Sentiment surrounding Bitcoin and the crypto market generally seems to be deteriorating, with most giant belongings declining in current days. On Friday, September 14th, the main cryptocurrency fell under the $95,000 stage for the primary time in additional than six months.

Curiously, Bitcoin value seems to be set for an additional long-term damaging transfer, because it issued a uncommon bearish sign for the primary time in 4 years. This is how a lot BTC value fell the final time this occurred:

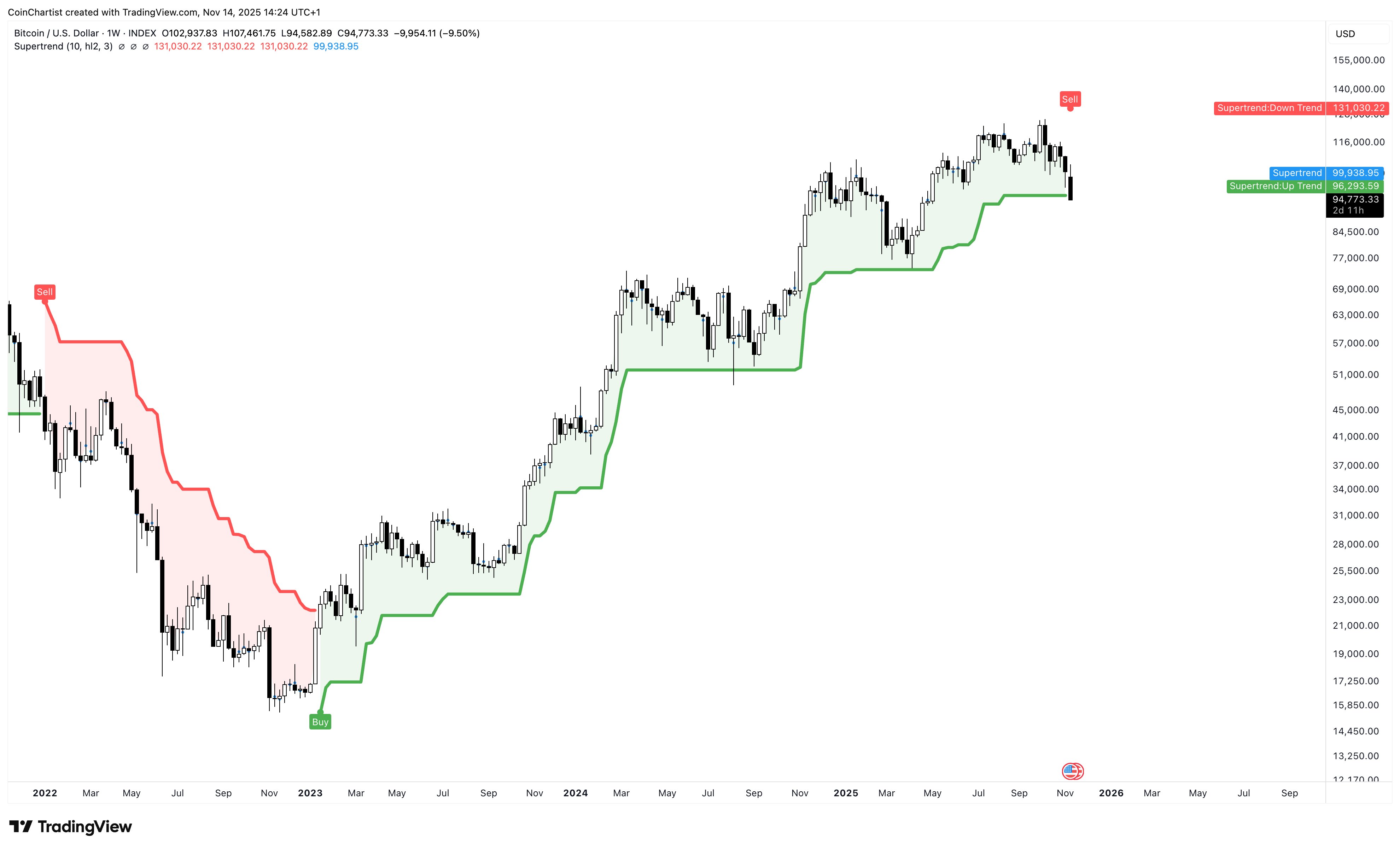

If the promote sign holds, BTC value dangers falling by 70%

In a current put up on social media platform A uncommon promote sign in BTC’s weekly supertrend has been triggered once more, in keeping with crypto consultants.

The “Weekly Supertrend” is a technical indicator that makes use of the Common True Vary (ATR) and a multiplier to pinpoint the route of an asset’s value development on a weekly timeframe. As seen within the chart under, the indicator turns inexperienced in an uptrend and purple in a downtrend, indicating a possible purchase or promote sign.

Supply: @TonyTheBullCMT on X

In a Friday put up on X (previously Twitter), Severino highlighted that Bitcoin has simply triggered a promote sign on the Supertrend indicator on the weekly timeframe. In line with a outstanding cryptocurrency commentator, that is the primary time this sign has been issued for a serious cryptocurrency since December 2021.

On the time, the promote sign signaled an abrupt finish to a earlier Bitcoin bull cycle, preceded by a chronic value decline. After this sign was triggered, the worth of Bitcoin fell by greater than 70%, matching the numerous decline following the collapse of Terra LUNA and FTX in 2022.

Traditionally, this promote sign foretells a possible 60-70% fall in Bitcoin value. A fall of this magnitude might take the market chief again to round $30,000 from its present value level.

Nonetheless, it’s price noting that the weekly supertrend promote sign has not been confirmed but. This indicator has been a purchase sign since January 2023, however a weekly shut under $96,300 might sign the start of a bear marketplace for Bitcoin.

Bitcoin value overview

As of this writing, the worth of BTC is sitting simply above $94,400, down greater than 6% prior to now 24 hours.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView