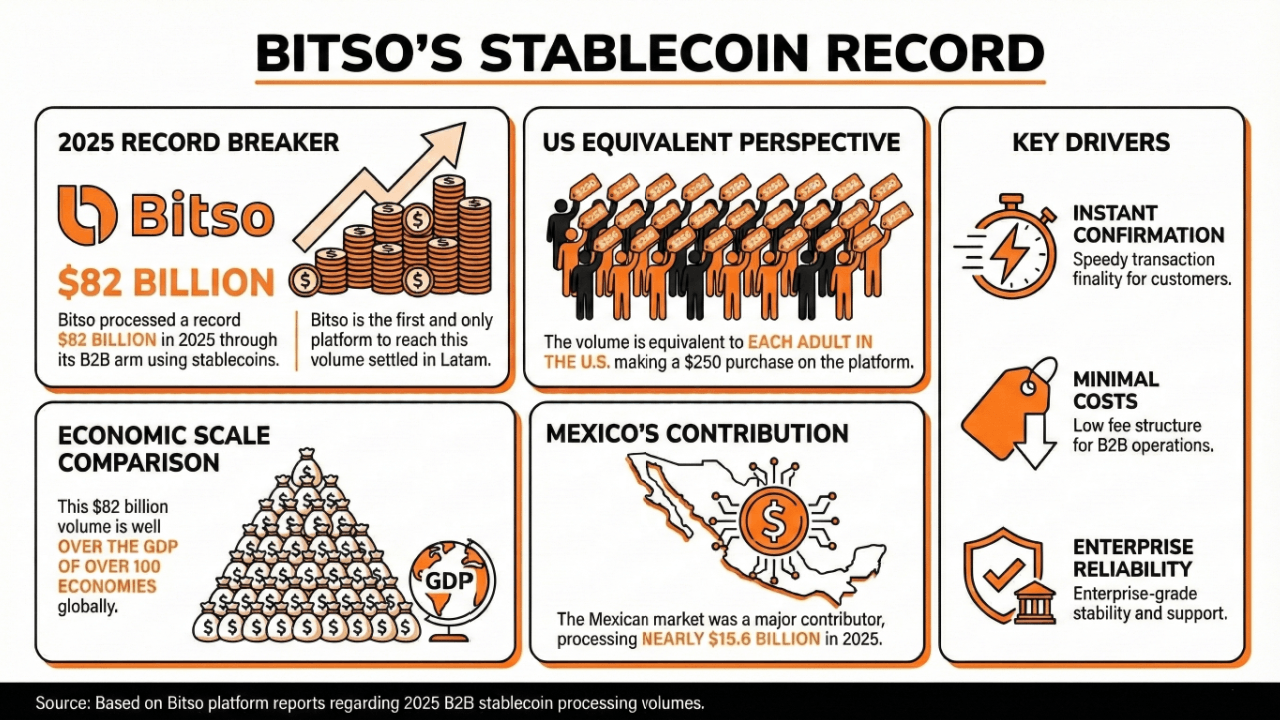

Bitso Enterprise, Bitso’s B2B arm, introduced that it plans to course of roughly $82 billion in stablecoin funds in 2025. Felipe Vallejo, CEO of Bitso and Nation Supervisor of Bitso Mexico, emphasised that this marks the transition to a stablecoin-based infrastructure.

Bitso Enterprise pronounces milestone: $82 billion in stablecoin funds processed in 2025

reality

Bitso, one of many largest cryptocurrency exchanges centered on Latin America, has reached document ranges in processing stablecoin funds within the area.

The platform reported that it processed $82 billion in 2025 utilizing stablecoins via its business-to-business (B2B) division, Bitso Enterprise. This milestone makes it the primary and solely platform to succeed in this sort of quantity in Latin America.

This quantity considerably exceeds the gross home product (GDP) of greater than 100 international locations and is equal to every grownup in america spending $250 on the platform.

The Mexican market was one of many international locations that contributed essentially the most to attaining this purpose, with the corporate processing practically $15.6 billion in 2025 and establishing itself as one of many main enablers of stablecoin funds in Mexico.

Bitso’s grip on the Mexican market is because of its increasing capabilities that provide a number of advantages to clients, together with prompt verification, minimal prices, multilingual help, and enterprise-grade reliability.

learn extra: Bitso Cryptocurrency Latin America Report: Stablecoin adoption will increase, Bitcoin reputation slumps

Why is it related?

Bitso’s progress within the area exhibits that there’s a large alternative to make use of stablecoins for each home and worldwide funds in Latin America, a market that’s nonetheless ripe for exploitation.

Felipe Vallejo, Bitso CEO and Nation Supervisor at Bitso Mexico, positioned this as an early step within the transition from conventional cost system rails to stablecoins.

“Reaching over USD 80 billion is not only a scale milestone, however an indication that the worldwide monetary system is present process a structural transformation in the direction of stablecoin-based infrastructure,” he mentioned.

I am trying ahead to it

Bitso expects these buying and selling volumes to proceed to surge within the quick time period, as Latin America has change into “one of many quickest rising markets for stablecoin-based monetary infrastructure,” in accordance with Imran Ahmad, Bitso COO and Normal Supervisor of Bitso Enterprise.

To proceed its progress in 2026, Bitso will strengthen its service providing with a give attention to connecting with native cost buildings, offering environment friendly cross-border funds, and enabling straightforward integration with different enterprise platforms.

Bitso’s document stablecoin funds FAQ

-

What document did Bitso obtain in 2025 for stablecoin funds?

Bit noticed machined $82 billion It turned the primary alternate in Latin America to succeed in this quantity for stablecoin funds via a B2B platform. -

Which markets have contributed considerably to Bitso’s efficiency?

of mexican market was the primary contributor and did nearly all of the processing $15.6 billion In stablecoin funds, we spotlight its function in native cost facilitation. -

What advantages does Bitso provide its clients?

Bitso’s platform gives: Immediate affirmationlow price, multilingual help, and enterprise-grade reliability for stablecoin transactions. -

What does Bitso’s progress point out concerning the monetary panorama in Latin America?

Bitso’s success is Stablecoin-based monetary system This represents a fast-growing market ripe for innovation.