Bitcoin confronted recent promoting strain this week as main funding funds withdrew their cash at a tempo not seen in months.

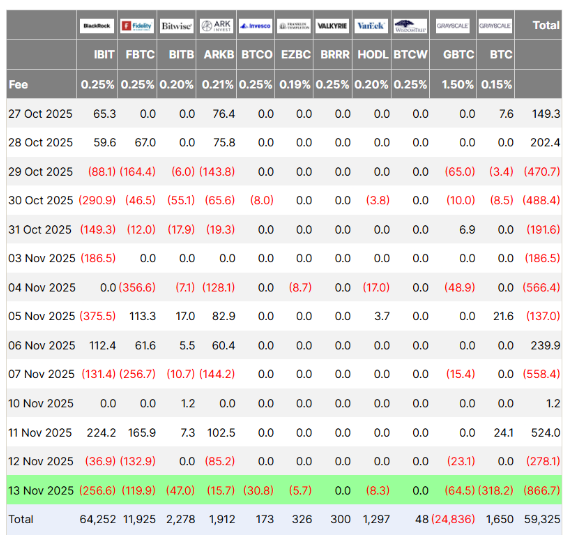

The Spot Bitcoin ETF recorded roughly $866 million in withdrawals on Thursday, a pointy improve even after the U.S. authorities reopened after a 43-day shutdown, in response to a report from Pharcyde Buyers.

The movement of cash out of those funds caught the eye of merchants who anticipated a stronger response as soon as political uncertainty eased.

Supply: Farside Buyers

Large withdrawals hit main Bitcoin funds

This wave of outflows prompted the U.S.-listed spot Bitcoin ETF to publish its second consecutive quarter of losses, in response to new knowledge.

Separate analysis from SoSoValue factors to almost $897 million leaving these merchandise on the identical day, suggesting a widespread exit from institutional buyers.

This alteration stunned some market individuals, as ETF inflows have been one of many essential drivers of Bitcoin’s sturdy efficiency in early 2025.

Those that entered Bitcoin 6-12 months in the past have a price base of practically 94,000.

Personally, I do not assume the bear cycle is confirmed until we lose that degree. I might slightly wait than soar to conclusions. pic.twitter.com/i9a5M0xnMW

— Ki Younger-ju (@ki_young_ju) November 14, 2025

CryptoQuant’s Ki Yong-joo warned that the general uptrend might weaken if Bitcoin falls under $94,000, the common buy degree for holders who entered previously six to 12 months.

XRP funds shine amid market pressures

Whereas Bitcoin funds are struggling, a brand new altcoin product has recorded an unusually sturdy debut. The Canary Capital XRP (XRPC) ETF had first-day buying and selling quantity of $58 million, in response to Bloomberg ETF analyst Eric Balchunas.

This quantity narrowly beat the $57 million recorded by the Solana ETF earlier this 12 months, however nonetheless ranked as the most important opening of the practically 900 ETFs set to launch in 2025.

The report additionally notes that the Ether ETF confronted $259 million in withdrawals on Thursday, whereas the Solana ETF added an extra $1.5 million, extending its 13-day influx.

Rate of interest reduce suspicions added to slides

Bitcoin fell under the $100,000 line on Friday and was buying and selling round $96,900 by midnight ET. The inventory fell to an intraday low of $96,650, weighed down by fading expectations for a December rate of interest reduce by the US Federal Reserve.

Markets are at the moment pricing in a roughly 45% likelihood of a 25 foundation level (bp) fee reduce on the December 10-11 assembly, down from 63% per week in the past.

The federal government shutdown left a niche in official inflation and jobs knowledge, giving the Fed fewer alerts to behave on and making merchants cautious of taking dangers.

Cryptocurrencies have blended feelings heading into the weekend

Demand from institutional buyers has cooled, as evidenced by repeated capital outflows and a slowdown in purchases of presidency bonds. Some analysts consider the market has been in a quiet bearish section in current months.

Bitwise’s Hunter Horsley stated the financial downturn could also be nearer to an finish than many anticipated, though broad danger markets are providing little assist.

Some are warning that Bitcoin’s shedding streak, now heading into its third week, might be prolonged if ETF withdrawals proceed.

Featured picture from Unsplash, chart from TradingView