All information is rigorously fact-checked and reviewed by main blockchain specialists and skilled business insiders.

- Chainlink (LINK) introduced 15 new integrations throughout chains and providers together with Ethereum and Coinbase.

- Main monetary establishments are additionally reportedly engaged on Cross-Chain Interoperability Protocol (CCIP).

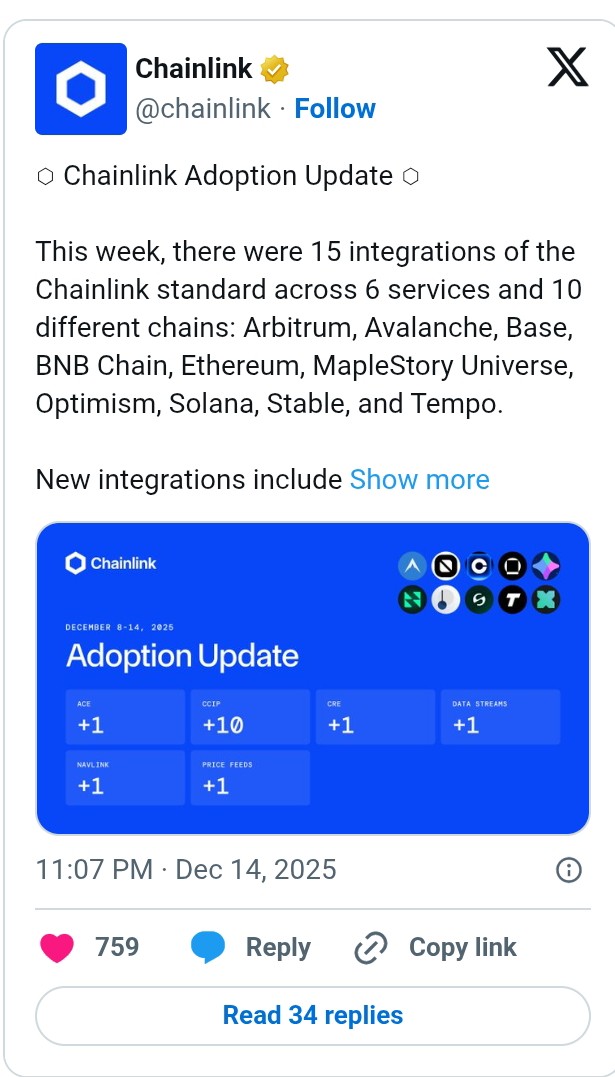

Chainlink (LINK) has seen elevated adoption of its requirements because it continues to dominate the decentralized oracle market. In line with the most recent replace, 15 integrations have been recorded throughout 10 totally different chains and 6 providers up to now 7 days.

Supply: Chainlink of X

Detailing the report, Chainlink revealed that chains at present working on its normal embrace “Arbitrum, Avalanche, Base, BNB Chain, Ethereum, MapleStory Universe, Optimism, Solana, Secure, and Tempo.” Other than these, new integrations have been established with Coinbase, Ascend Protocol, MapleStory Universe, Neox, Pendle, Codatta, and extra.

For Coinbase, it expects Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to function an unique bridge to its $7 billion wrapped asset lineup, as said in a earlier information article.

Different notable partnerships between Chainlink and monetary establishments

On December 12, the all-in-one oracle platform revealed a report highlighting its deep partnerships with main monetary establishments and market infrastructure, together with Swift, DTCC, Euroclear, UBS, and Wellington Administration. The usual reportedly permits monetary establishments to create personalized, compliant, and future-proof blockchain functions.

The corporate says it has realized tens of trillions in worth and enabled the world’s largest on-chain migrations of infrastructure and establishments. The corporate defined the influence of its integration progress on general ecosystem progress and highlighted in its third quarter (Q3 2025) report that Complete Worth Secured (TVS) reached a historic milestone of $100 billion.

The corporate attributes this success to new integrations and a rise within the variety of current customers like Aave. The report states that Chainlink’s oracle market share dominance reaches roughly 70%.

In the meantime, the corporate additionally goals to ascertain world requirements for each decentralized finance (DeFi) and conventional capital markets. As a part of this, we launched the Chainlink Runtime Atmosphere (CRE) to combine blockchain expertise, oracle networks, and sensible contracts into built-in functions.

In line with a earlier weblog submit, Chainlink additionally goals to document extra integrations with new instruments akin to DECO Sandbox. Along with this, we declare to increase the continual evolution of CCIP. That is reported to enrich the protocol’s dependable and safe approach of transferring tokens between chains.

Chainlink’s function in institutional tokenization throughout knowledge, compliance, interoperability, and privateness can be highlighted in analysis papers, such because the report by Blockworks Analysis detailed in our earlier publication.