Ethereum misplaced the $3,000 mark and didn’t regain it for days, elevating issues that the market is getting into a deeper correction. Promoting stress continues to construct as merchants exit positions and sentiment turns cautious.

The general cryptocurrency market can be in a droop, fueling hypothesis {that a} bear market may kind prior to most anticipated. Concern and uncertainty are at the moment dominating social indicators, derivatives knowledge, and spot flows, with buyers questioning whether or not ETH has already set a cycle prime. Nevertheless, regardless of the pessimism and deteriorating worth construction, not all gamers are exiting. In truth, among the largest market members are actively build up capital.

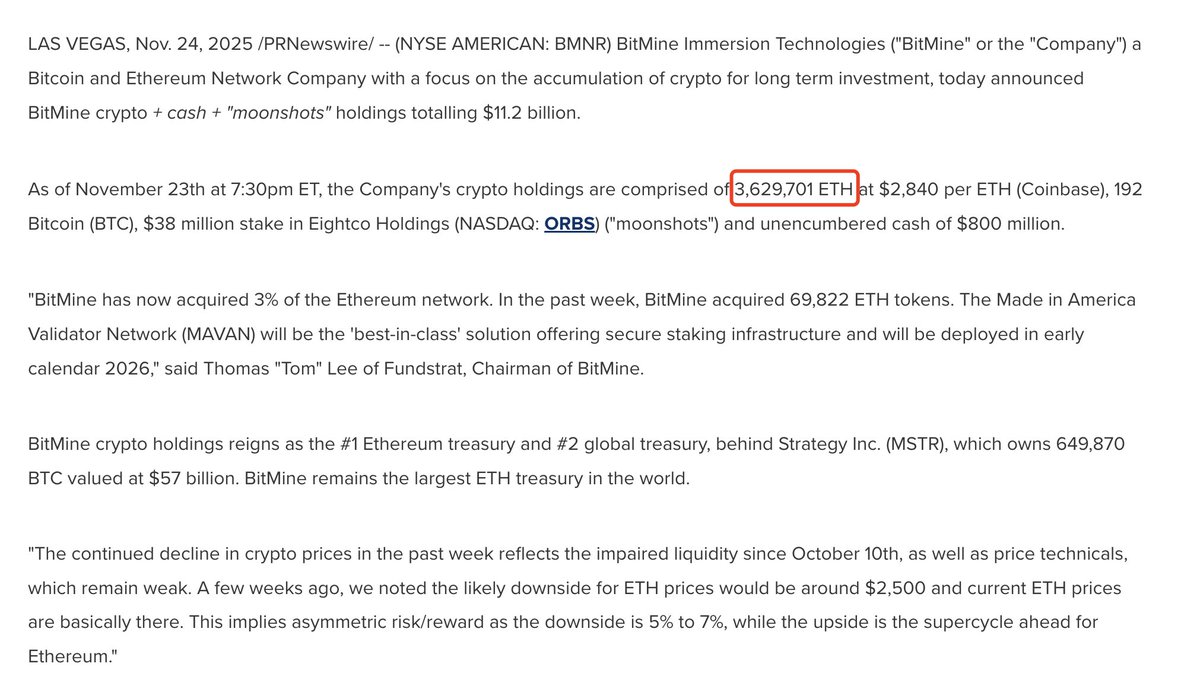

New knowledge from Lookonchain reveals that Tom Lee’s Bitmine bought 69,822 ETH price $197.25 million within the final week alone. This brings their whole holdings to a staggering 3,629,701 ETH, price roughly $10.25 billion.

Bitmine faces large unrealized losses as market waits for path

In keeping with Bitmine’s press launch, the corporate’s common buy worth was near $3,997, leading to roughly $4.25 billion in unrealized losses at present market ranges. This disclosure highlights the quantity of conviction behind Bitmine’s accumulation technique, nevertheless it additionally highlights how deeply Ethereum has reversed from its current highs. The continued drawdown displays the broader uncertainty gripping the market, with concern and hesitation overwhelming momentum and liquidity remaining skinny.

The market is at the moment getting into a vital section that would decide worth tendencies within the coming months, as merchants assess whether or not ETH can stabilize and start to regain misplaced floor. Many analysts argue that regardless of the sharp retracement, Ethereum remains to be positioned to get better, particularly if the macro setting improves and promoting stress eases. They level out that traditionally, comparable aggressive whale accumulations have occurred in periods of market downturns, preceded by sturdy rebounds and restoration of investor confidence.

Nevertheless, some warn that if ETH is unable to regain momentum above a key psychological stage, the draw back continuation may deepen additional. Due to this fact, this second is the distinction between bullish expectations and bearish warning.

Ethereum worth motion exhibits weak restoration makes an attempt amid bearish construction

Ethereum worth motion on the each day chart continues to replicate a market struggling to regain upward momentum after shedding the $3,000 stage. Whereas the current pullback to $2,900 signifies a brief response, the general construction stays bearish as ETH trades under its 50-day, 100-day, and 200-day transferring averages.

This transferring common alignment (quick common sitting under gradual common) confirms a sustained downward development that has been underway since early October.

The chart additionally exhibits decrease highs and decrease lows, confirming that consumers haven’t but regained management. A spike in quantity throughout a decline signifies that bearish exercise is driving market motion relatively than accumulation. Regardless of the transient restoration, any makes an attempt to maneuver greater have been rejected close to resistance close to the $3,150-$3,250 vary, suggesting that sentiment stays fragile.

Moreover, the purple 200-day transferring common close to the $3,500 zone is now an necessary long-term threshold. If ETH is unable to regain this space within the coming weeks, we’ll seemingly see continued consolidation or a extra extreme correction.

For now, Ethereum stays in a weak place and wishes stronger demand to show the development again to the bullish aspect.

Featured picture from ChatGPT, chart from TradingView.com