Bitcoin stays in a tightening vary simply above $80,000. Regardless of the latest restoration from sub-$85,000 ranges, the general tone of the market stays cautious. There isn’t any significant breakout and sentiment has not but turned bullish.

BTC technical evaluation

Written by Shayan

every day chart

On the every day timeframe, the value remains to be trapped throughout the descending channel that has been lively for the previous few months. BTC just lately rebounded from the $81,000 help zone and has made a sequence of recent lows since then. Nevertheless, every push is capped at roughly $95,000, which is slightly below the higher restrict of the channel and the principle bearish order block.

The asset is presently buying and selling beneath its 100-day and 200-day transferring averages and is curving downwards round $107,000. It is a clear signal that consumers are nonetheless battling macro tendencies. The construction stays bearish to impartial until a powerful every day shut above $96,000 happens.

4 hour chart

Zooming in on the 4H chart, BTC has shaped a transparent ascending triangle between $80,000 and $95,000. This kind of construction typically resolves to the upside, however provided that quantity and momentum help a breakout. In the meanwhile, breakout makes an attempt round $94,000 proceed to be rejected.

There’s a narrowing between trendline help and horizontal resistance, and the value is nearing the highest. Due to this fact, a breakout or breakdown might happen throughout the subsequent few classes.

Consumers will likely be hoping for a clear breakout above $95,000 and quantity focusing on the $100,000 zone. However, sellers will deal with a break beneath the uptrend line and intention for a retest of $85,000 and even the essential $80,000 space.

On-chain evaluation

Bitcoin alternate reserves

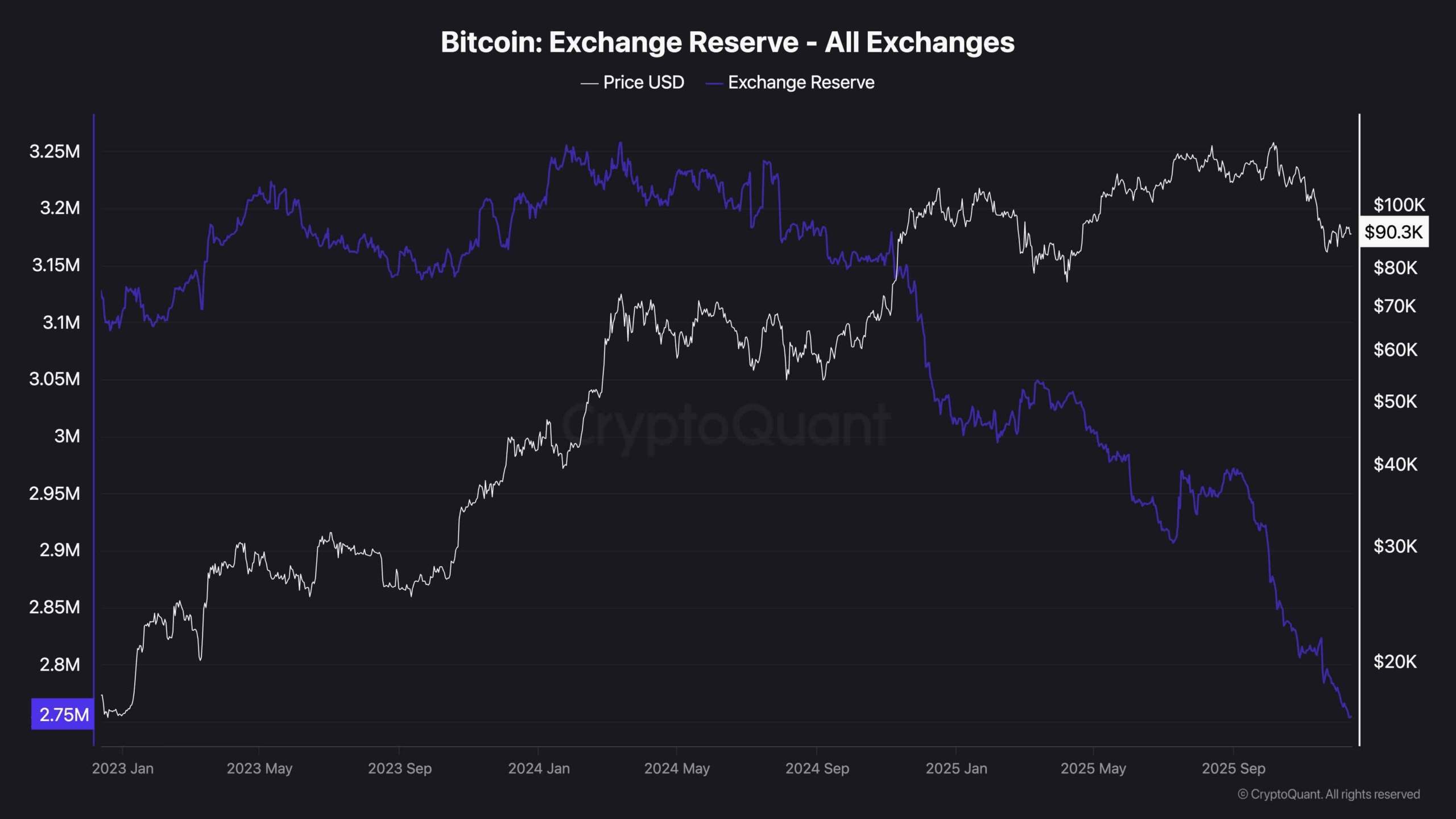

Alternate reserve information paint a extra fascinating image. The alternate’s BTC reserves proceed to say no considerably and are presently at a multi-year low of round 2.75 million BTC. This often means that long-term holders will not be occupied with promoting and provide is drying up.

Nevertheless, this isn’t but mirrored in worth energy. The divergence between declining reserves and flat worth tendencies signifies that regardless of low alternate provide, demand is just not but sturdy sufficient to drive costs up.

This could possibly be as a result of institutional flows and retail curiosity stay weak at present ranges, or as a result of capital is sitting on the sidelines ready for macro transparency. Till spot demand turns into critical, declining reserves alone is not going to be sufficient to set off a sustainable bull market.