$WULF targets 250-500 MW of recent HPC signatures every year and plans to mine Bitcoin till at the very least the top of 2026.

The next visitor put up is from bitcoinminingstock.io, A public market intelligence platform that gives information on firms uncovered to Bitcoin mining and crypto treasury methods. First printed by Cindy Feng on November 13, 2025.

It is earnings season once more, and lots of firms have introduced fascinating updates, however TeraWulf’s Q3 2025 convention name caught my consideration. Not due to the income numbers, however as a result of it alerts what could possibly be the subsequent working mannequin for Bitcoin miners. Beneath all of the speak about AI/HPC, leasing, and gigawatts, some miners come to mild power infrastructure supplier In direction of the AI period.

Let’s break it down.

Growth of transaction dimension

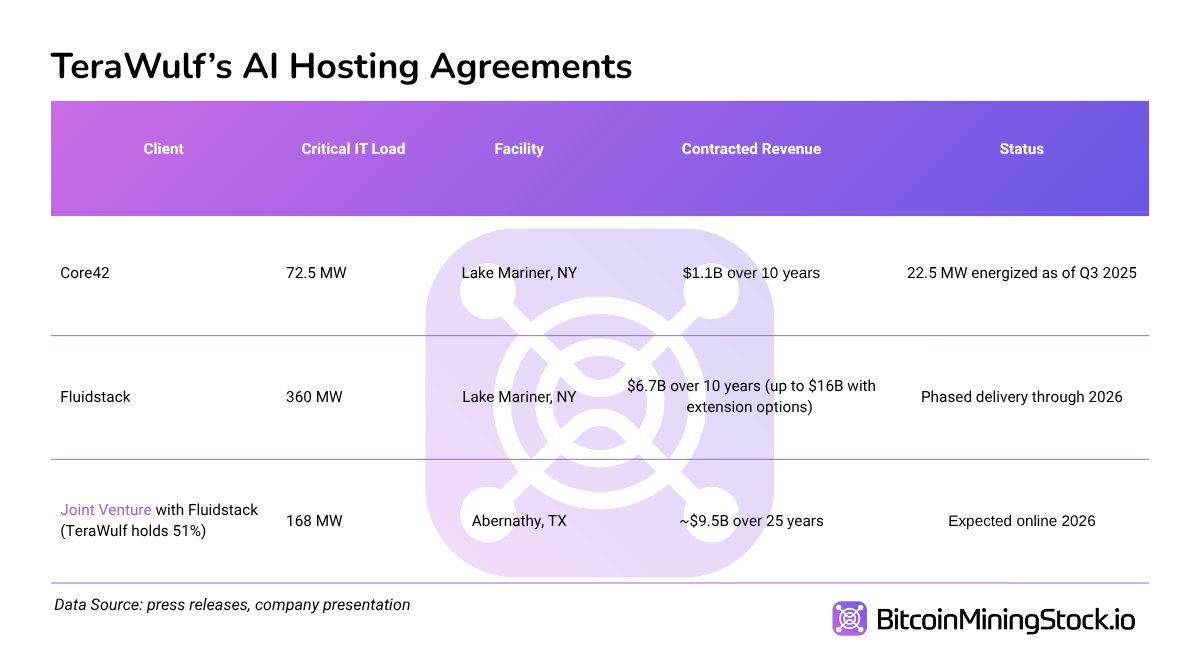

Inked by TeraWulf in August 2 HPC lease agreements With Fluidstack, that is a complete of 360 MW. These offers introduced one thing new to the mining sector: Google. Tech giants backstopped leasing and positioned institutional belief in constructing crypto infrastructure that was beforehand thought of speculative.

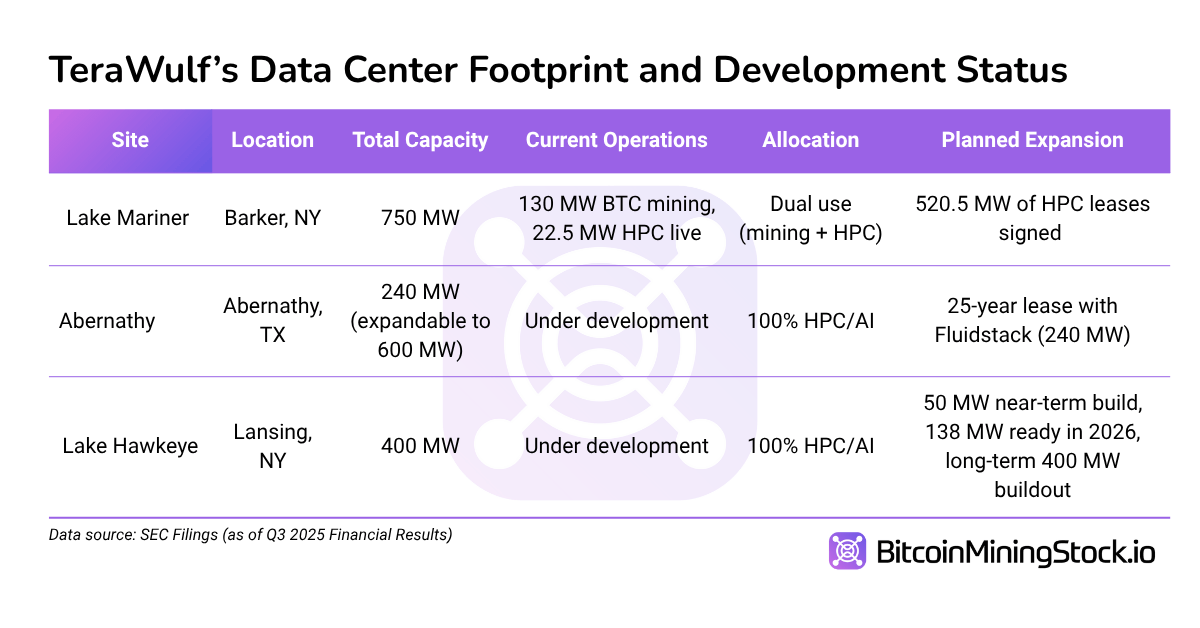

In November, TeraWulf reported greater than 520 MW of whole contracted HPC IT workload. This is likely one of the largest scales we now have ever seen within the Bitcoin mining area, and it occurred inside a couple of months.

Of word is the 72.5MW Core42 leasesigned late final yr and nonetheless a part of the combination. However that’s fluid stack who got here out as a key companion On this play. Past the lease scale, the 2 firms have entered right into a partnership (together with credit score enhancement from Google). three way partnership We collectively developed the Abernathy website. 240MW HPC campus, with enlargement potential as much as 600 MW.

It is a refined level, however necessary shift: Somewhat than leasing land and area to hyperscalers, TeraWulf is now co-building.

Three way partnership in Texas

Abernathy’s three way partnership is totally different construction From what we have seen within the trade. The deal features a 25-year lease with Fluidstack (longer than typical AI leases) and is backed by $1.3 billion in credit score enhancement from Google. TeraWulf retains as much as 51% management and the fitting to take part within the development of a further 200 MW led by Fluidstack.

This multi-layered method, consisting of land possession, lease constructions, shopper partnerships, and entry to hyperscalar credit, offers one thing uncommon in mining: long-term visibility.

Apparently, this wasn’t even WULF’s thought. CEO Paul Prager stated in an earnings name that it was Google that requested Abernathy to anchor the three way partnership. This remark reveals how hyperscalers assume. Overlook mining labels, what issues is grid entry, execution historical past, and website management. Prefer it or not, WULF has all three of these issues.

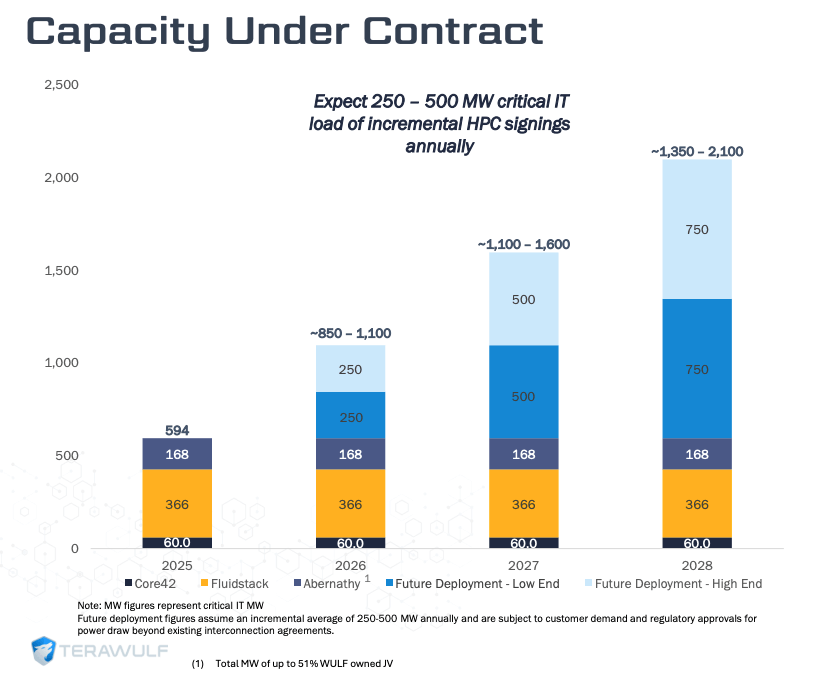

Focusing on 250-500 MW of recent HPC contracts per yr

Maybe the boldest second of the third quarter convention name was when TeraWulf elevated its annual purpose for HPC contracts. Beforehand, it was directed as 100-150 MW per yr; New goal is 250-500MW per yr. If realized, this may equate to an annual income enhance of between $465 million and $930 million (assuming a calculation of $1.86 million/MW).

TeraWulf screenshot Investor presentation (10 pages)

Though execution dangers stay, administration expressed sturdy confidence in reaching these targets, citing greater than 150 websites evaluated final yr and an expanded growth/acquisition group. Whereas a few of the $5.2 billion in funding has been earmarked to help these expansions, capital wants stay steep, particularly for purpose-built HPC information facilities (which conservatively vary from $8 million to $11 million per MW).

In comparison with conventional miners that chase hashrate and halving cycles, this mannequin goals for steady income primarily pushed by shopper demand moderately than block rewards.

The way forward for Bitcoin mining enterprise

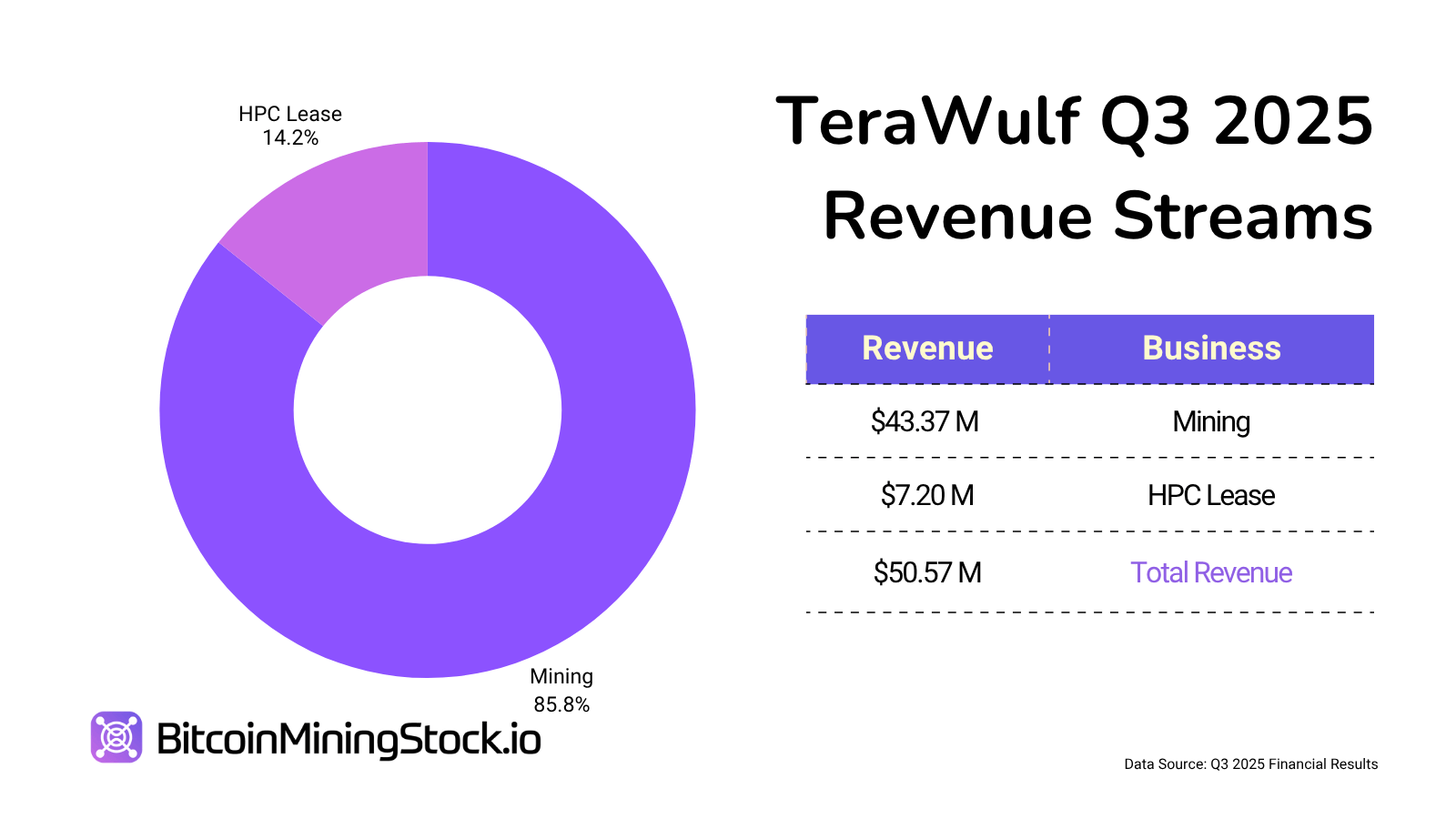

HPC is a brand new frontier for the corporate, however Bitcoin mining stays Fundamental income contributors immediately. In Q3, TeraWulf self-mined 377 BTC (down from 485 BTC in Q2) because it decommissioned previous mining items and commenced reallocating infrastructure to HPC.

Future developments at Mariner Lake, a serious hub the place the transition to HPC is in full swing, are as follows: Targeted solely on AI/HPC. The corporate revealed that No new Bitcoin mining infrastructure is being constructed Except it helps dual-use performance.

Nonetheless, TeraWulf stated it intends to mine Bitcoin “at the very least till the top of 2026.”

This method will not be distinctive, nevertheless it units a transparent sign. Some miners could have talked about AI pivots, however TeraWulf hardcoded it into site-level methods, capital funding priorities, and annual KPIs.

ultimate ideas

TeraWulf’s third quarter does not simply symbolize a win for Reese, it additionally factors to a potential path for different Bitcoin miners to comply with within the AI period. Somewhat than merely leasing infrastructure, the corporate leverages what it already controls (land, energy, venture execution) to type long-term capital-based partnerships. In doing so, we secured a multi-billion greenback HPC/AI dedication and de-risked our roadmap. The query is now not whether or not miners can entice AI offers, however whether or not miners are ready to scale rapidly. Few individuals have the sources to repeat this technique, however the market is watching to see who makes the subsequent transfer.