The FED week hasn’t introduced any surprises to the market. The Fed plans to chop rates of interest by 1 / 4 of a share level, a call that three in 10 folks voted in opposition to. Present Fed President Jerome Powell has confirmed one other charge minimize in 2026, however after that the Fed will seemingly take a break because the employment scenario stabilizes, and the Fed’s subsequent focus in its twin mandate will seemingly be on inflation.

However merchants have already begun to downplay the dovish nature of Kevin Hassett, the person recognized for his dovish rhetoric. He mentioned earlier this week that there may very well be greater than three charge cuts.

The euro, yen and different main currencies are pushed by hawkish rhetoric in comparison with the US greenback. For instance, Germany’s 30-year bond yield has reached yet one more document excessive.

Along with reducing rates of interest, the Fed broadcasts about $40 billion in short-term bond buybacks (T-bills) every month, which pushes down actual rates of interest and brings some liquidity to the market. That is seen as a light optimistic for shares, metals and cryptocurrencies.

However whereas U.S. inventory indexes have struggled to take care of momentum, metals have posted strong beneficial properties, with gold above $4,300 and silver at a brand new all-time excessive. Platinum and palladium additionally hit new medium-term highs.

Bitcoin is locked in a comparatively slim buying and selling vary across the 92,000-93,000 value vary and is struggling to take care of momentum. After important outflows from Bitcoin ETFs and a return from cryptocurrencies to fiat belongings, Bitcoin is attempting to regain demand.

To this point, the primary driver now could be the distinction between US and European belongings, favoring the latter. Chinese language shares are additionally attracting large inflows, and hedge funds are bracing for a rally, in keeping with Bloomberg consultants. Given the above data, let’s dig into the potential alternatives.

dachshund

DAX is poised to interrupt by means of the huge integration patterns which were constructing since June 2025. Regardless of the tip of dovish financial coverage within the EU, inflation stays secure at round 2.3%. Equities may additionally appeal to inflows as German bond yields have hit new highs and should not anticipated to proceed rising.

Given the strain on the US greenback and the overheating of the AI sector, European shares appear to be a balanced resolution. Because the probabilities of an instantaneous continuation are comparatively low, the DAX is ready to check the 20-day shifting common earlier than breaking to a brand new peak.

hansen

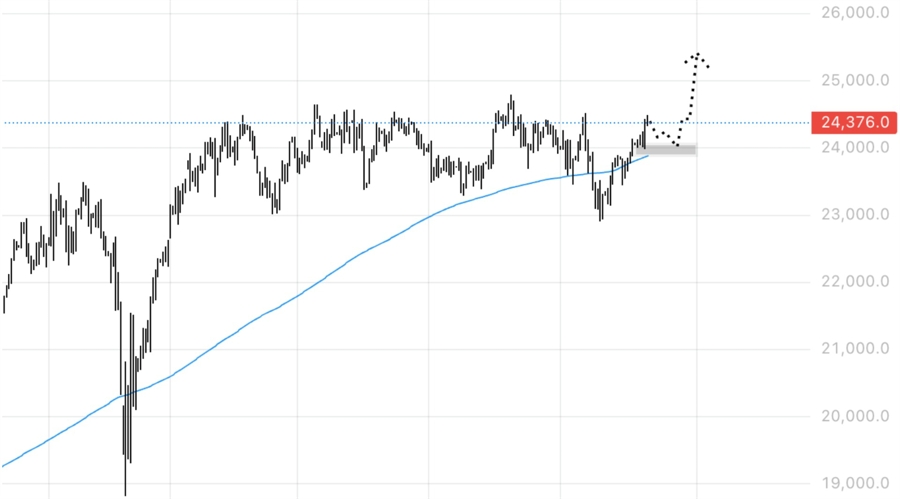

The Cling Seng Index is consolidating simply above its 200-day shifting common.

The market is shedding volatility and might have to check the strategic help zone (200-day shifting common) under to discover a set off for a transfer.

This can be a frequent sample for triangular formations. Speedy value results can swing you each methods earlier than you determine on a course.

The logical vacation spot is the 24500 space. After testing this space, the market could reverse and transfer increased, creating shopping for strain as proven within the chart under.