Members of the Bitcoin neighborhood and supporters of Technique, the biggest company holder of BTC, have criticized JPMorgan’s proposed Bitcoin-backed bonds, accusing the financial institution of spreading concern, uncertainty, and suspicion about Technique and different crypto treasury corporations.

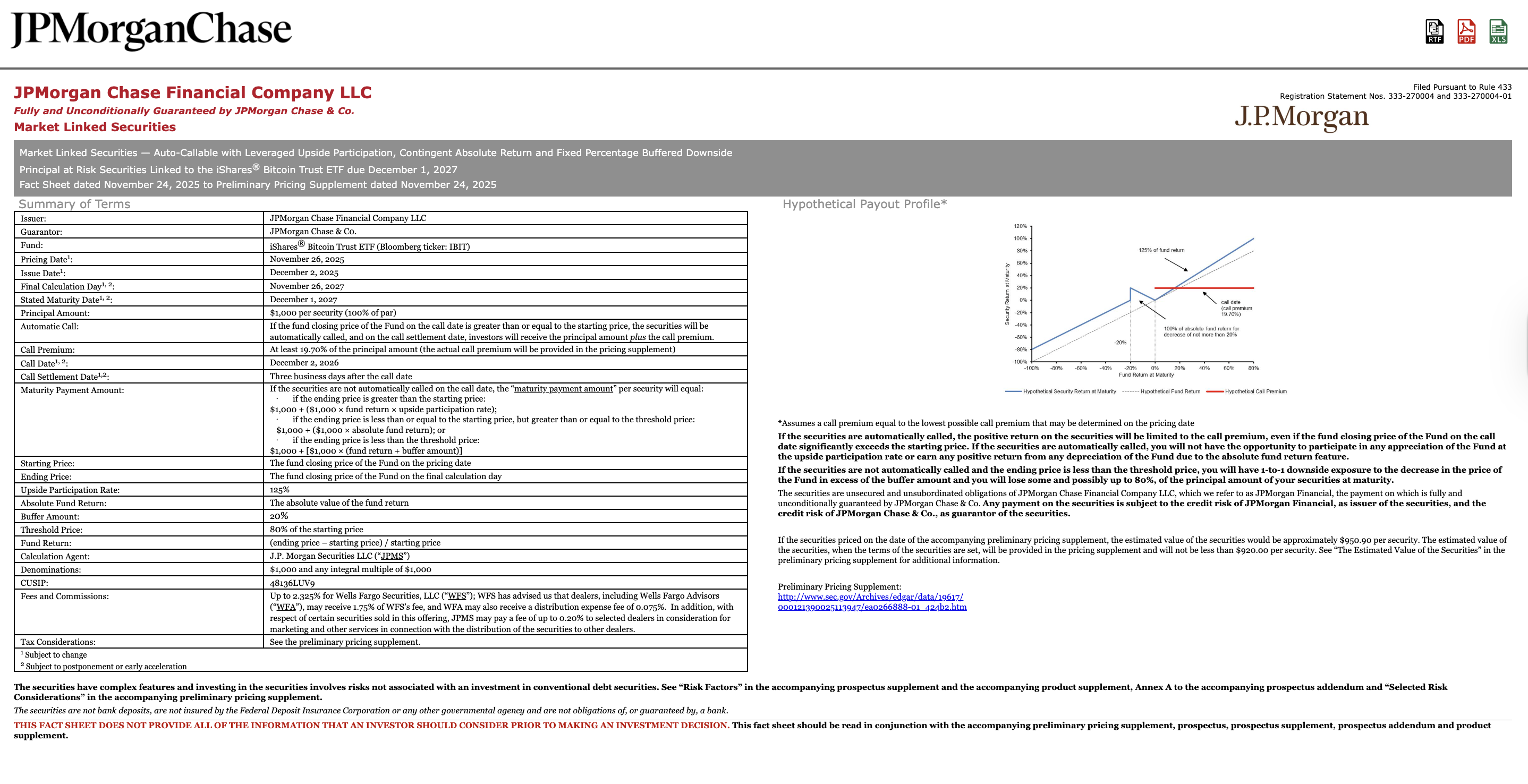

JPMorgan bonds are leveraged funding merchandise which might be linked to the value of Bitcoin (BTC). This product tracks BTC however amplifies its outcomes, giving holders 1.5x earnings or losses till December 2028. The observe is predicted to be issued in December 2025, in accordance with SEC filings.

The transfer drew sharp criticism from the Bitcoin neighborhood, with many saying JPMorgan is now a direct competitor to BTC Treasury and has an incentive to marginalize corporations like Technique with the intention to promote its personal structured finance merchandise.

JPMorgan Bitcoin Notes Reality Sheet. sauce: JP Morgan

“Saylor opened the door to a $300 trillion bond market and a $145 trillion bond market. Now JPMorgan is issuing Bitcoin-backed bonds to compete,” Bitcoiner X stated, including, “The identical establishments which might be attacking MSTR are copying the technique.”

Bitcoin advocate Simon Dixon additionally identified that JPMorgan’s subsequent product exists to “set off a margin name on Bitcoin-backed loans,” and argued that it could “pressure promoting stress from Bitcoin bond corporations in a down market.”

At X, crypto lovers and technique advocates are presently calling for a boycott of JPMorgan, encouraging fellow Bitcoiners to shut their accounts with the monetary providers large and promote any shares they could have within the firm.

sauce: bitcoin therapist

MSCI rule change proposal causes battle

The backlash in opposition to JPMorgan started after MSCI (previously Morgan Stanley Capital Worldwide), the corporate that manages inventory indexes and units index inclusion standards, proposed a change in coverage to exclude monetary corporations from its merchandise.

The proposed modifications, that are scheduled to take impact in January, would prohibit crypto corporations that handle greater than 50% of their belongings in cryptocurrencies from being included within the index.

JPMorgan shared the proposed coverage change in a November analysis observe, which drew harsh criticism from the BTC neighborhood and technique traders.

Excluding crypto treasury corporations from inventory indexes might deprive them of passive capital flows and pressure these corporations to promote their crypto holdings to qualify for index inclusion, additional miserable asset costs.