decisively bearish. Many analysts are brazenly calling for decrease ranges within the coming months, citing weak momentum, macro uncertainty and sustained promoting strain throughout danger belongings. Excessive concern dominates positioning, with traders displaying little confidence that the latest restoration can develop right into a sustained uptrend.

This pessimistic background highlights latest institutional-related exercise. Amid widespread alarm, knowledge means that Fundstrat co-founder Tom Lee and affiliated entity Bitmine is growing its publicity to Ethereum.

Bitmine is a digital asset mining and funding automobile centered on long-term participation in blockchain infrastructure, combining mining operations with strategic accumulation of main crypto belongings. Slightly than buying and selling on short-term worth actions, corporations like Bitmine usually function with a multi-year horizon, specializing in community fundamentals and uneven upside.

The distinction is hanging. Whereas retail and short-term traders stay on the defensive, long-term capital seems to be keen to intervene in occasions of concern. Traditionally, this disconnect between sentiment and positioning has usually appeared close to transitions in market cycles.

Bitmine expands publicity to Ethereum amid market fears

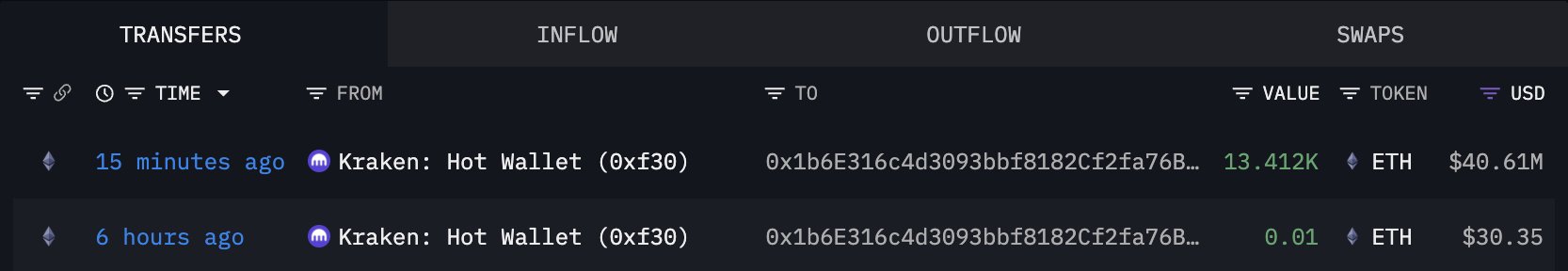

Arcam’s on-chain knowledge confirms that Bitmine has added an extra 13,412 ETH to its holdings, an acquisition value roughly $40.61 million at present market costs. This buy comes at a time when Ethereum sentiment stays extraordinarily bearish, reinforcing the distinction between short-term market uncertainty and long-term capital positioning.

Following this newest accumulation, Bitmine’s complete Ethereum holdings now stand at roughly 3.769 million ETH, with an estimated market worth of roughly $11.45 billion. This locations Bitmine as one of many largest holders of Ethereum recognized globally and highlights the size and perception behind its technique.

Such a place isn’t according to short-term hypothesis. As a substitute, this displays an intentional method centered round long-term publicity to Ethereum’s community worth and future position throughout the digital asset ecosystem.

Bitmine’s accumulation habits suggests confidence in Ethereum’s long-term fundamentals regardless of short-term volatility and widespread pessimism. Traditionally, giant purchases made throughout occasions of utmost concern have usually resulted in costs buying and selling under their perceived intrinsic worth.

Whereas this transfer doesn’t remove the danger of additional decline within the coming months, it does sign that structurally affected person capital continues to be deployed. The rising divergence between bearish sentiment and aggressive accumulation highlights a market atmosphere the place positioning could present clearer perception into long-term expectations than headlines.

Some traders are utilizing the present pessimism as a possibility to extend publicity, reinforcing the concept even a fear-driven atmosphere can entice structurally affected person patrons.

Ethereum worth struggles to rebuild bullish construction

Ethereum is at the moment buying and selling simply above the $3,000 degree and is trying to stabilize after an prolonged interval of correction. This chart exhibits that ETH remains to be under the important thing medium-term shifting averages, with the 50-day shifting common and 100-day shifting common nonetheless performing as dynamic resistance overhead. All latest makes an attempt to lift costs have been met with promoting strain, underscoring the market’s issue in regaining bullish momentum.

Structurally, the worth motion because the October peak displays a transparent sequence of falling highs and falling lows, confirming that ETH remains to be working inside a bearish pattern on the every day time-frame. Whereas the latest bounce from the $2,800-$2,900 zone suggests demand exists, volumes stay subdued in comparison with earlier growth levels, indicating an absence of purchaser confidence. This helps the view that the present motion is a correction somewhat than the beginning of a brand new impulsive rally.

From a help perspective, the $2,900 space is necessary proper now. If losses at this degree proceed, ETH will probably be uncovered to a deeper retracement in direction of the $2,600-$2,700 space the place the earlier consolidation occurred. On the upside, the bulls will want a decisive every day shut above the descending shifting common round $3,300 to invalidate the bearish construction.

General, the chart exhibits a consolidation under resistance somewhat than a pattern reversal. Till ETH expands in quantity and regains key shifting averages, worth motion suggests continued distribution and elevated danger of additional draw back.

Featured picture from ChatGPT, chart from TradingView.com