The NFT lending market has collapsed to single-digit thousands and thousands in complete worth lock (TVL), ranges final seen in 2022. In line with DefiLlama information, the sector’s TVL is at present round $8.3 million, down about 97% from the sector’s all-time excessive of over $300 million in March 2024.

NFT lending TVL. Supply: Defilama

Arcade, the Pantera Capital-backed NFT financing startup that secured a $15 million Sequence A in December 2021, at present has solely about $300,000 in TVL left, down greater than 98% from its peak of $21.5 million in March 2024.

However even protocols that when appeared extra resilient are feeling the ache. The TVL of Blur’s lending arm Mix, which was based in partnership with crypto VC large Paradigm, is at present round $3 million, down greater than 90% from greater than $115 million in early 2024.

Nicolas Larmento, co-founder of NFT Pricefloor, an NFT evaluation web site that tracks greater than 1,750 collections, instructed The Defiant that the March 2024 peak was largely pushed by Blur’s incentives.

“Mix (Buller’s lending arm) completely dominated the market on the time, and its progress was largely pushed by Buller’s agricultural meta. As these incentives tapered off, Mix’s volumes and debt balances fell off a cliff, and the broader sector reverted with them. So the chart appears like a peak on which a crash continues,” Lament mentioned.

The market has since moved to a “extra steady mannequin” led by Gondi, a non-custodial peer-to-peer lending protocol for NFTs, Lament mentioned. He defined that the kind of collateral used has additionally modified, as many of the blended loans have been tied to profile image NFTs and fashionable IP collections like Pudgy Penguins, that are extremely speculative and event-sensitive.

“To me, it is a wholesome transition. NFT artwork behaves like a standard collectibles market, and that stability creates higher lending conduct,” Lallement defined.

Commenting on the declining TVL throughout lending protocols, Lallement prompt that excellent on-chain debt can be the “finest lens via which to know the NFT lending market” right now, as NFT collateral is “very illiquid.”

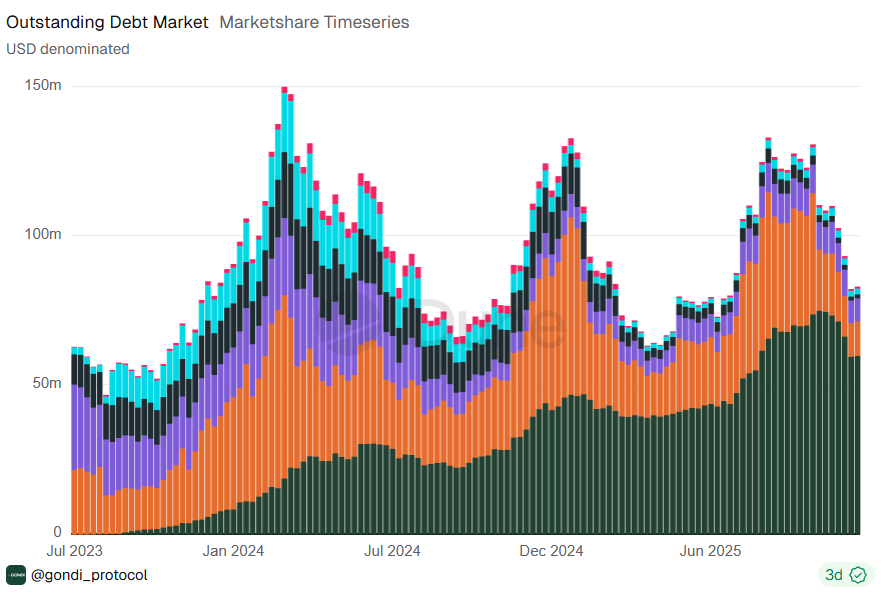

NFT debt stability

Knowledge compiled by Gondi on Dune exhibits that regardless of the liquidity crunch, excellent debt has declined extra slowly, down about 45% from $150 million in March 2024 to $83 million now, suggesting that individuals are nonetheless taking out loans at the same time as complete capital out there declines.