Bitcoin BTC$90,174.13 has thus far rebounded 15% above $90,000 from its Nov. 21 low of about $80,000, supporting a confluence of value analysis throughout three necessary value metrics: 2024 annual volume-weighted value foundation, true market common, and common value foundation for U.S. spot exchange-traded funds (ETFs).

These indicators can assist establish the place traders are almost definitely to defend their positions throughout a drawdown. This space of help was discovered to be extraordinarily necessary because it carefully matched the typical acquisition value of a number of investor cohorts.

First, the true market common represents the typical on-chain buy value of Bitcoin held by energetic market members. This displays the price base of traders almost definitely to commerce because it focuses on cash which have lately moved and excludes long-term dormant provide.

Throughout this decline, the true market common was round $81,000, which served as clear help. Notably, Bitcoin surpassed this degree for the primary time in October 2023 and has not traded beneath this degree since then, reinforcing its significance as a structural bull market threshold.

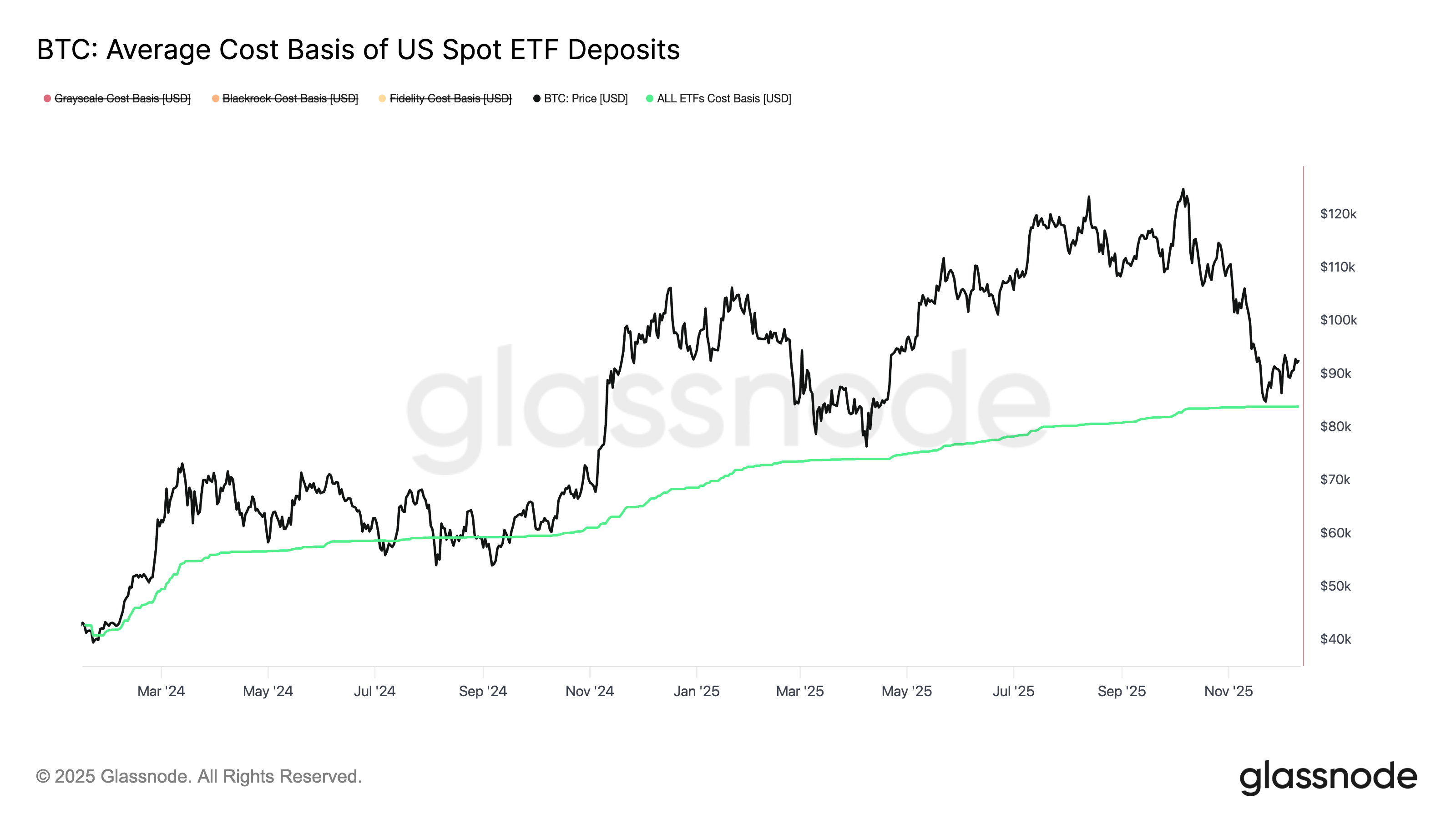

Second, the price foundation of US spot ETFs displays the weighted common value of Bitcoin flowing into US-listed spot ETFs. That is calculated by Glassnode utilizing a mixture of day by day ETF inflows and market costs.

The typical value foundation is at present round $83,844, based on Glassnode, and Bitcoin has rebounded from this degree once more, because it did throughout April’s tariff-driven selloff.

ETF value base (glassnode)

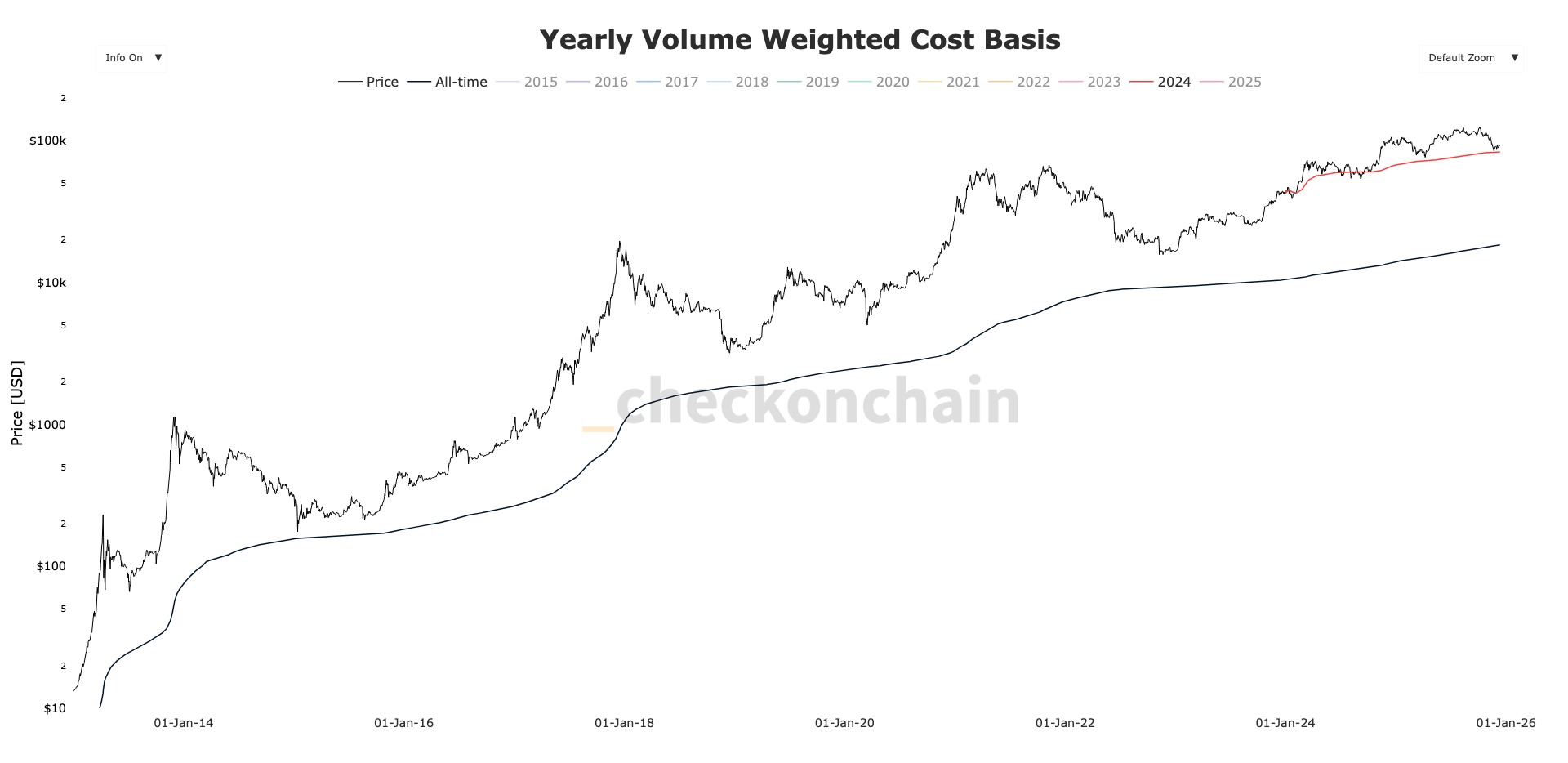

The third metric, 2024 Annual Price Base, tracks the typical value at which cash acquired in 2024 had been withdrawn from exchanges. CoinDesk Analysis confirmed a sample that the annual cohort value base tends to behave as help throughout bull markets.

On this case, based on checkonchain, the 2024 value foundation is near $83,000, additional affirmation of demand, which was additionally thought of help in the course of the April correction.

Annual quantity weighted value foundation (Checkonchain)

These indicators spotlight the depth of help demand within the $80,000 area.