Ethereum has pulled again from the $3,240 stage and is presently testing the $3,150 zone as help, making it a key space for merchants to look at. Bulls wish to defend this stage after a modest pullback, however uncertainty stays excessive because the market makes an attempt to determine course after weeks of volatility and aggressive promoting strain. Whereas some analysts see this development because the early levels of a restoration, others warn that ETH may nonetheless fall additional if momentum doesn’t strengthen.

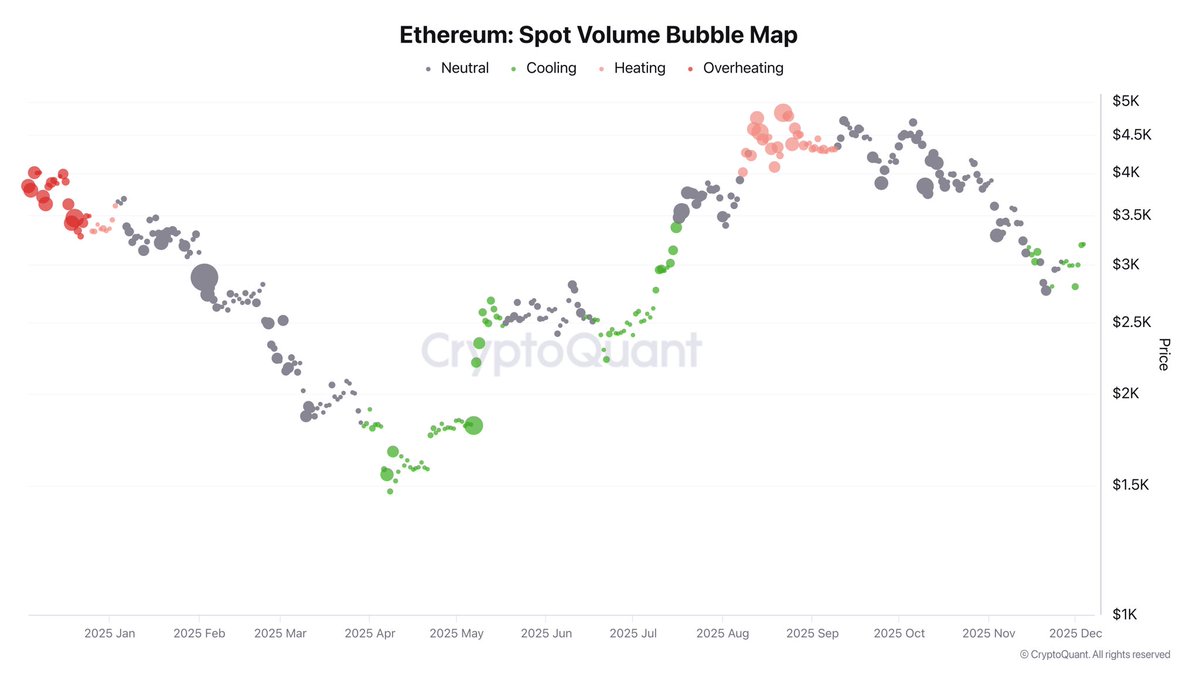

In keeping with prime analyst Dirkforst, Ethereum’s latest worth actions have been formed by vital modifications in market construction. Over the previous few days, spot buying and selling volumes continued to say no at the same time as costs tried a slight restoration. This weakening of spot exercise reduces the influence of precise shopping for and promoting on the underlying asset, making the futures market more and more influential in figuring out short-term worth course.

As Dirkforst explains, when spot quantity thins out, futures usually turn out to be the dominant supply of volatility. This dynamic can speed up each upside and draw back actions, relying on the dealer’s positioning. Ethereum is presently at an vital help stage, and the market is ready for clearer alerts to find out whether or not this pullback develops right into a sustained restoration or just marks a pause within the downtrend.

Ethereum stakes rise with futures-led momentum

Dirkforst additional elaborates on this transfer by noting that when spot quantity weakens to the extent seen over the previous few days, the danger of elevated volatility will increase sharply. Skinny spot liquidity means there are fewer purchase and promote orders obtainable to soak up sudden actions, and futures-driven momentum has a larger influence on costs. This surroundings usually ends in sharper swings and speedy modifications in course as leveraged merchants and algorithmic methods dominate short-term market motion.

For now, the futures market is tilted to the upside, offering constructive pressure for Ethereum to interrupt above the $3,150 help zone. Dirkforst highlights that this upward strain from futures may work within the bulls’ favor, because the spot market may comply with the identical trajectory if volatility expands to the upside.

In different phrases, a sustained futures-led rally may function the catalyst wanted for a broader restoration, particularly if spot consumers acquire confidence and start to re-enter the market.

Nevertheless, this setting has a two-way impact. Except spot participation strengthens, a reversal in futures positions may shortly result in accelerated downward strain. For now, Ethereum is in a fragile stage the place volatility is each a possible catalyst and a possible menace, and the subsequent few periods shall be essential in figuring out the near-term course of the market.

ETH weekly construction holds vital help

Ethereum’s weekly chart reveals that the market is trying to stabilize after a pointy decline from the $4,500 space. ETH rebounded in direction of $3,140 and regained its 100-week transferring common (inexperienced line). This can be a traditionally vital help stage that usually defines the boundary between bullish and bearish phases within the medium time period. This rally signifies renewed demand in key zones, particularly after the robust core rejection seen round $2,700 the place consumers intervened aggressively.

Nevertheless, Ethereum nonetheless faces vital resistance overhead. The 50-week transferring common (blue line) is presently hovering round $3,400-$3,500, however it has become resistance and stays the subsequent huge hurdle for bulls. If the restoration of this zone is profitable, it should considerably enhance the technical construction of ETH and open the door to higher-level challenges. Till then, the weekly development stays impartial to barely bearish.

Quantity is offering encouraging alerts. The latest rally comes with a notable enhance in shopping for exercise in comparison with the earlier week, suggesting power of curiosity at these decrease ranges. Nevertheless, the broader construction reveals a sample of excessive declines since August, which means ETH wants to point out follow-through to keep away from reverting to deeper consolidation.

Featured picture from ChatGPT, chart from TradingView.com