Major highlights

- Bitcoin rises, leaping 8% in 24 hours to greater than $92,000

- The rise got here after Vanguard introduced: This can give the brokerage’s shoppers entry to funding funds similar to ETFs targeted on Bitcoin, Ethereum, XRP, and Solana.

- The cryptocurrency’s surge is seen as sparking additional upward momentum forward of the Fed assembly on December tenth.

On December 2nd, the biggest cryptocurrency Bitcoin (BTC) soared greater than 8% on the each day chart, leaping from $84,800 to greater than $92,000.

On the time of writing, the cryptocurrency was buying and selling at round $91,740, with a market cap of a formidable $1.83 trillion, in accordance with CoinMarketCap.

Why is Bitcoin rising?

One of many fundamental causes for the upward pattern is the buildup of Bitcoin by whales. Crypto whales took the initiative final month and launched various large-scale transfers. They’re transferring tens of millions of {dollars} value of Bitcoin from safe private wallets to exchanges and to new, unknown addresses.

BlackRock deposited 1,634 $BTC($142.6M) to #CoinbasePrime. https://t.co/qmuDIrPHc6 pic.twitter.com/sP3Mm1JOPW

— Lookonchain (@lookonchain) December 2, 2025

For instance, BlackRock has deposited 1,634 Bitcoins value $142.6 million with Coinbase Prime. Some consultants imagine this can be a tactic to sway small buyers and create a possibility to purchase extra Bitcoin at a cheaper price.

Information from the evaluation platform Arkham reveals uncommon ranges of whale exercise in November. Over $100 million value of Bitcoin was transferred from chilly storage wallets to exchanges in a number of transfers.

Typically, any such transaction signifies {that a} main holder is making ready to promote their holdings.

Vanguard opens the door to Bitcoin ETFs

Vanguard, a serious asset administration firm, made a serious announcement on December 2nd. The corporate modified its earlier stance and revealed that it’s going to now permit brokerage shoppers to entry funding funds similar to ETFs targeted on Bitcoin, Ethereum, XRP, and Solana.

Vanguard impact: Bitcoin rose 6% close to the US Open on the primary day after the ban on Bitcoin ETFs was lifted. Coincidence? I am afraid not. Moreover, IBIT’s buying and selling quantity reached $1 billion within the first half-hour of buying and selling. Even among the many most conservative buyers knew there was a little bit of perversion in Vanguardian… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

“Cryptocurrency ETFs and mutual funds have been examined by way of intervals of market volatility and have carried out as designed whereas sustaining liquidity,” stated Andrew Kajeski, head of brokerage and investments at Vanguard. “The administration processes for servicing a lot of these funds have matured and investor preferences proceed to evolve.”

That is thought-about to be one of the vital information tales of immediately that prompted an increase within the cryptocurrency market.

Based on market consultants, the cryptocurrency market is displaying indicators of restoration. We’re already beginning to construct a bullish outlook for the massive day of December tenth, when the following Fed assembly might be held.

Based on crypto fortressthe following vital level is anticipated to be on December 4th. The intraday worth motion will probably point out short-term path. If costs rise on December 4th, a short-term reversal is anticipated. Conversely, if costs fall, the downtrend is more likely to proceed.

The worth of Bitcoin is presently buying and selling simply 19% above the estimated common price of electrical energy for miners to supply Bitcoin. Traditionally, market costs have fallen beneath this vital manufacturing price threshold solely twice up to now 5 years. The primary time was in the course of the world monetary disaster in March 2020, and it occurred once more in April 2024.

This stage is presently a serious focus for consultants, as any potential decline beneath this stage is more likely to set off a wave of mine surrenders.

Nonetheless, there are additionally some contradictory predictions concerning Bitcoin. For instance, one analyst stated that Bitcoin’s 4-hour candlestick failed to shut the physique above a sure stage.

“At the moment, nobody can confidently say that Bitcoin will rise till it breaks by way of that stage, that’s, till the definitive 4-hour candlestick breaks above that stage,” the analyst stated.

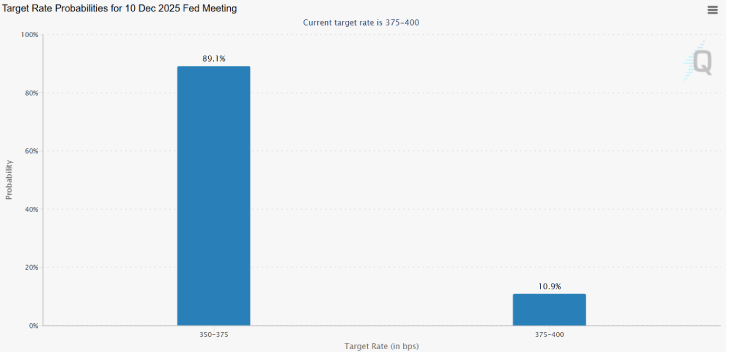

(Supply: CME Group)

Individually, expectations for decrease federal rates of interest are additionally rising. CME Group’s indicators present there’s about an 89% likelihood that the Fed will minimize charges by 25 factors.