2025 was a troublesome yr for the crypto market and trade, and Spot Bitcoin Trade Traded Funds (ETFs) weren’t spared. The US-based Bitcoin ETF market skilled an equal proportion of moist and dry seasons all year long.

However BlackRock’s spot Bitcoin ETF, iShares Bitcoin Belief (ticker: IBIT), has been a standout performer at occasions this yr. Based on the most recent market knowledge, the efficiency of this product in 2025 earned it the place as among the finest funds within the international ETF market.

BlackRock’s IBIT data $25 billion in web inflows in 2025

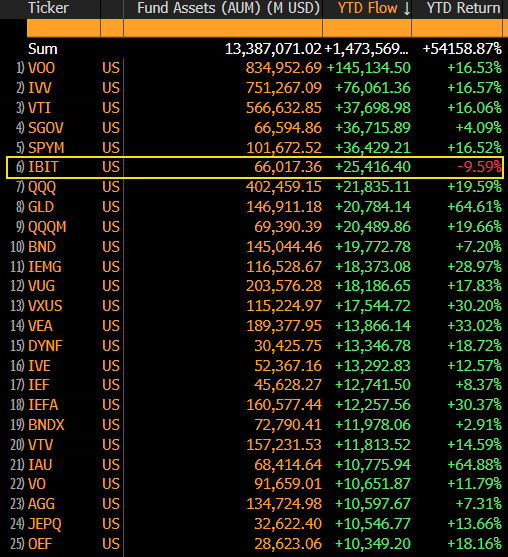

Bloomberg senior analyst Eric Balchunas revealed in a latest put up on social media platform This feat was achieved regardless of BTC exchange-traded funds recording detrimental returns throughout the identical interval.

BlackRock’s IBIT has recorded web inflows of roughly $25 billion to date final yr, in line with knowledge shared by Balchunas. What’s attention-grabbing is that the Bitcoin ETF attracted this massive amount of cash regardless of being the one fund with detrimental efficiency amongst conventional inventory and bond ETFs, as seen within the graph under.

Supply: @EricBalchunas on X

Apparently, SPDR’s GLD ETF, the world’s largest physically-backed gold exchange-traded product, has lagged behind BlackRock’s IBIT when it comes to capital inflows, regardless of returning 64% yearly. Notably, Vanguard’s S&P 500 ETF (VOO) led the pack with over $145 billion in capital inflows because the starting of the yr.

Moreover, Balciunas emphasised that whereas it’s pure for the crypto neighborhood to complain about Bitcoin ETF yields, additionally it is essential to acknowledge the numerous feat of attracting sixth place capital regardless of this detrimental return. ETF consultants say this annual efficiency bodes effectively for the long run.

Balchunas writes:

If you will get $25 billion in a nasty yr, think about the circulate potential in a very good yr.

A Bloomberg analyst credited the constructive web inflows seen in BlackRock’s Bitcoin ETF to what he calls the “HODL clinic” of older, long-term traders (boomers).

Bitcoin ETF data $497 million in weekly outflows

The US-based Bitcoin ETF ended the week with web outflows totaling $158 million on Friday, December 19, in line with knowledge from SoSoValue. This brings the ETF’s file one-week outflow to roughly $497.05 million.

The woes of the Bitcoin ETF market could be seen within the worth actions of this premium cryptocurrency in latest weeks. Bitcoin worth is down precisely 30% from its all-time excessive of $126,080.

As of this writing, the worth of BTC is round $88,293, reflecting a 2% decline over the previous seven days.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Getty Photographs, chart from TradingView