Michael Saylor’s technique could also be in large hassle as his large Bitcoin struggle chest instantly begins to look invincible. Virtually 40% of the corporate’s Bitcoin stack was within the crimson after Bitcoin fell beneath $90,000 for the primary time in seven months. There are roughly 649,870 Bitcoins within the bag.

Only a few days in the past, the autumn in Bitcoin dealt a good greater blow to MSTR, as Michael Saylor introduced one other large buy. Additionally purchased 8,178 BTC at a median worth of $102,171. Bitcoin is presently buying and selling at practically $92,000, which means it has misplaced practically $100 million from this single buy. Nevertheless, the cumulative cryptocurrency market is dealing with excessive promoting stress as sentiment returns to “excessive worry” territory.

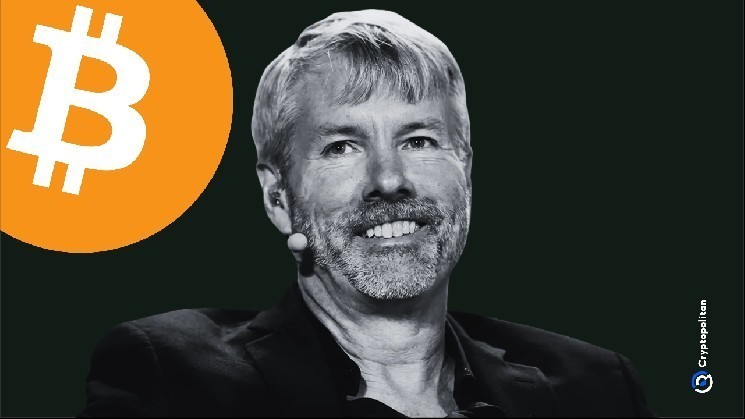

Saylor’s Bitcoin wager cracks

At $106,000, Technique’s stash was a few 90% revenue. Knowledge exhibits that amid the criticism, profitability has collapsed by round 60%. This new shopping for comes amid intense stress on Technique inventory ($MSTR). The corporate’s inventory worth had fallen about 55% from its peak earlier this 12 months. MSTR final traded round $206.8.

Supply: CryptoQuant

The inventory lately fell to its lowest degree since October 2024. This worn out an estimated $72 billion in market worth. The corporate has already raised important issues amongst traders in regards to the sustainability of its extremely leveraged, Bitcoin-heavy enterprise mannequin. MSTR inventory has fallen nearly 50% over the previous six months.

Longtime Bitcoin critic Peter Schiff was fast to name all the technique mannequin a “rip-off.” He even challenged Saylor to a debate at Binance Blockchain Week in Dubai in December of this 12 months. In a submit on X, he stated, “No matter what occurs to Bitcoin, I imagine MSTR will finally go bankrupt.”

Schiff additionally took photographs from his favourite angles. He famous that gold costs are nonetheless buying and selling above $4,000 per ounce, and Bitcoin gold costs are presently down 40%. He argued that the “digital gold” narrative was crumbling underneath stress. “Anybody serious about it would promote it,” he added.

The market is continually in a state of stress as a result of fall in BTC

Bitcoin is down greater than 25% from its all-time excessive of greater than $126,000. Shares have fallen beneath a number of psychological ranges and proceed to fall amongst leveraged merchants. Saylor is often very sociable when BTC prints inexperienced, however he was unusually quiet throughout this drawdown. Nevertheless, though I lately posted “₿elieve” and “HODL”, Technique has not stated something about unrealized losses piling up.

Bitcoin managed to climb above $93,500, however has since fallen as US shares tumbled and the Nasdaq hemorrhaged. BTC worth has fallen 10% prior to now 7 days. Regardless of the renewed restoration, Bitcoin is buying and selling at a median worth of $92,617 on the time of writing.

The worldwide cryptocurrency market rejoiced on the slight restoration. Cumulative market capitalization elevated by 1.5% to $3.16 trillion. 24-hour buying and selling quantity rose 3% to $211 billion. Main altcoins similar to Ethereum, XRP, and Solana additionally characteristic inexperienced indexes. ETH and XRP costs have elevated by over 3% prior to now 24 hours. Solana’s worth soared 7% over the identical interval, making it extra worthwhile than another firm.