Bitcoin’s worth efficiency within the ultimate quarter of 2025 has been a significant concern for crypto fans, and rightly so. At one level up to now few weeks, the premium cryptocurrency regarded like it might finish the 12 months deep within the crimson zone.

Over the previous week, Bitcoin worth has proven indicators of a wholesome restoration, regaining a major help stage at $90,000. Crypto consultants say the market chief could also be performing higher than the charts presently present.

Has BTC already set its worth?

In a Nov. 28 put up on social media platform Questions that Bitcoin buyers are continuously confronted with.

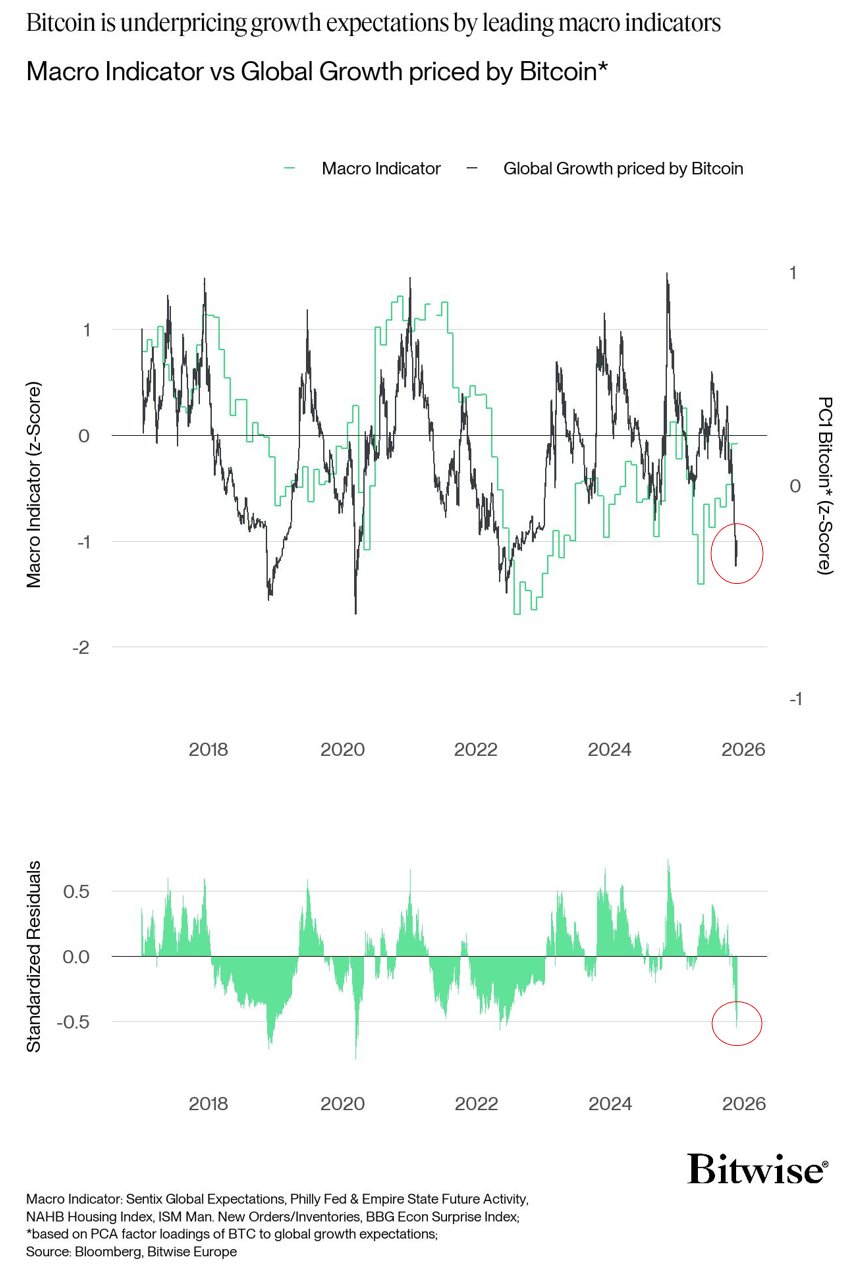

The macro analyst says the flagship cryptocurrency is pricing within the weakest world progress outlook since 2022 (marked by Federal Reserve tightening and the collapse of FTX) and 2020 (within the midst of the COVID-19 pandemic).

Dragos revealed that through the use of a sequence of key macro research, he was capable of decide the extent of worldwide progress expectations that Bitcoin is already pricing in. “Bitcoin is actually priced in a recessionary progress atmosphere,” Bitwise researchers wrote.

Dragosh added:

Personally, I am a macro contrarian as a result of Bitcoin can underperform or overperform the overall macro outlook. Asset pricing is basically decided by macro sentiment. In my view, that is the place many of the alpha is created.

As talked about above, the final time macro expectations had been this pessimistic was in 2020 and 2022, when Bitcoin underperformed macro expectations earlier than making a robust restoration. Dragosh believes {that a} reenactment of this situation is presently underway.

Supply: @Andre_Dragosch on X

Bitwise head of European analysis then mentioned: “Based mostly on the quantity of economic stimulus thus far, world progress expectations will speed up from right here. This factors to a re-acceleration by means of 2026.”

Dragosh mentioned the final time there was this uneven risk-reward was throughout a pandemic, when Bitcoin costs initially crashed in the course of the shock of March 2020, earlier than hovering sixfold by the tip of the 12 months. This macro setting might be in comparison with a “coiled spring or a ball in water.”

In line with the macro analyst, Bitcoin’s present trajectory seems to be within the type of a “coiled spring,” that means the value could also be poised for a violent transfer after a interval of momentary compression. Dragosh concluded his evaluation by saying that buyers aren’t bullish sufficient in any respect.

Bitcoin worth overview

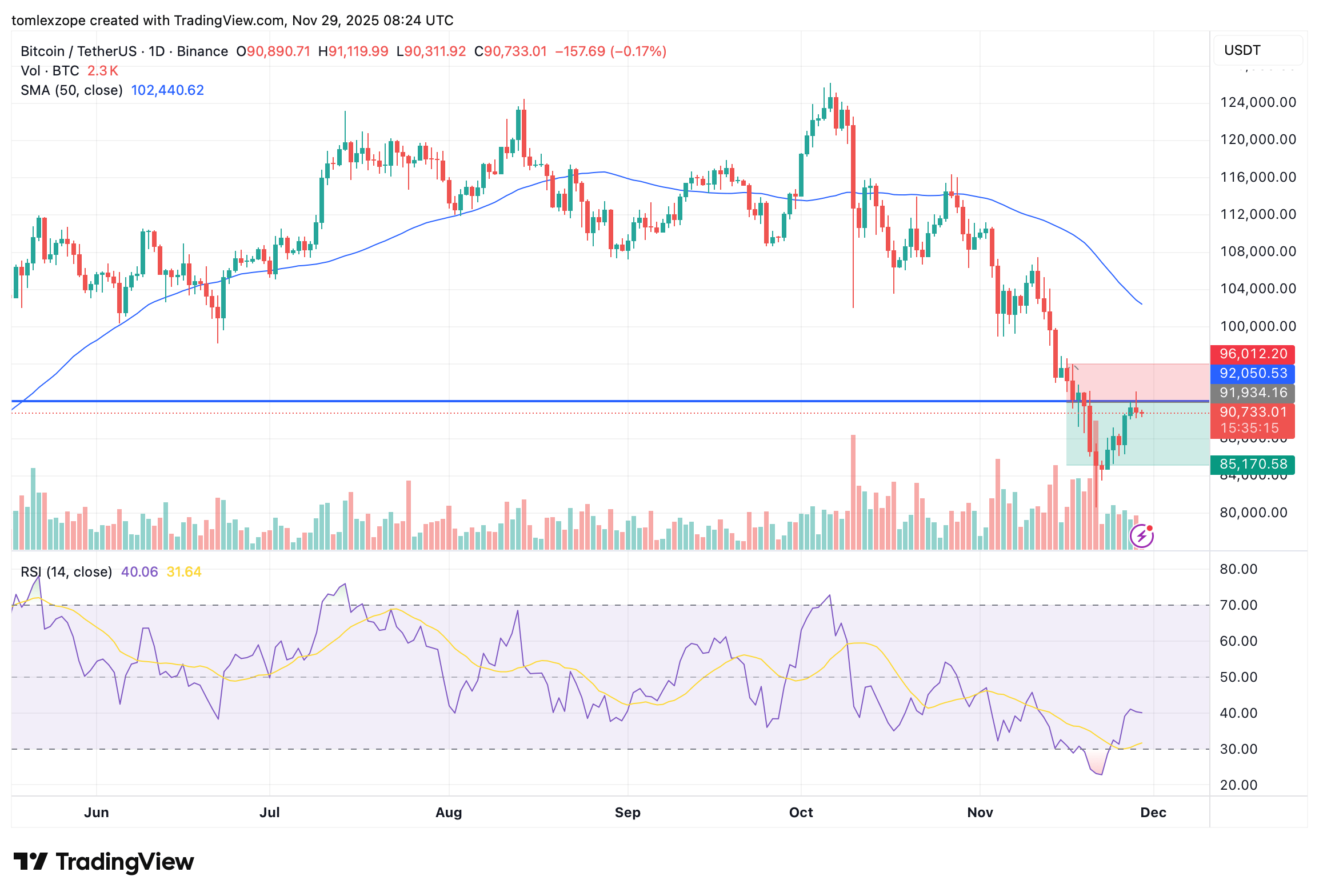

As of this writing, the value of BTC is round $90,880 with no vital motion up to now 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView