Bitcoin costs have remained unstable this week as traders await the Financial institution of Japan’s rate of interest choice, scheduled for December nineteenth.

abstract

- Bitcoin costs fell this week as merchants awaited the Financial institution of Japan’s choice on rates of interest.

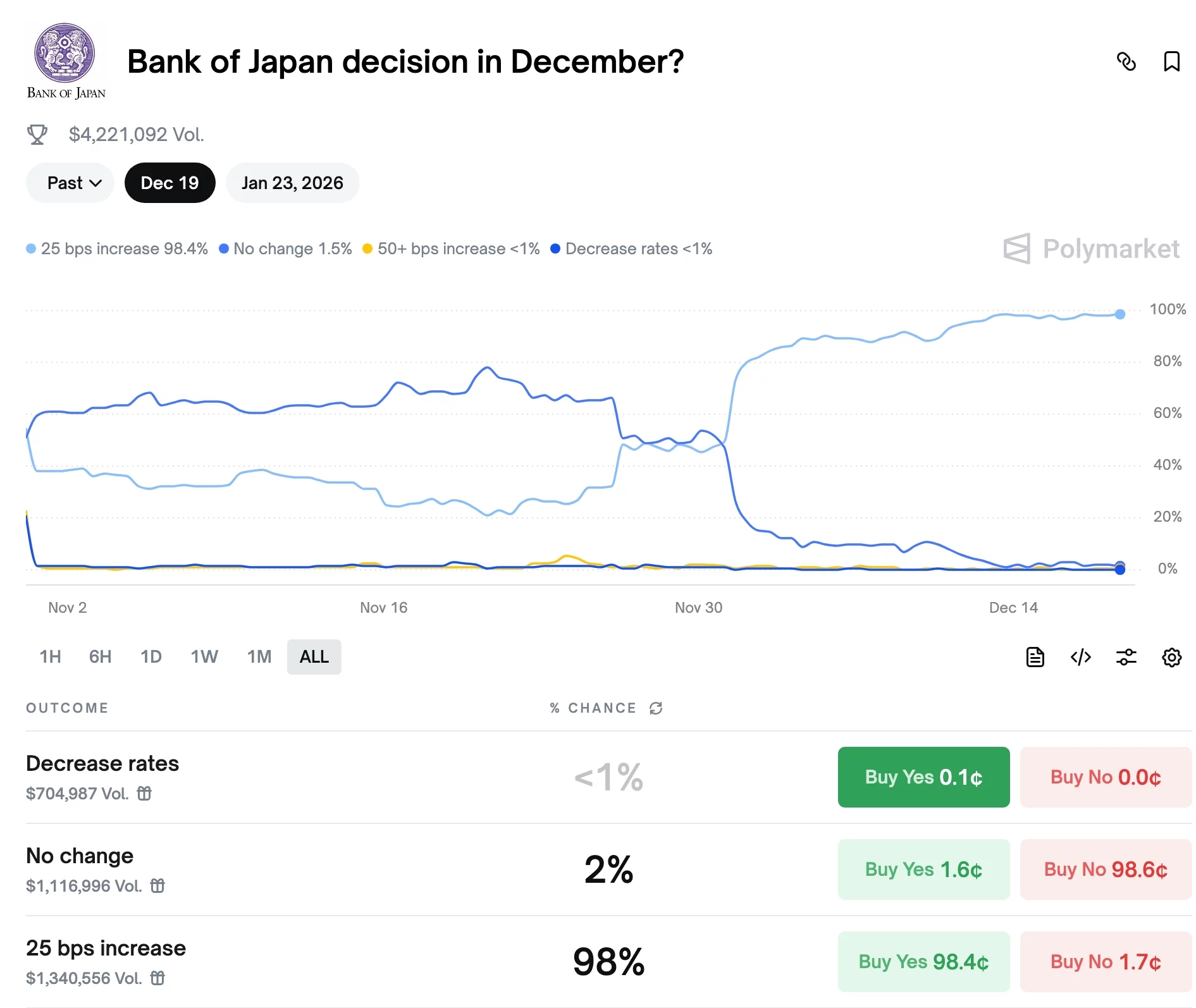

- Polymarket’s fee lower likelihood has risen to 99%.

- Bitcoin has shaped a bearish flag sample on the each day chart.

On the time of writing, the Bitcoin (BTC) token was buying and selling at $87,700. This value was about 7.47% beneath this month’s excessive and 30% beneath the all-time excessive.

The potential of a Financial institution of Japan rate of interest hike is growing

Bitcoin, altcoins, and inventory markets have tumbled in latest days because the likelihood of a Financial institution of Japan fee hike has skyrocketed. Polymarket places the likelihood of a fee hike at 98%.

Chance of Financial institution of Japan rate of interest hike | Supply: Polymarket

The Financial institution of Japan is among the world’s largest central banks, with belongings of over $4.48 trillion, and its fee hikes are vital given its dimension. It’s also the most important holder of US authorities bonds.

You might also like: Bitwise says Bitcoin, Ethereum and Solana will goal for brand spanking new highs as ETF demand surges by 2026

The danger of the Financial institution of Japan elevating charges when the Fed is reducing charges is that it may immediate traders to unwind carry trades. Carry trades happen when traders borrow from international locations with low rates of interest and spend money on high-yield belongings.

Japan has maintained low rates of interest for many years, one of many largest drivers of the carry commerce. Due to this fact, if the yield hole between the U.S. and Japan narrows, traders might promote dangerous belongings they’ve bought.

Nonetheless, there isn’t a likelihood that Bitcoin will fall because of the Financial institution of Japan’s rate of interest hike. The likelihood of a fee hike is 99%, and market members are presently pricing it in. As such, the coin may rebound as traders purchase on the information and settle for the brand new regular.

Technical evaluation of Bitcoin value

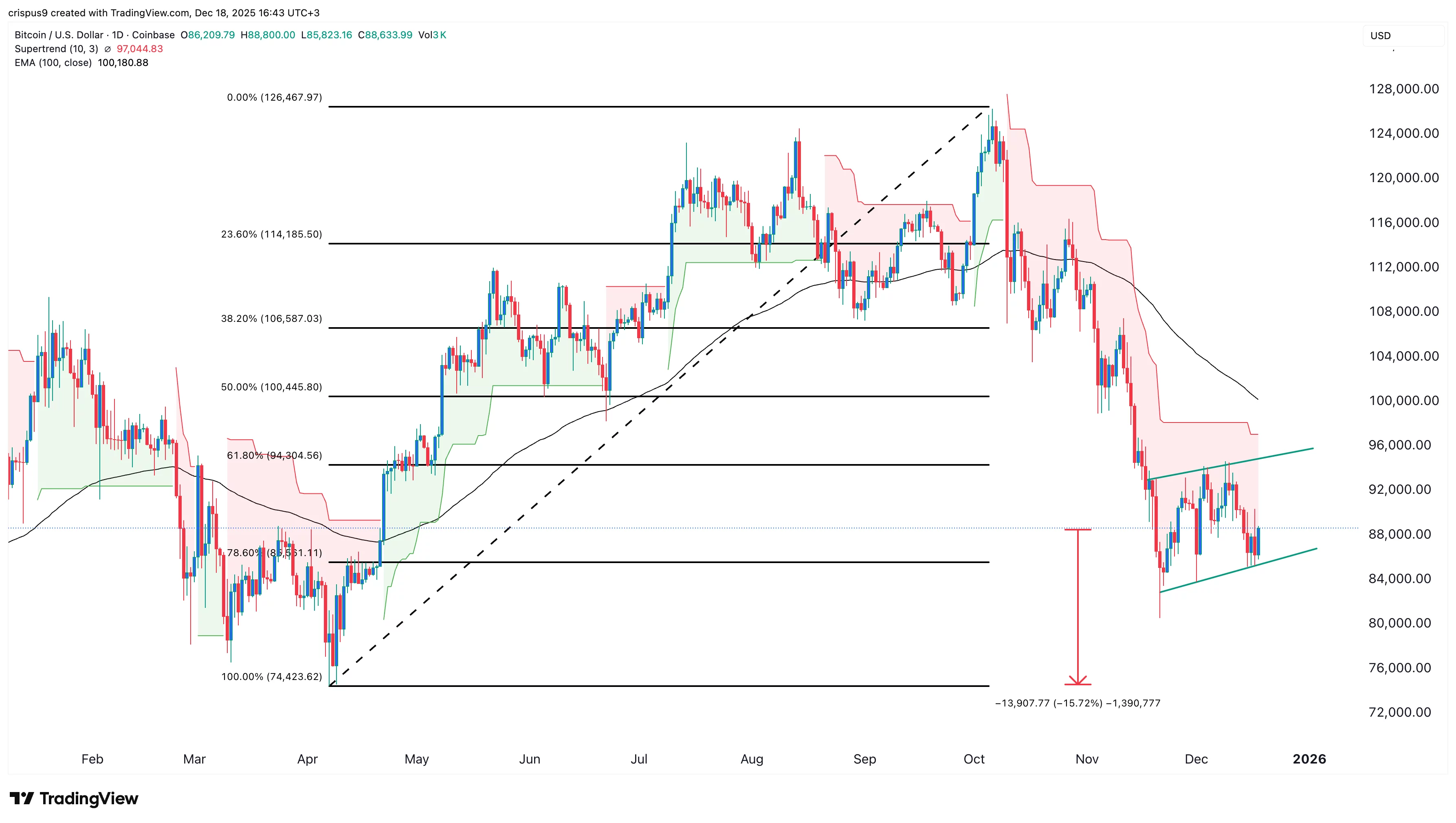

BTC value chart |Supply: crypto.information

The each day chart reveals that Bitcoin’s path of least resistance is bearish within the brief time period. A bearish flag sample is progressively forming. Now we have already completed forming the reverse flagpole and at the moment are coming into the flag part.

Bitcoin stays beneath the supertrend indicator and the 100-day exponential shifting common. It’s also near the 78.6% Fibonacci retracement degree.

Due to this fact, there’s a threat that Bitcoin value will ultimately fall and retest its year-to-date low of $74,423, which is about 15% beneath present ranges.

The outlook for Bitcoin is probably bearish, nevertheless it may rebound and retest the $94,500 prime, earlier than returning to the bearish development once more.

learn extra: Dogecoin value kinds bullish reversal setup on account of whale purchases and declining trade balances