Bitcoin fell under $90,000 this week as a consequence of a mixture of liquidation strain, weak ETF demand, and macro uncertainty.

The decline erased positive factors from earlier makes an attempt to reclaim the $94,000-$95,000 zone, marking the second main decline this month.

Market-wide compelled liquidation

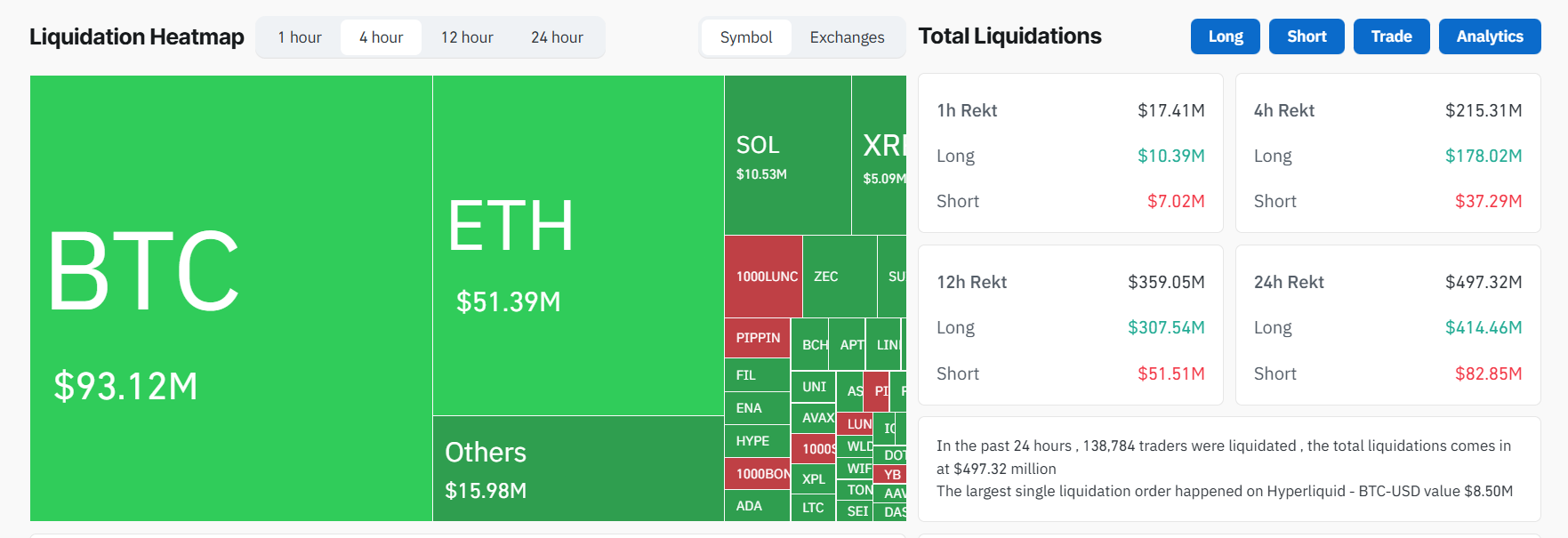

The set off was a sequence of compelled long-term liquidations. Roughly $500 million was worn out throughout the alternate, together with roughly $420 million in lengthy positions, and greater than 140,000 merchants had been liquidated inside 24 hours.

Cryptocurrency clearing immediately. Supply: Coinglass

ETF flows had been unable to soak up the promoting. BlackRock’s iShares Bitcoin Belief recorded six consecutive weeks of whole outflows of greater than $2.8 billion.

U.S. ETF inflows fell to simply $59 million on Dec. 3, indicating much less urge for food from institutional buyers.

The US Bitcoin ETF recorded an outflow of roughly $195 million on December 4, 2025. Supply: SoSoValue

Macro strain provides gasoline to the drop

The macro background turned hostile. The Financial institution of Japan has signaled the opportunity of elevating rates of interest, threatening the liquidity of the carry commerce that has stored the world’s dangerous property afloat.

Bitcoin fell right into a cautious holding sample between $91,000 and $95,000 as merchants additionally prevented threat forward of the US PCE inflation announcement.

BREAKING: Bitcoin soars above $1,500 after lower-than-expected PCE information. However then it crashed by -$3500 in 60 minutes.

This worn out $155 million value of lengthy positions up to now hour.

There isn’t a adverse information or sudden FUD that may trigger this type of sudden dumping.

Apparently… pic.twitter.com/G3twQw0Yud

— Bull Principle (@Bull Theoryio) December 5, 2025

The most recent U.S. PCE information was broadly consistent with expectations, exhibiting core inflation has declined however stays above the Fed’s goal.

Markets reacted cautiously, deciphering the print as proof that inflation continues to ease, however not quick sufficient to warrant a fast fee reduce.

Company indicators amplified concern. MicroStrategy warned that if its authorities bond valuation ratio falls, it might promote Bitcoin and trigger its inventory worth to fall by 10%.

Power prices rose, hashrate fell, and stress for miners elevated as high-cost operators started liquidating BTC to remain solvent.

On-chain flows mirrored divided sentiment. Matrixport has moved over 3,800 BTC from Binance to chilly storage, suggesting accumulation amongst long-term holders.

However analysts estimate that at present costs, 1 / 4 of circulating provide stays underwater.

Matrixport withdrew 3,805 $BTC($352.5M) from #Binance within the final 24 hours. https://t.co/GLzqCvlogX pic.twitter.com/54whKSsISy

— Lookonchain (@lookonchain) December 5, 2025

Neighborhood sentiment exhibits concern – but in addition some optimism

Merchants on social platforms debated whether or not the transfer was pure or manipulated. Market analysts primarily blamed extreme leverage, illiquidity and macro hedging reasonably than coordinated worth intervention.

Some pointed to long-term optimism, citing JPMorgan’s new 2026 pricing mannequin of $170,000.

Bitcoin is at present buying and selling close to an vital pivot. A liquidation cluster between $90,000 and $86,000 will depart the market weak with out new ETF inflows or easing of macro pressures.

For the restoration momentum to be confirmed, the pair wants to maneuver again above $96,000-$106,000.

For now, the tape is dominated by volatility. Bitcoin fell, rallied, and broke once more. And merchants are maintaining a tally of the following decisive transfer.

The publish Why did Bitcoin drop under $90,000 once more? A breakdown of the most recent sell-offs appeared first on BeInCrypto.